One of the tangible policy actions by the administration of President Donald Trump was the formation of the Comprehensive Economic Dialogue with China, as outlined in Panjiva research of April. The first 100 days of talks are due to end on July 16, with a meeting on July 19 likely to be the venue for wrapping up the initial process, Reuters reports.

An initial announcement included 10 action points to increase trade, with two focussed specifically on U.S. exports of beef and liquefied natural gas to China (and exports of cooked chicken from China. A subsequent 117 page document from the Chinese government outlined a broader range of objectives, including agriculture (soybeans), energy (refined oil products), aerospace, semiconductors and machine tools as well as other high technology products.

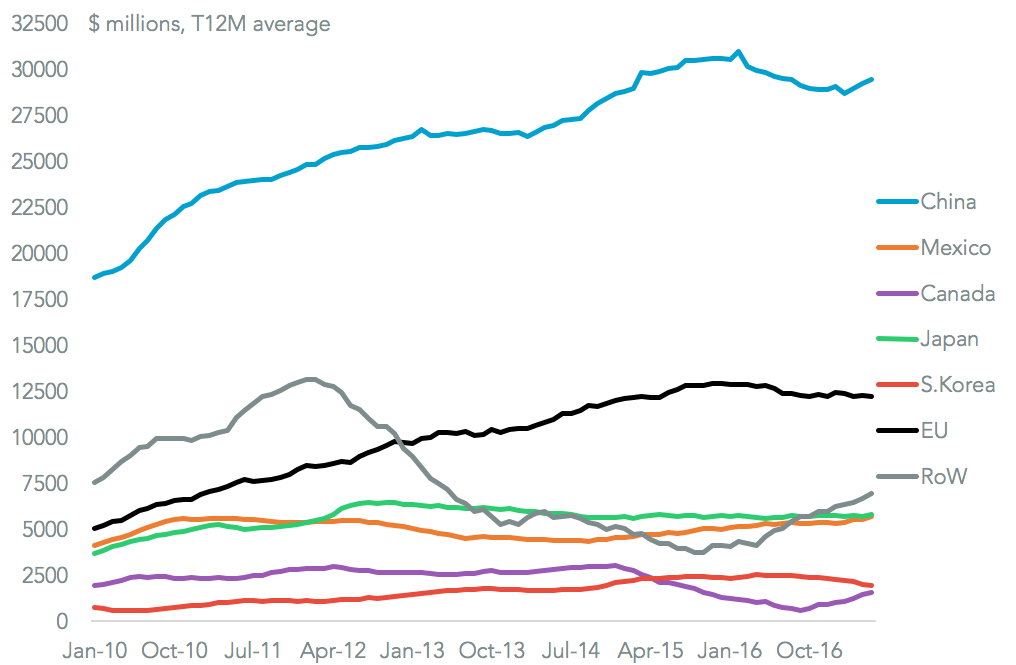

Panjiva analysis of Chinese imports of the product areas proposed shows that semiconductors provide the biggest market opportunity when looking for significant scale sectors that are growing, but where the U.S. has a low market share. Chinese semiconductor imports reached $249.2 billion in the past 12 months, 2.0% higher than a year earlier but U.S. suppliers had just 3.9% of the market.

Liquefied natural gas, which has grown 18.0% has already been addressed, while in soybeans the U.S. already has a 41.8% share. One area that may be under threat is aerospace. The U.S. accounted for 58.6% of Chinese imports, but imports have fallen 13.0% already with a domestic supplier close to launching.

Source: Panjiva

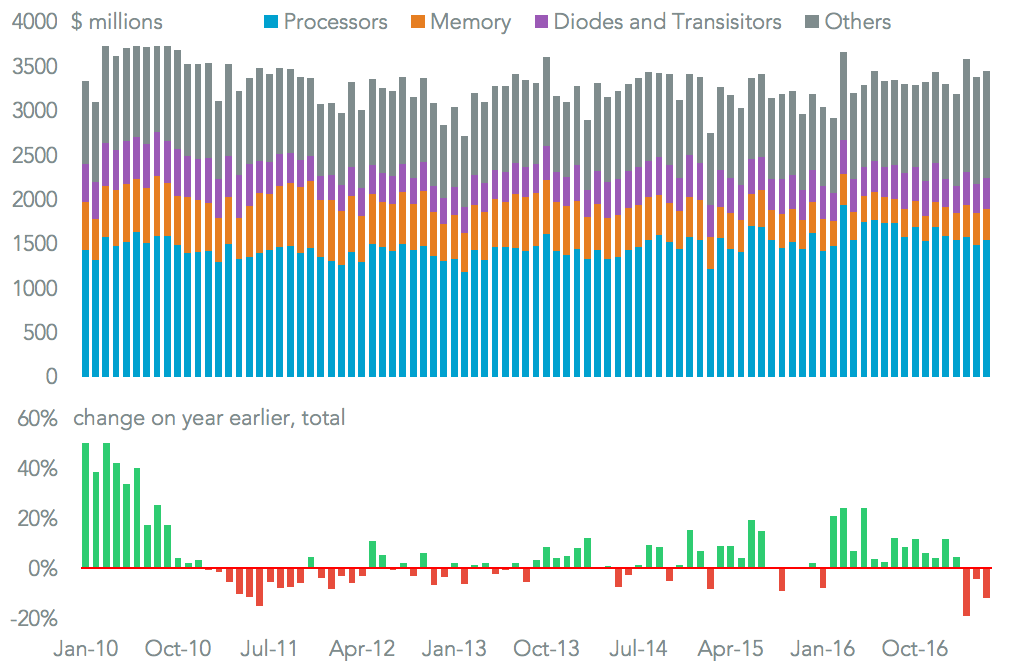

U.S. semiconductor exports have seen a slowdown in the past year, with total exports increasing by just 4.6% in the past 12 months on a year earlier. An 8.6% drop in sales of memory chips has been the biggest driver, though a 12.2% drop in processor exports in the past quarter has also contributed. A boost to exports would come at a good time for the industry.

Source: Panjiva

One complication may come from the reform of CFIUS rules by the Trump administration. This has followed concerns about Chinese firms buying control of U.S. high tech manufacturing operations and proposed extension of CFIUS rules, the New York Times reports.

In turn that may lead to an unwillingness to actively promote exports of products to China. These accounted for 21.3% of the total in the past 12 months vs. 17.3% in 2011, and increased 9.7% on a year earlier in the three months to May 31. One problem for the U.S. is its bargaining position. China accounts for 23.0% of U.S. exports, but the U.S. only accounts for 3.9% of U.S. exports.

Source: Panjiva

Another fly in the ointment may be the ongoing state of the Chinese surplus with the U.S. This increased by 9.0% on a year earlier in May to reach $31.6 billion, the third straight increase, based on U.S. import and export data. That was the result of a 11.7% rise in exports to the U.S., as outlined in Panjiva research of June 8. In turn the growth may reflect concerns about increased tariffs or broad quotas resulting from the various trade reviews the Trump administration is carrying out.

Source: Panjiva