There were many winners, and three notable losers, among the NVOCCs operating on U.S.-inbound lines in May. Panjiva data shows total volumes handled increased by 3.4% on a year earlier. That was largely driven by increased volumes coming from Asia, as outlined in Panjiva research of tktk.

The largest gainer in absolute terms was number two operator CH Robinson, which saw volumes increase by 10.8%. DSV’s 50.0% increase was solely due to its acquisition of UTi, without this its volumes only increased 0.9% on a year earlier. Apex Shipping and Shipco both lost volumes marginally, though the former lost just 2.4% while the latter continued to see marked declines with a 20.8% drop.

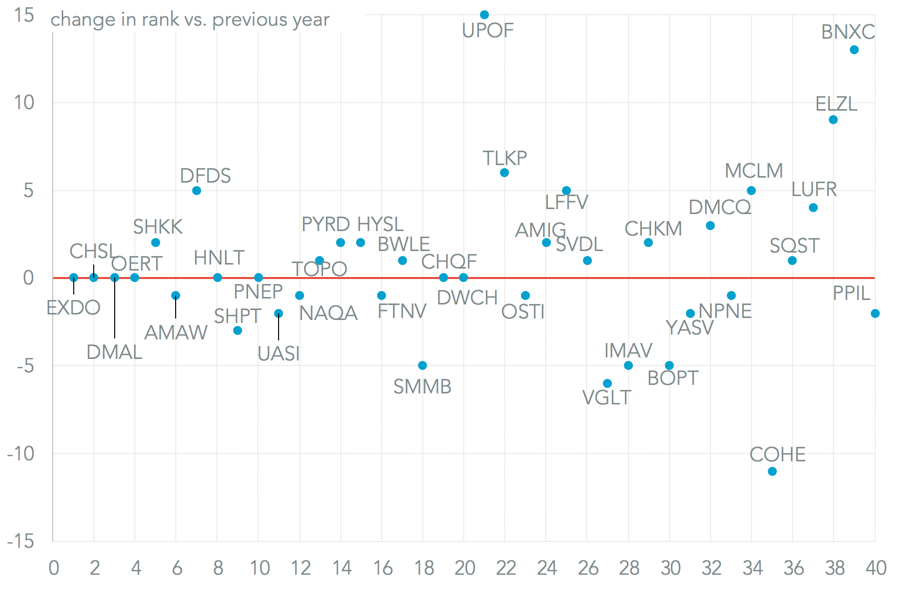

Source: Panjiva

In absolute terms the biggest loss though was a 2.5% reduction in volumes handled by number one operator Expeditors International. That resulted in a 0.18% points loss of market share to reach 2.91%. That was still 1.5 times the size of CH Robinson, its nearest competitor. Part of Expeditors’ market share may have been gained by Deutsche Bahn-Schenker, which saw an 8.4% growth in volumes handled, and moved to fifth largest operator from seventh in May 2017.

Source: Panjiva

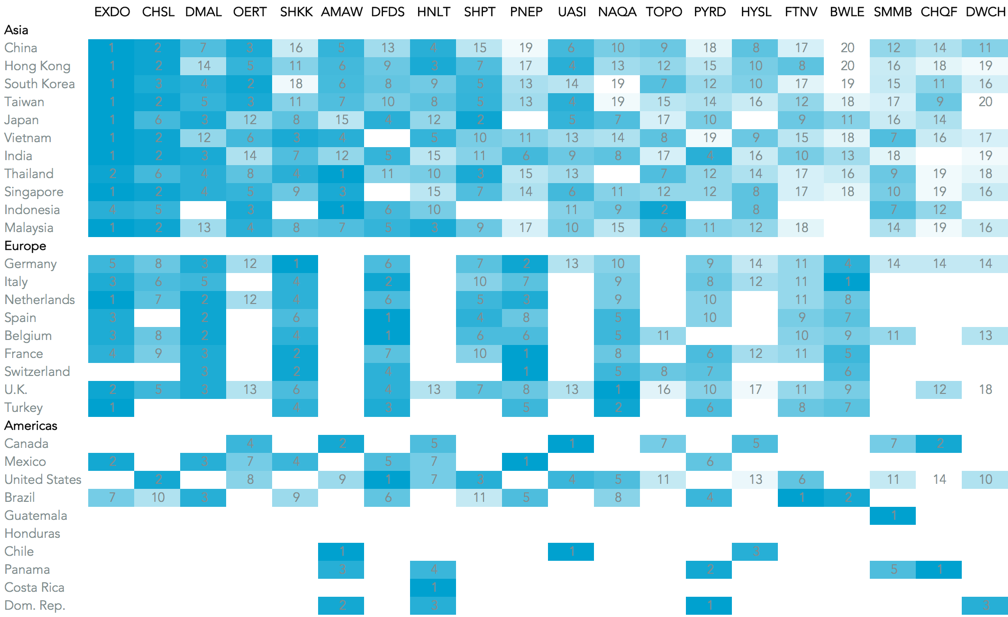

A significant difference between the container-lines and NVOCCs has been the lack of consolidation in the latter, at least since DSV’s acquisition last year. Panjiva analysis of over 3,500 NVOCC/country pairs shows Expeditors is relatively under-represented on Latin America-U.S. routes, while DB-Schenker and Panalpina are lighter on Asia-U.S. routes.

Source: Panjiva