Freight forwarder Expeditors has acquired the digital platform Fleet Logistics. The business will augment Expeditors’ existing platform, Koho, which is U.S. truckload focused with Fleet’s global booking system. The acquisition is likely to represent a response to FedEx’s joint venture with Microsoft, outlined in Panjiva’s research of May 21, as well as digital-first operators led by Flexport.

Panjiva’s data shows that Expeditors has underperformed its peers for the past five quarters on U.S. seaborne import lines, most recently with a 10.7% year over year drop in Q1 compared to a 5.2% slide for the market overall. FedEx had done worse though with a 16.3% drop in Q1.

Source: Panjiva

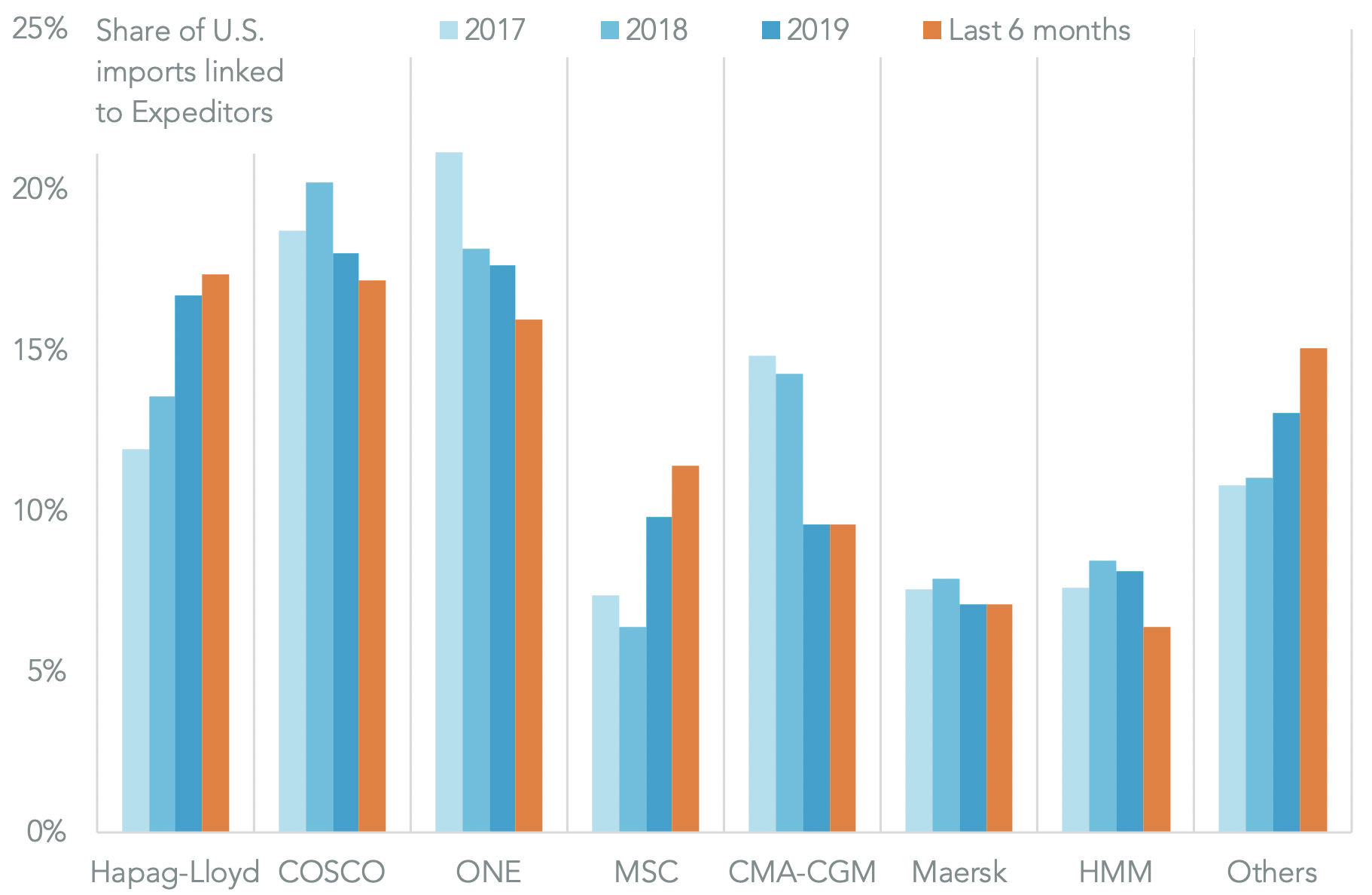

One area of advantage that Expeditors can bring is in expanding Fleet’s range of available ocean carriers. So far Fleet’s partners are Maersk, MSC, CMA-CGM and Hapag-Lloyd. A tie-up with Expeditors could widen that list as well as provide the firm with the opportunity to review the share of traffic it allocates to each container line.

The largest handler of Expeditors traffic in the six months to April 30 was Hapag-Lloyd, representing 17.4% of inbound traffic to the U.S. That was increased from 11.9% in 2017, suggesting that Expeditors has been happy to restructure services in the past. Similarly, shipments handled by MSC were only fourth largest at 11.4% of the total, but that represented an increase from 7.4% in 2017.

The biggest losers of market share were CMA-CGM and Ocean Network Express which lost 5.3% points and 5.2% points of share in Expeditors’ traffic in the past six months versus 2016.

Source: Panjiva