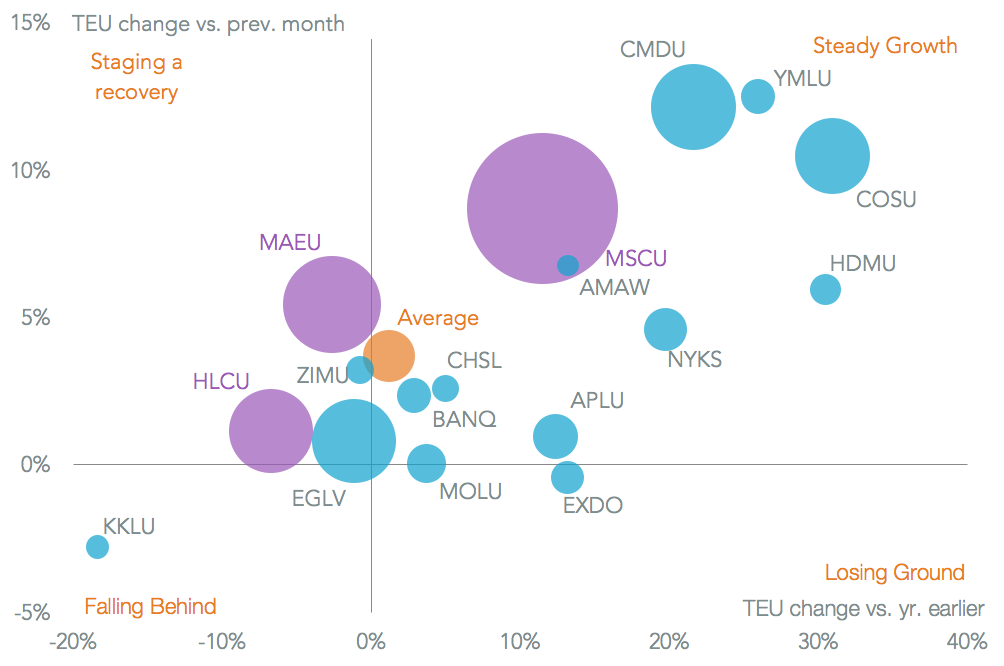

Container-lines operating on U.S.-inbound routes had another bumper month in August. Total shipments hit a new high after rising 2.1%, as outlined in Panjiva Research of September 11. COSCO Shipping (31.0% higher) and Hyundai Merchant Marine (30.5% better) grew the quickest, Panjiva data shows, though the former benefited from the acquisition of CSCL last year while the latter has picked up business from the now-defunct Hanjin Shipping.

Remarkably number one shipper MSC expanded by 11.5%, picking up volumes that it had previously lost. Hapag-Lloyd saw a 6.7% decline, which may represent a (potentially temporary) loss of business as the integration of UASC continues.

Source: Panjiva

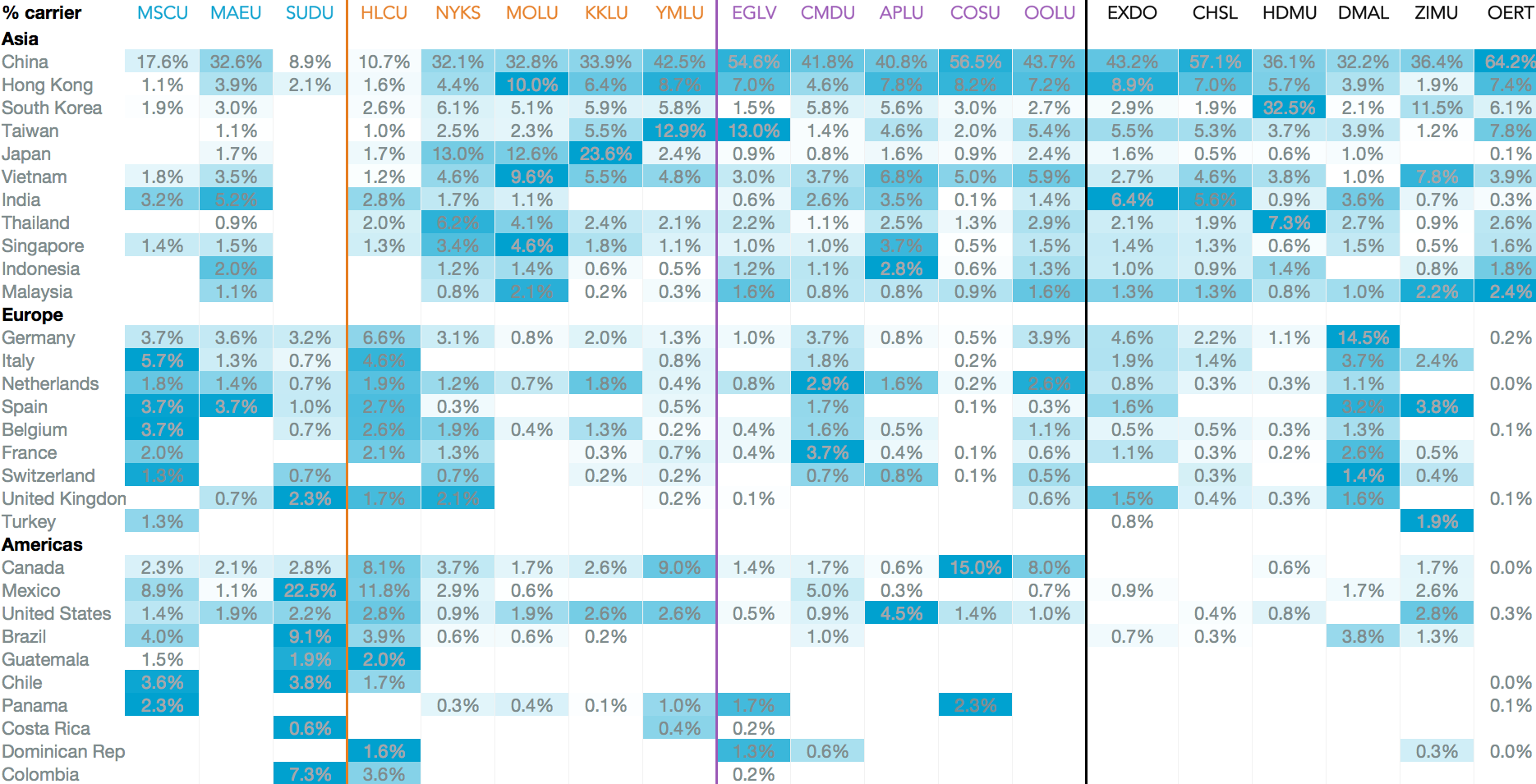

Panjiva analysis of over 4,100 carrier-country pairs shows MSC may have gained market share particularly from Hapag-Lloyd on European routes, which represent an outsized proportion of both company’s operations vs. their peers. Maersk’s 2.6% slowdown may represent a loss of market share on Asian routes to local shippers – members of the Ocean Alliance all did better and are move heavily exposed to shipments from China.

Hurricane Harvey – and in September Hurricane Irma – may have had an outsized impact on shippers exposed to seaborne shipments from Mexico and south America. That could also explain the weakness seen by Hapag-Lloyd and Hamburg Sud.

Source: Panjiva

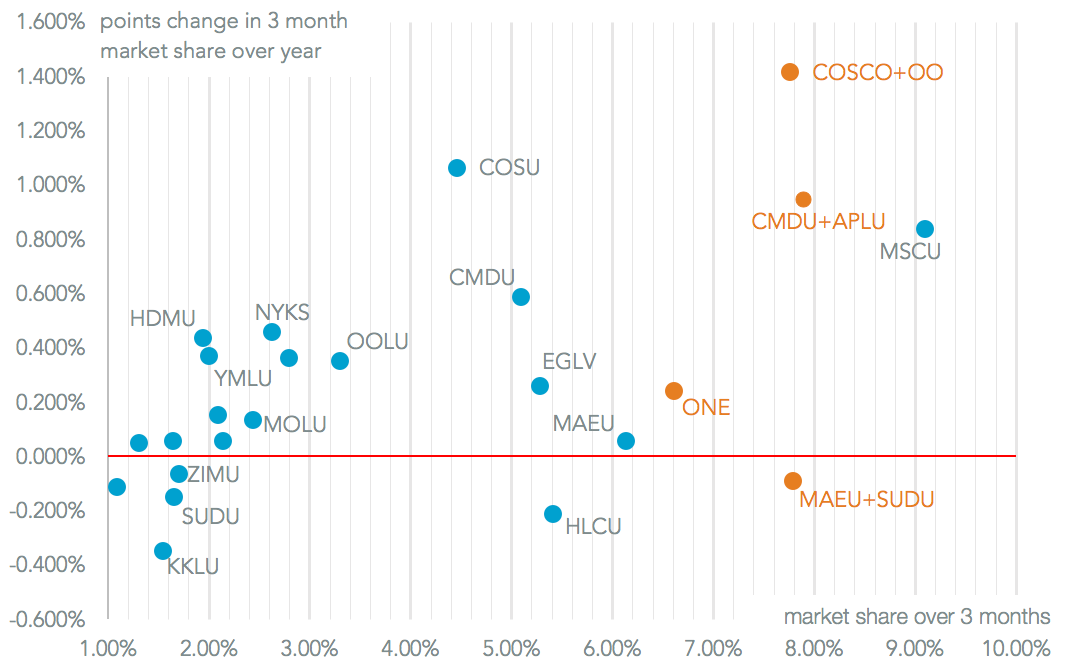

The weakness from Hamburg Sud is unlikely to derail the acquisition by Maersk – that’s based more on longer-term geographic coverage issues. The process of industry consolidation, most recently seen in COSCO’s bid for Orient Overseas, will result in the top five shippers having held a 39.2% market share in the past quarter. That compares to 31.0% currently, with the “new top five” having added 3.34% points of market share vs. a year ago.

Source: Panjiva