The U.S. Congressional Executive Committee on China has sought to reintroduce the “Hong Kong Human Rights and Democracy Act” that was first proposed two years ago. The Act would remove Hong Kong’s special tariff conditions with the U.S. – which dates back to British control of the region – should the State Department determine it is not independent from China.

The Act’s resurgence comes as protests are being held in Hong Kong in relation to new extradition procedures that could increase the integration of the Hong Kong and mainland judicial systems, the BBC reports.

There’s clearly a long way to go for such a bill to pass including approval by Senate Foreign Relations, a vote in both Houses and the President’s signature. Yet, it comes at a time when the trade war has escalated beyond tariffs, as outlined in Panjiva’s Jun. 12 research, and when dealing with China’s ascent is becoming a bipartisan issue.

The move could actually be detrimental to Hong Kong’s independence. Panjiva data shows Hong Kong accounted for $5.47 billion of U.S. imports in the 12 months to Apr. 30, after dropping by 23.9% in the past year. Yet, that’s only equivalent to 1.0% of the total of Greater China including the mainland and so hardly represents a form of significant leverage over the Beijing government.

It’s also worth noting that Hong Kong is also a major transshipment hub for mainland Chinese exports, particularly for the neighboring Guangdong province.

Source: Panjiva

Hong Kong’s manufacturing sector is relatively focused. The top imports by value are led by telecoms and PC products, worth $438 million in 2018, precious metals and jewelry worth $777 million together and toys valued at $72 million.

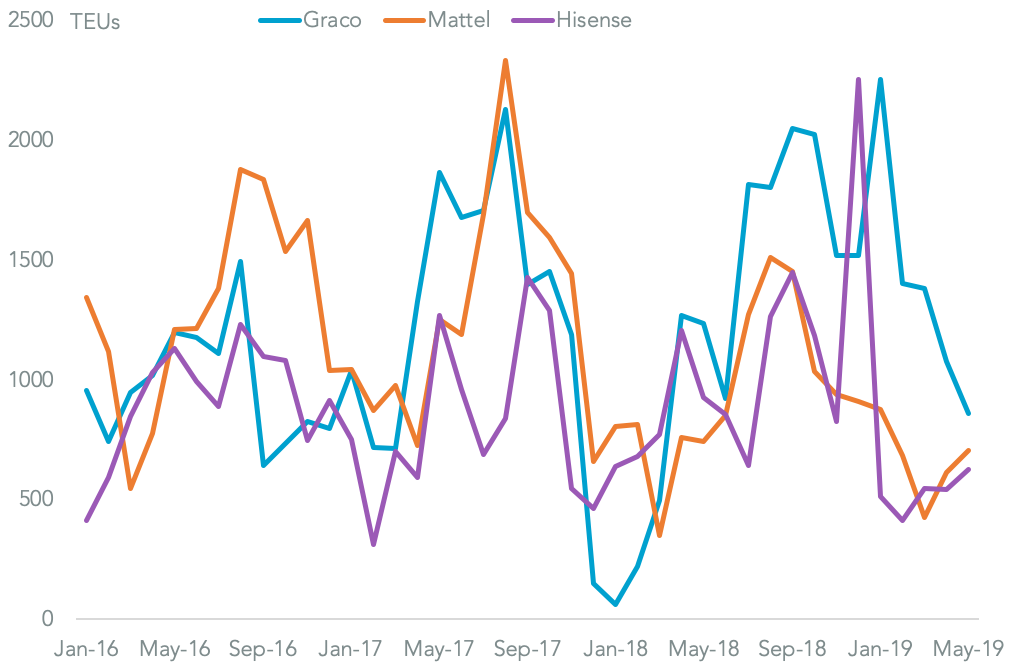

The removal of tariff preferences will hit kid focused manufacturers such as Graco, which imported 18,633 TEUs from the region in the 12 months to May 31, and Mattel with 11,279 TEUs. Among major domestic electronics manufacturers major exporters to the U.S. are led by Techtronics’ 11,115 TEUs including vacuum cleaners and Hisense with 6,006 TEUs, focused on televisions.

Most of those manufacturers also face significant seasonality in their exports, focused around holiday season sales. As a result a worsening of tariff uncertainty heading into the early summer could cause significant planning risks and cost increases at just the wrong time of year.

Source: Panjiva