Power tool maker Husqvarna reported an 11% year over year decline in revenues in Q1. The group’s CEO, Henric Andersson, has warned that “the second quarter will be tougher than the first quarter” which is “simply a function of countries being in lockdown“, Reuters reports. The firm’s “negative impacts initially related to supply chain disturbances” with sales falling “towards the end of the quarter“.

The firm has also seen a marked drop in its construction business, representing the capital equipment end of the disruptions that were seen by fittings providers such as Kone as outlined in Panjiva’s April 24 research.

Shipments to the U.S., Husqvarna’s largest single national market, had continued to improve modestly in Q1. Panjiva’s data shows that U.S. seaborne imports linked to the firm increased by 4.9% year over year in Q1. That included a 13.5% slide in shipments from China in response to trade war related tariffs while imports from Europe surged 41.2% higher to compensate.

In the nearer term the supply chain disruptions mentioned by Andersson can be seen in the 31.3% year over year slump in imports in March. That’s reversed in early April with a 47.3% rise in the first 15 days of the month versus a year earlier.

Source: Panjiva

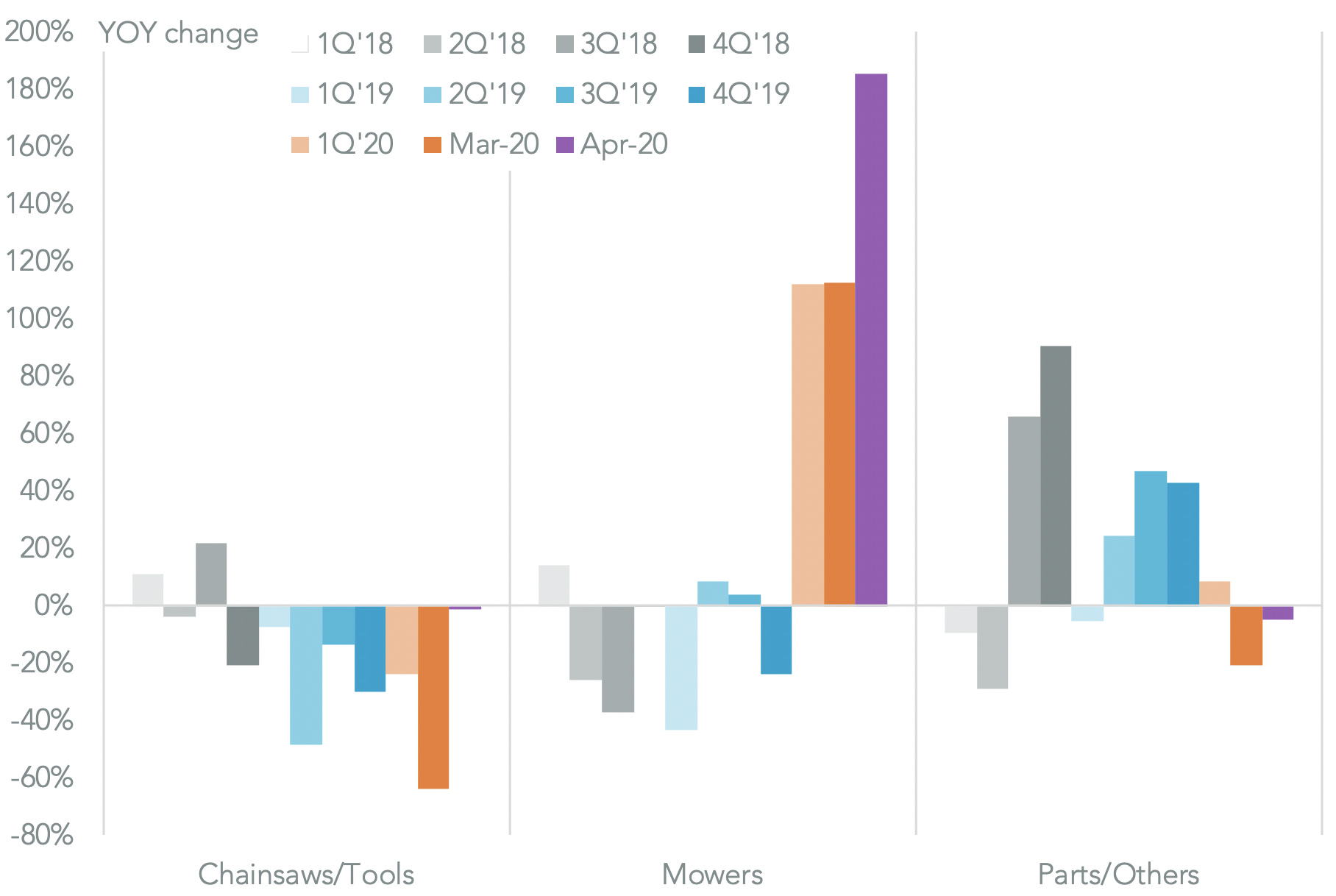

The improvement runs the risk of course that the firm is left with excess inventories if lockdown don’t come off before the peak season of purchasing before the summer. At the product line much of the recent surge has come from garden equipment including lawn mowers where imports jumped 112.2% year over year in Q1 and by a further 185.7% in the first two weeks April.

Imports of forestry equipment including chainsaws meanwhile have been in a steady decline with a 24.0% drop in Q1 and a 1.4% slip in April. Components and other machinery rose modestly in Q1 by 8.4% before slipping 4.8% lower at the start of April.

Source: Panjiva