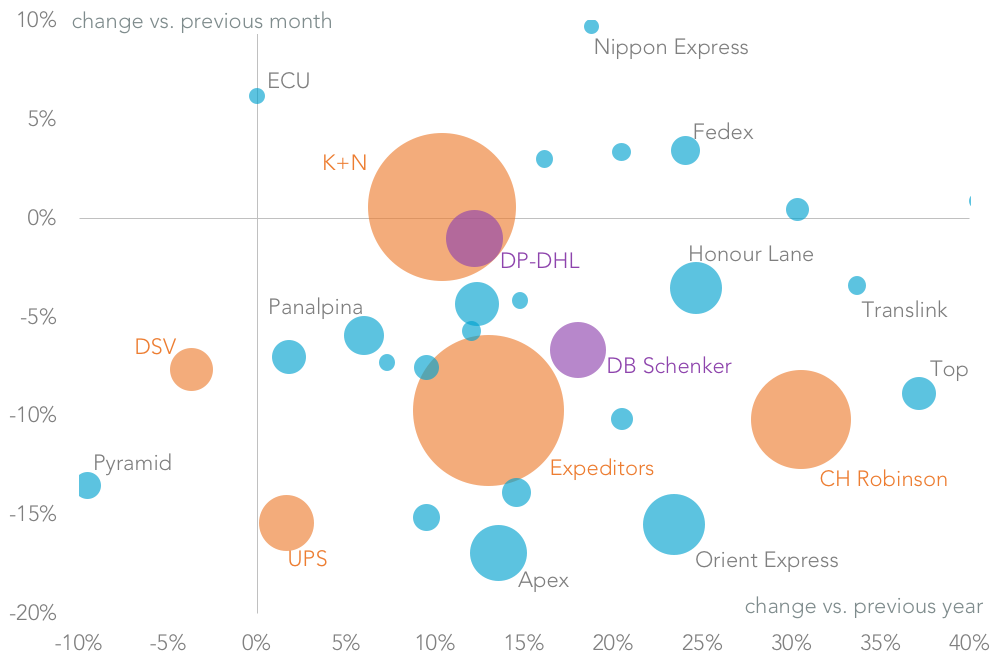

The freight forwarders operating U.S.-inbound, marine shipment services had a bumper month in February after shipments climbed 13.0% on a year earlier, Panjiva data shows. A large part of that was due to the seasonal effects of the lunar new year, as outlined in Panjiva research of tktk. The growth in market scale vs. the year earlier did not prevent an apparently aggressive grab for market share by some market operators. That came despite a year-over-year decline in profitability in the fourth quarter.

Among the top 10 operators CH Robinson grew the most quickly with a 30.5% surge on a year earlier in shipments handled, which likely came largely at the expense of UPS which only grew by 1.6%. The latter appears to have scaled back its ambitions after a challenging fourth quarter, though with best-in-class profitability it could choose to react later in the year should its market share fall too far.

Among the European operators DB Schenker grew the quickest with an 18.0% surge, while DSV contracted by 3.7% – likely reflecting a normalization of operations after the completion of the UTi acquisition last year. Other major operators that held pace with the market, and therefore may be satisfied with their market share / profitability mix were Expeditors (13.0% higher) and Deutsche Post (up 12.2%).

Source: Panjiva

Expeditors remained the number operator overall. Orient Express surged to fourth largest shipper in the month from sixth a year earlier, though that likely reflects the lunar new year shipping effect also seen by Apex Shipping (up one place).

The next stage of consolidation among the forwarders is overdue, with continued comments from management teams across the logistics industry during the results season that they are ready to take part in a renewed round of mergers. We continue to see a consolidation between European-focussed operators including DSV and Panalpina with mid-sized Asian operators including Honour Lane and Hecny as making the most sense from a service-offering perspective.

Source: Panjiva