The freight forwarders operating on U.S.-inbound containerized traffic had another strong month of growth in April. Total volumes handled increased 9.7% on a year earlier, with only three of the top 25 experiencing lower volumes, Panjiva data shows. Expeditors International expanded by just 6.0% on a year earlier, a similar growth rate to that it saw globally in the first quarter, as outlined in Panjiva research of May 3. Expeditors’ main rivals CH Robinson and Deutsche Post DHL grew by 23.8% and 29.9% respectively suggesting competition for market share remains fierce.

Source: Panjiva

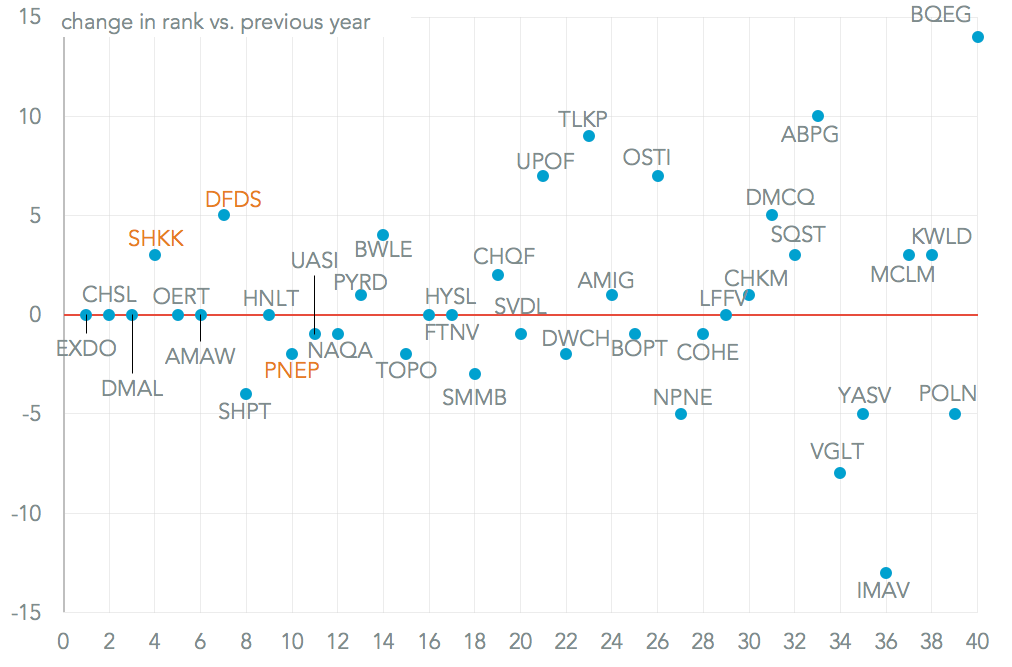

The main losers in that battle were Shipco and Panalpina. The latter dropped to tenth place from eighth in the rankings by volume, which may suggest the underperformance it experienced relative to its peers globally in the first quarter may be continuing. DSV’s jump to seventh is explained by its purchase last year of UTi, while Deutsche Bahn-Schenker continued its rapid run of organic growth to reach fourth.

Source: Panjiva

There may be room for further consolidation in the sector, particularly for larger operators that have significant geographic gaps in their portfolio. Smaller operators may also become increasingly vulnerable as technological improvements in booking systems allow customers to put together their global requirements more independently. Panjiva analysis of 3,400 NVOCC-country pairs shows the top 10 operators are relatively under-represented in shipments from Latin America.

Source: Panjiva