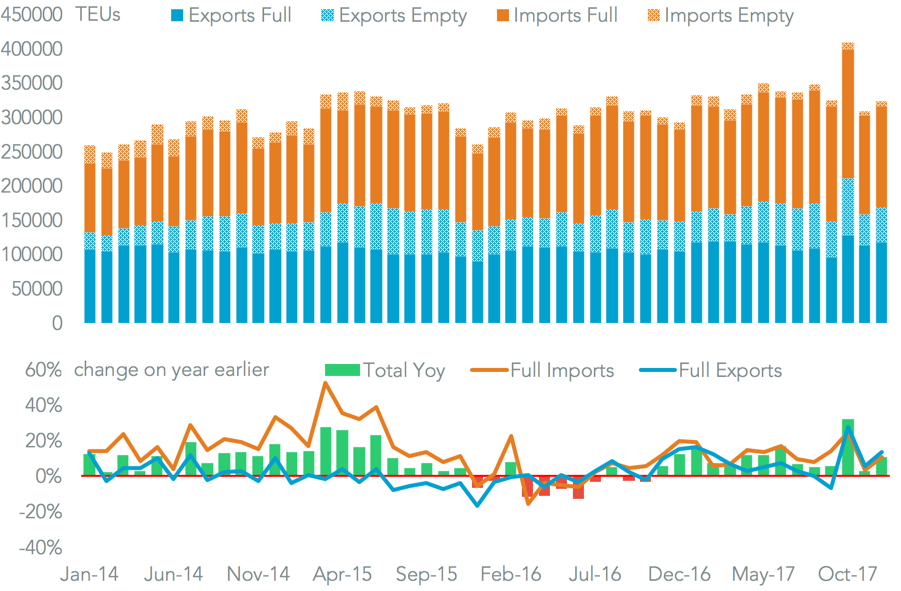

Container handling by the Georgia Ports Authority, centered on Savannah, climbed 10.6% on a year earlier in December. That brought the 2017 total to 4.04 million TEUs, or 15.4% higher than 2016.

Import growth of 11.0% lagged the 13.6% rise in exports in December, but was still well ahead of the 6% expansion seen at the national level as outlined in Panjiva research of January 9. It also outperformed regional competitor Charleston, with the South Carolina Ports Authority having achieved a growth of 9.1% for 2017 overall.

Source: Panjiva

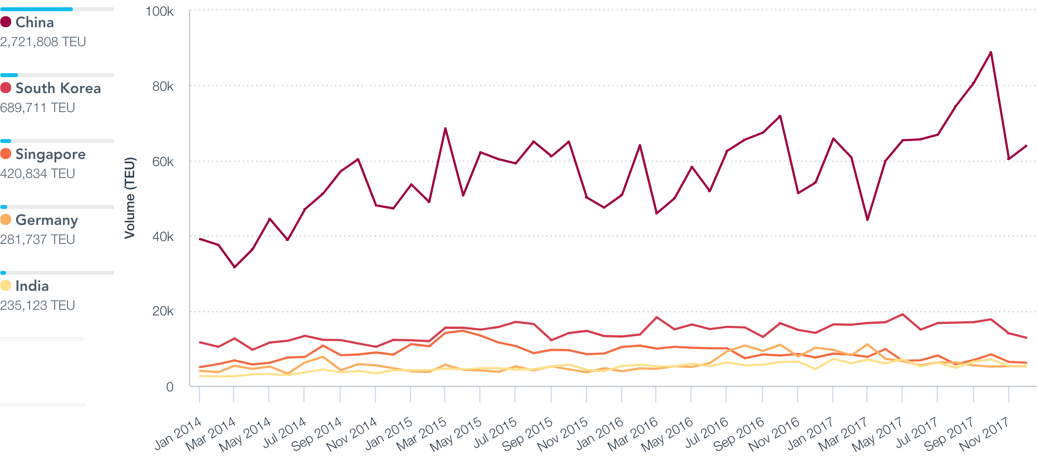

The superior growth vs. the national average was in part owed to a 21.5% growth in shipments from China and Hong Kong during the year, Panjiva data shows. Yet, that in part came at the expense of lower imports from the European Union, likely reflecting a restructuring of services after the implementation of the new container-line alliances earlier in the year.

Source: Panjiva

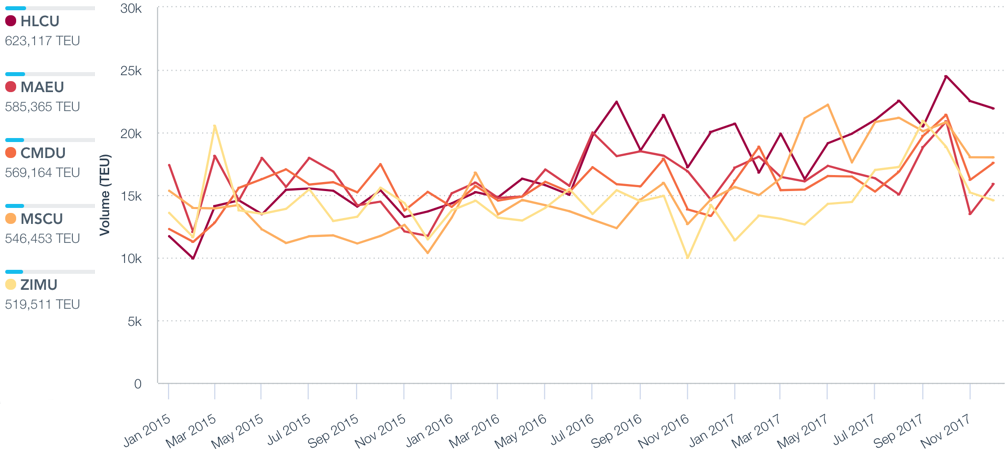

The largest container-lines operating inbound routes to Savannah in 2017 were Hapag-Lloyd (12.2% of the total), MSC (11.3%) and CMA-CGM (10.3%). Hapag-Lloyd’s 15.4% growth in handling in 2017 vs. 2016 put it ahead of Maersk, which grew by just 1.3%.

Source: Panjiva

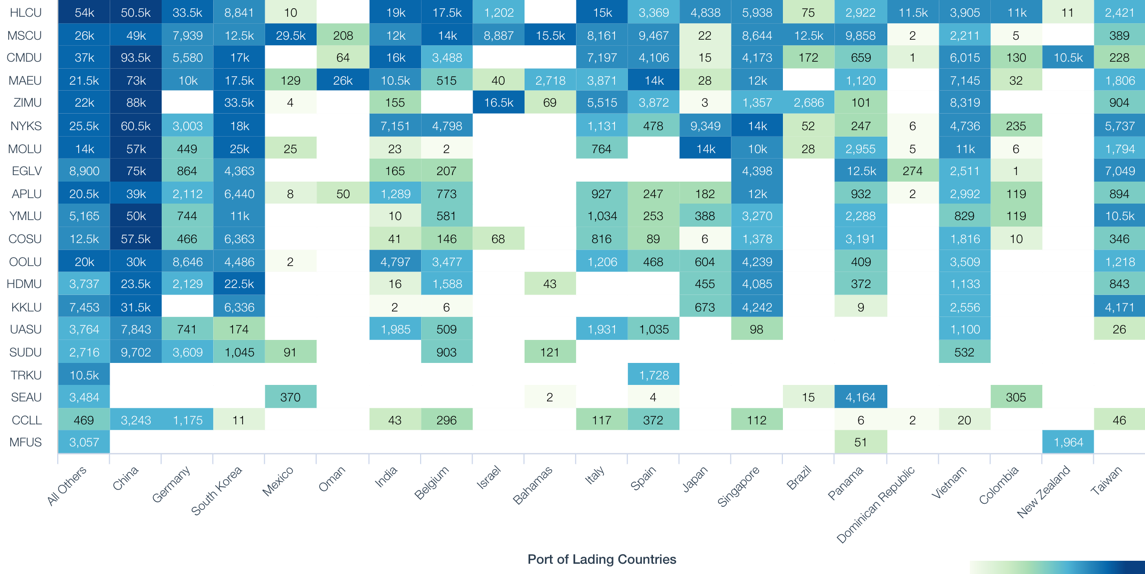

The largest carrier-route combination though was CMA-CGM’s shipments from China (4.7% of the total) followed by ZIM’s Chinese routes (4.4%). The largest non-China lanes were Hapag-Lloyd’s from Germany (1.7%) and ZIM’s from South Korea (1.7%).

The challenge for the Authority is to maintain the rapid rate of growth seen in 2017 by providing additional capacity and services for the container-lines and their customers. The Savannah Harbor Expansion Project will help in the longer-term – the harbor deepening is due to be completed by 2020. Investments in port automation could also help, though that comes with labor-relations complications.

Source: Panjiva