Global coffee exports fell for the sixth month out of the past seven in March, Panjiva analysis of ICO data shows, with a 1.9% decline on a year earlier. While exports in the first quarter were 3.4% higher that was due to a particularly weak January the year earlier.

A continued decline in exports from Brazil and Indonesia were the main culprits, with shipments from Vietnam not quite providing an offset. Notably shipments from India fell 4.8%, the first decline since June, though that likely reflects growing conditions rather than the effect of export subsidies outlined in Panjiva research of April 30.

Source: Panjiva

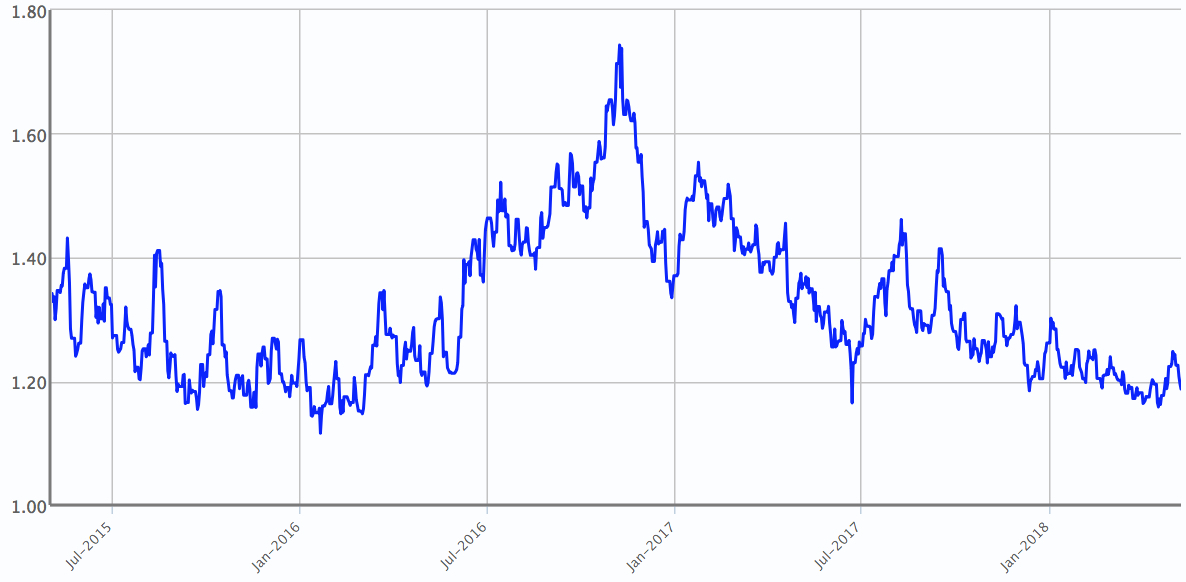

Yet, the decline in exports has not had a significant effect on prices. Global coffee prices have actually fallen 2.7% since the start of the year and by 7.9% on a year earlier as at April 30, S&P Global Market Intelligence data shows.

Source: Panjiva

Among the customers for Brazilian customers those in the U.S. have borne the brunt of reduced shipments, with exports down 12.0% on a year earlier in the first quarter of 2018, Panjiva data shows. That’s largely been due to increased shipments to Japan (up 11.4%) while in Europe Italy (up 9.4%) has attracted volumes away from Germany (7.6%) lower.

Source: Panjiva

Major U.S. buyers of Brazilian coffee that will have had to find alternative sources in the first quarter include JM Smucker’s Folgers (22.0% of imports), Starbucks (21.5%) and Rothfos (6%).

Source: Panjiva