Strides Pharma has started exports of Favipiravir, a generic version of Fujifilm’s Avigan, which may help in the treatment of COVID-19, Bloomberg reports. The firm’s factory in Bengaluru is licensed by the U.S. Food & Drug Administration though the exports will initially be sent to the Middle East. The drug does not appear to be covered by India’s export limitations, detailed in Panjiva’s April 1 report, though these have been steadily loosened.

Panjiva data shows exports from India linked to Strides Pharma had already started to surge ahead of the coronavirus pandemic, with exports having increased by 57.6% year over year in January after a 19.6% rise in Q4.

The expansion was led by a surge in shipments to markets outside the U.S. – indeed exports to the U.S. by Strides actually fell by 4.0% year over year in January after a 28.0% improvement in Q4. The U.S. represented 58.8% of Strides’ exports in 2019.

Source: Panjiva

There’s likely been a pickup in shipments to the U.S. subsequently. U.S. seaborne imports linked to the firm increased by 20.8% and 15.8% year over year respectively in February and March and rose by 9.5% in the first half of April.

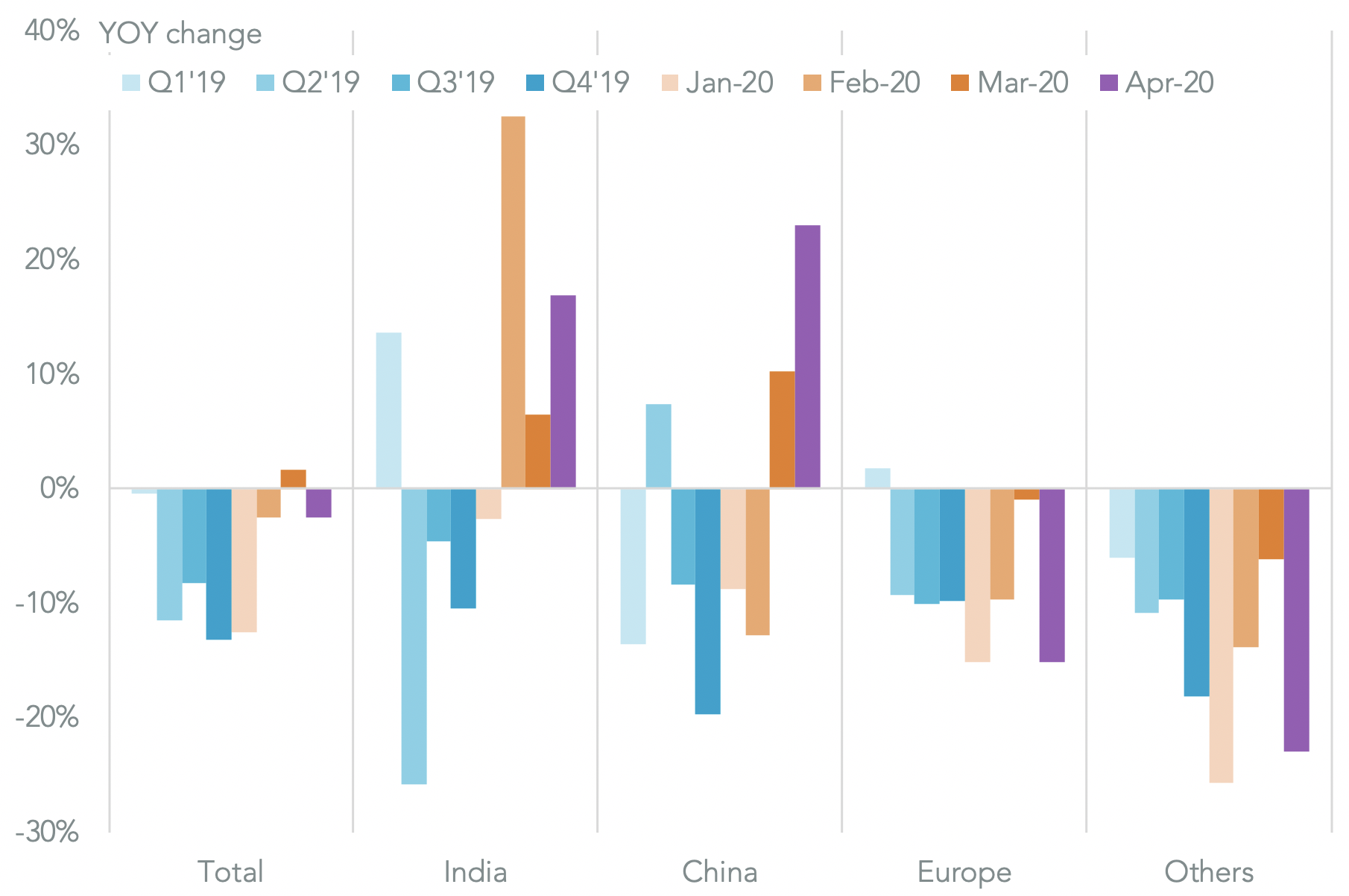

More broadly U.S. seaborne imports of pharmaceuticals and ingredients, dominated by generics from India and China, fell by 2.6% year over year in the first half of April. That includes a significant change in the mix of supplies though.

Imports from India and China surged 17.0% and 23.0% higher year over year. The former was enabled by the Indian government’s decision to allow contracts signed before the recent round of export bans to be fulfilled.

Imports from Europe and the rest of the world meanwhile dropped by 15.0% and 23.0%. The EU’s strategy of moving to a single community-wide export restriction clearly took effect, though shipments had already steadily declined since Q2’19.

Source: Panjiva