The apparel industry has had a particularly tough pandemic but may be returning to normal. This report sets the scene of the performance of supply chain in apparel, footwear and textiles using U.S. seaborne import data applied to a series of paired comparisons.

Total U.S. seaborne imports of apparel, footwear and textiles improved in September with a 0.8% year over year increase being the first rise since Sep. 2019, Panjiva’s data shows. That marks an important point of inflection after the pandemic-related shutdowns of manufacturing and retail which reached its nadir in a 47.6% slump in May.

The improvement is far from consistent or sustained. Shipments of apparel and footwear dropped by 1.6% and 17.0% year over year respectively in September while textiles climbed by 18.9%. For Q3 as a whole, the driver of the forthcoming earnings reporting season as well as the start of the peak sales season, imports of apparel, footwear and textiles were down by 4.2% year over year.

Source: Panjiva

A defining feature of COVID-19 has been the increased need to work from home, despite recent return-to-work and school reopening policies. The impact of that trend can be seen in the types of apparel being imported. Shipments of athleisure type products including leggings, tank tops and yoga wear increased by 3.0% year over year in Q3 while imports of formalwear such as suits and shirts fell by 17.6%. Somewhat surprisingly, imports of denim apparel fell by 16.5% – closer to formalwear – though that may reflect the inclusions of outerwear (see below).

Source: Panjiva

Uncertainties regarding the process of returning to school may have suppressed spending on kids clothes during the back-to-school season. While purchasing may have been prolonged, as flagged by Genesco in Panjiva’s research of Sep. 9, there’s nonetheless been a shortfall in the import of clothes linked to kids, which fell by 18.1% year over year in Q3, and all others which fell by a more modest 13.0%.

Source: Panjiva

There are signs that supply chains may be retooling towards a focus on textiles for home use rather than those for clothing. That can be seen in a 20.7% surge in imports of home textiles in Q3 including a 361% surge in shipments linked to Welspun. Meanwhile imports of winter clothes, which typically peak in Q3, fell by 21.1% compared to a year earlier including a 24.7% drop in shipments linked to Sumec Corp.

Source: Panjiva

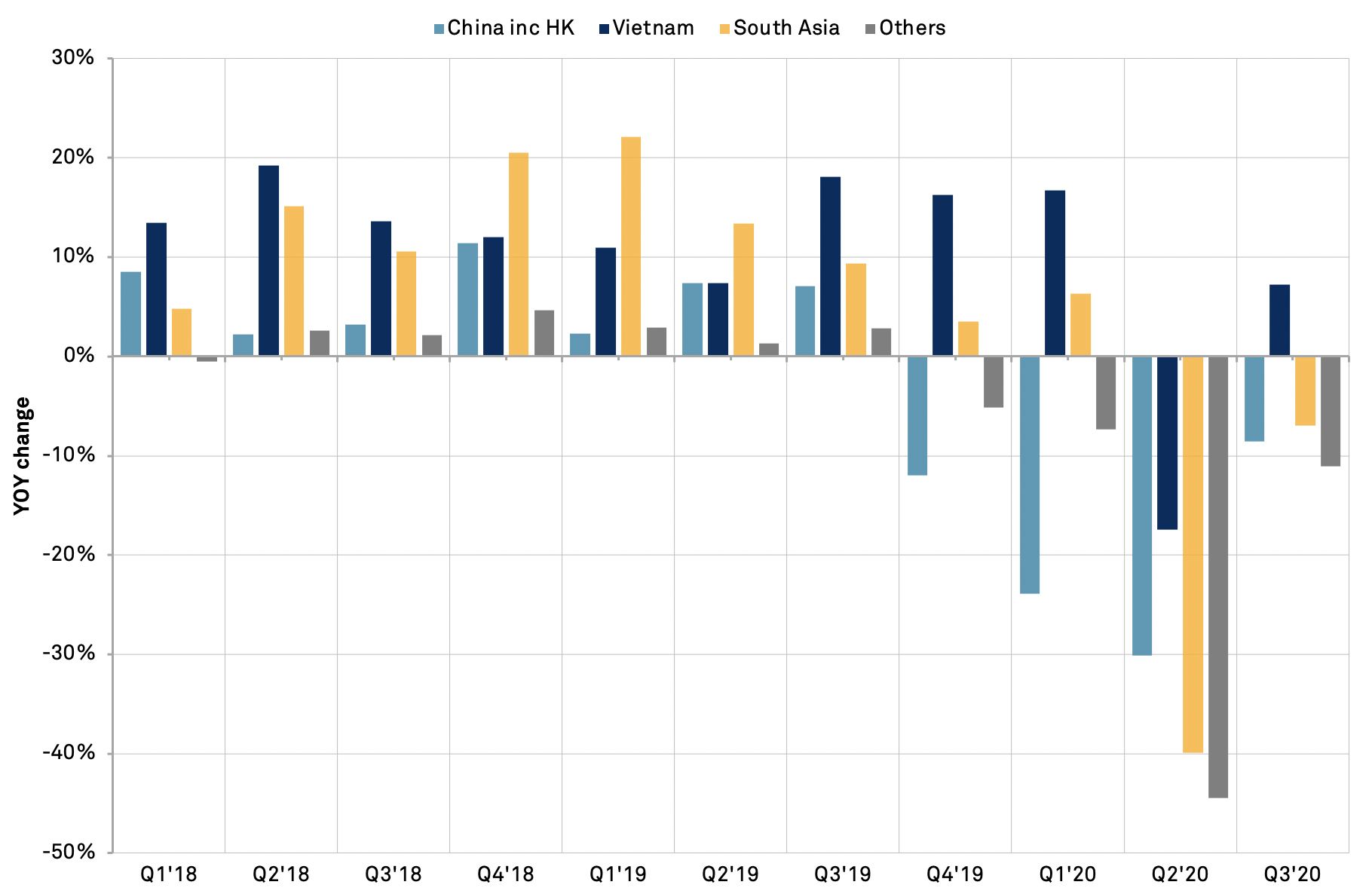

A longer-term challenge for apparel supply chains lies in tackling changes in trade policy. Under the Trump administration there’s been a shift away from supplies from China, with imports of apparel, footwear and textiles which fell by 17.4% year over year in the 12 months to Aug. 31. Instead imports have switched to Vietnam and South Asia with an increase of 5.5% for the former and a decline of just 9.3% for the latter – both saw an increase in 2019 compared to 2018.

The Trump administration’s newly launched section 301 review of Vietnamese currency practices is unlikely to be completed before the elections. Should President Trump retain power than supply chains connecting to Vietnam may face an extended period of uncertainty. The position of former Vice President Biden is less clear, but a multilateral approach to trade policy and a focus on countering China’s position in Asia may make a Biden administration less hostile.

Source: Panjiva