President Donald Trump’s latest Executive Order calls for “performance reviews” of all current trade deals in operation, as well as World Trade Organization-driven relations with countries where the U.S. has a “significant” trade deficit. That appears to extend an order already in place covering an Omnibus review of the drivers of the U.S. trade deficit that needs to be completed by June 29, as outlined in Panjiva research of April 26. The new order calls for a completion of reviews – which include an assessment of the impact on employment – within 180 days, or October 26.

The reference to WTO rules does not appear to be a direct reference to reconsidering membership, rather it calls for an analysis of whether WTO rulings are being adhered to. An argument can be made that the WTO has not made enough use of WTO rulings.

Panjiva analysis of WTO filings shows the U.S.filed half as many WTO complaints under Presidents George W. Bush and Barack Obama as under President Bill Clinton. The Obama administration also filed 60.9% of its complaints against China. By contrast Clinton’s focussed on the EU and Bush on NAFTA. Additionally, the U.S. has a better-than-average record of winning cases, Bloomberg reports.

Source: Panjiva

The order refers explicitly to the need for deals to “contribute favorably” to the U.S. trade the balance. Notably the National Trade Council has been reformed under as a second Executive Order. It’s responsibilities are more focussed on being a conduit regarding trade policy including “special projects” on trade. It will still be headed by Peter Navarro, who has been continually hawkish on the link between the deficit and economic activity.

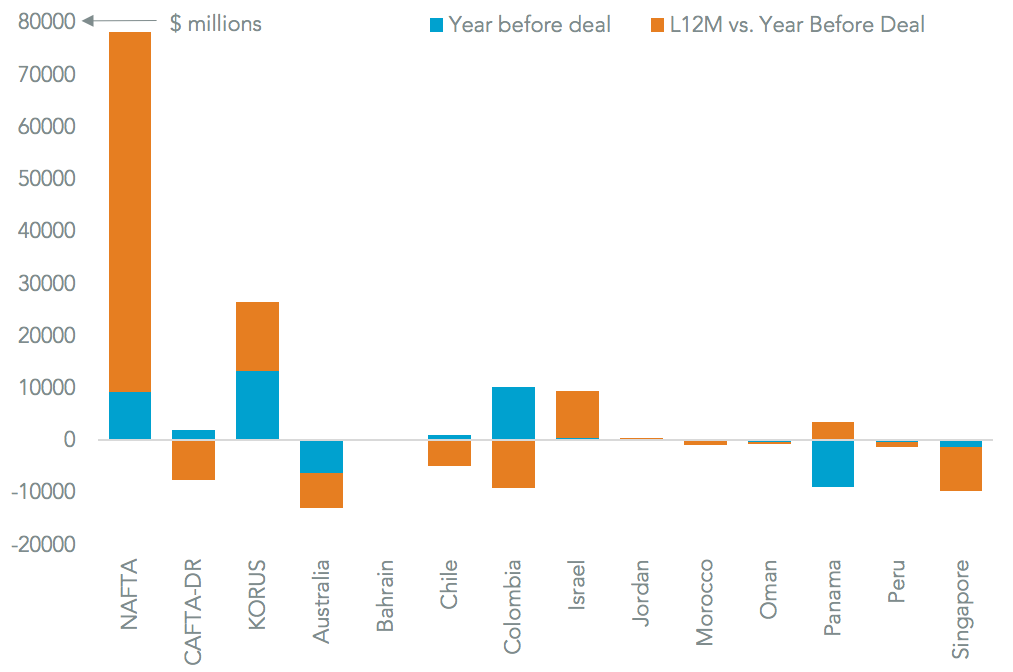

Panjiva analysis of U.S. import and export data shows that deals that may be deemed a “failure” (ie either a larger trade deficit or smaller trade surplus) include NAFTA, KORUS (with South Korea), Colombia, Israel and Panama.

Given the U.S. has already committed to reopening NAFTA the latest EO may be seen as providing firm evidence for renegotiation of KORUS in particular. It had the largest swing of all the trade deals except NAFTA at $13.3 billion. It is difficult to see a reopening of the other three – especially Israel – being worthwhile or politically valuable. “Successful” deals include CAFTA-DR, Australia, Bahrain, Chile, Jordan, Morocco, Oman, Peru and Singapore.

Source: Panjiva