U.S. crude oil imports have continued to increase, with a 12.1% rise in April, Panjiva data shows. EIA data suggests this may have continued in May with a further 7% rise. While the stated energy policy of the administration of President Donald Trump is to cut America’s reliance on OPEC supplies, this can include net exports too. In that regard exports jumped 69.3% to their second highest since at least 2009. That was only a partial offset, however, as net imports still increased by 5.4% in April.

Source: Panjiva

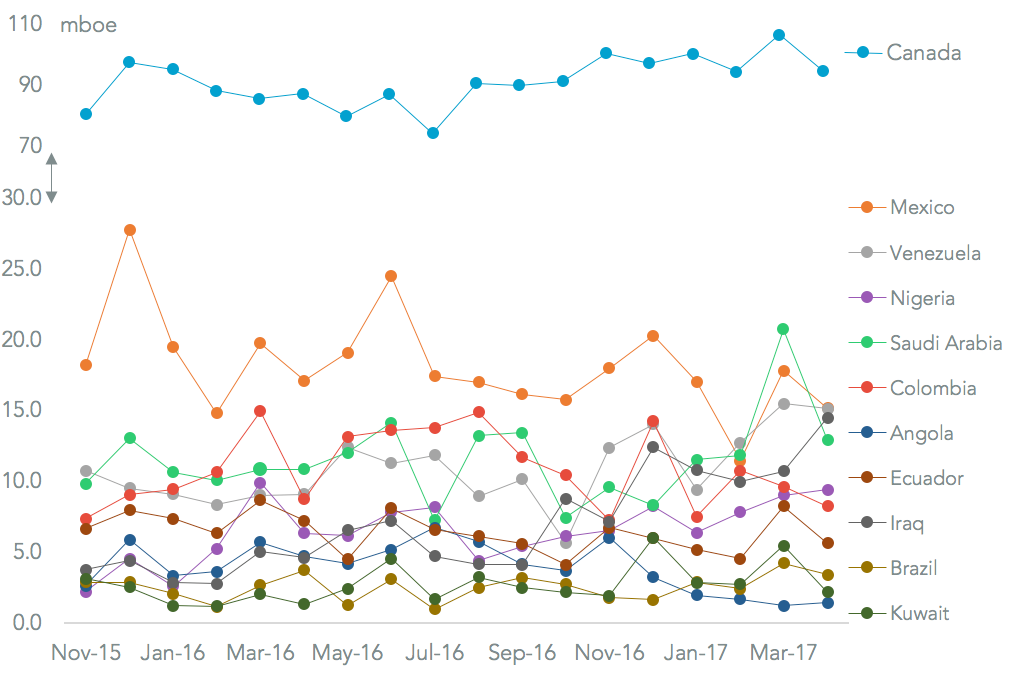

The biggest contributor to the growth in imports in April was Iraq, which reached a new high in April having climbed 185% in the three months to April 30. That moved Iraq ahead of Saudi Arabia as a supplier. The latter has committed to cutting its U.S. bound shipments, the Wall Street Journal reports. Imports from Saudi Arabia are still 18.7% higher in April than a year earlier, despite being a 37.7% lower than the prior month. That reflects a normalization after the unwinding of its Motiva joint venture with shell.

Supplies from Venezuela have been steadily gaining, with a 64.1% in the three months to April 30 coming at Mexico’s expense. The latter fell 14.1% over the same period. They may fall further as the Mexican government looks to rebalance its trade surplus with the U.S., as outlined in Panjiva research of June 7.

Source: Panjiva

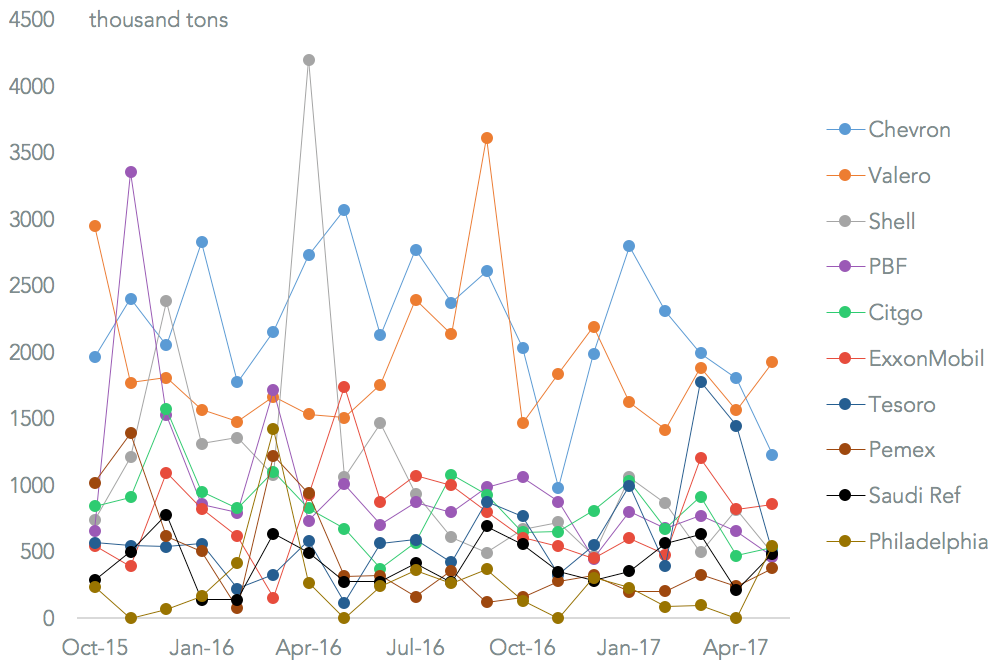

Among the major refiners buying crude oil, Chevron saw a 59.9% cut on a year earlier, with its lowest shipments since November. That led to it being overtaken as the largest buyer by Valero, which saw a 27.7% rise. Imports by Shell dropped 54.1%, which likely reflected the unwinding of its joint venture, Motiva, with Saudi Aramco.

Among the smaller operators, LyondellBassell’s Houston Refinery imported oil for a second month, having previously only done so in May 2016, making it the fourth largest importer for the month.

Source: Panjiva

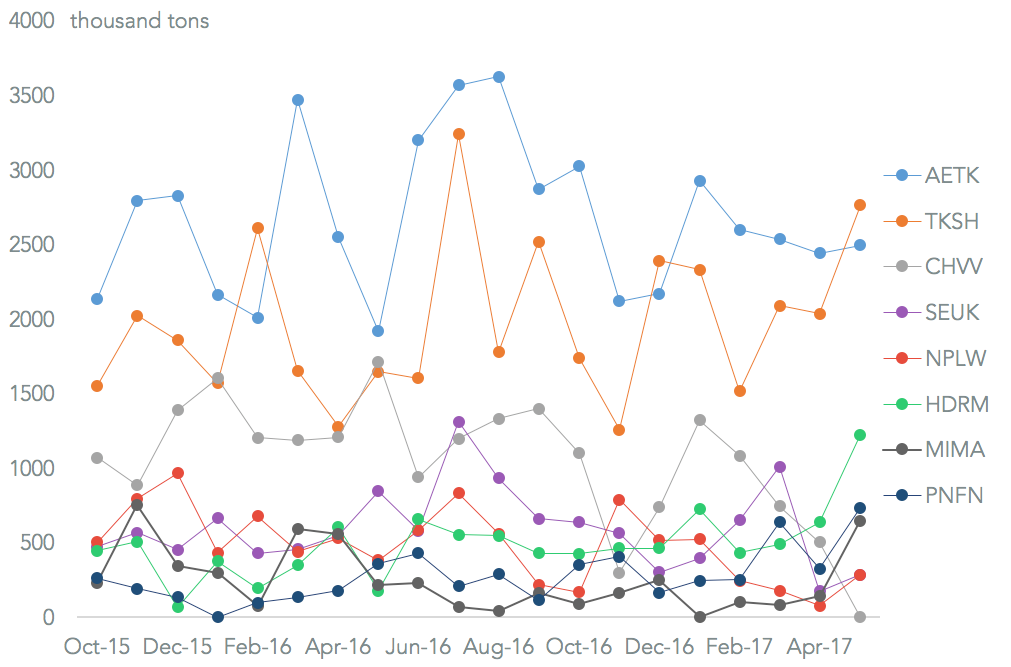

Teekay overtook MISC’s AET as the largest carrier after increasing its volumes handled by 67.7%. That may reflect it competing more aggressively for share in what it referred to as a market as facing “ headwinds”. The loss of market share for MISC represents the continuation of a trend seen throughout the first quarter. The fastest growing carrier was fleet operator Heidmar, which saw a rise to fifth place from eight after handling volumes jumped 582% on a year earlier.

Source: Panjiva