China’s international trade activity surged 23.0% higher than a year earlier in October, Panjiva analysis of official data shows. That represented a marked acceleration from the 13.9% growth rate seen in the third quarter and included the fastest growth in exports (20.1%) since at least 2014 excluding lunar new year distortions.

Source: Panjiva

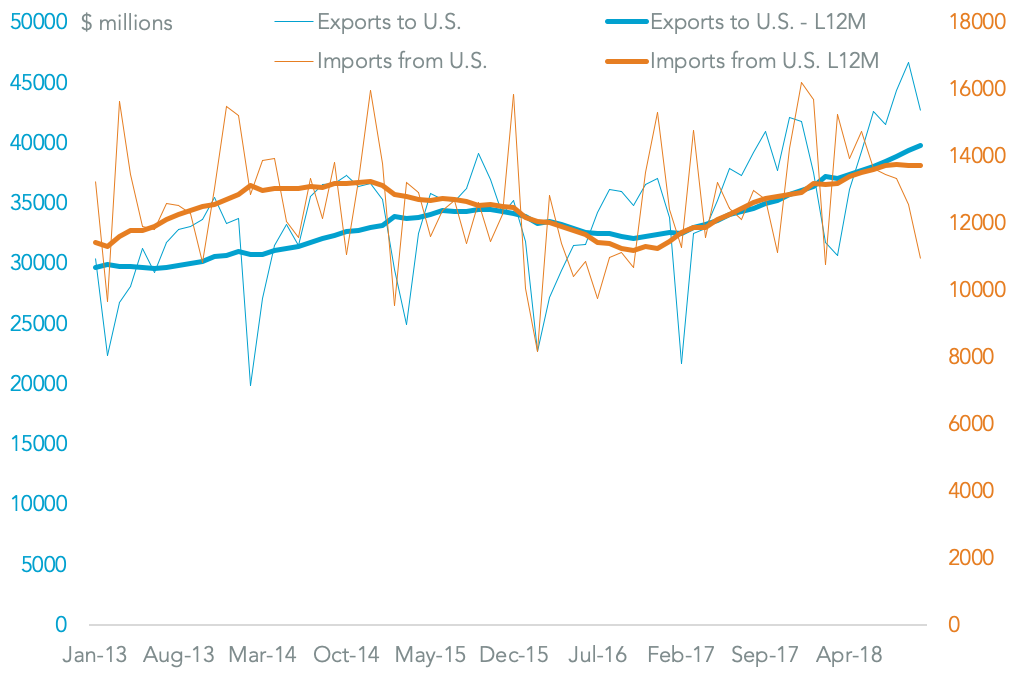

The export growth rate was well ahead of the 11.2% expected by analysts surveyed by S&P Global Market Intelligence but was partly flattered by the weakening yuan. In dollar terms growth was a still considerable 9.6%. That included a 13.2% surge in exports to the United States, which was above the 12.9% seen in the third quarter and was particularly remarkable given the imposition of tariffs on $200 billion of annualized exports from late September, as outlined in Panjiva research of Nov. 18.

The opposite is not true, however, with imports from the U.S. having fallen by 1.7%. The growth in exports / fall in imports would suggest that China’s retaliation against the U.S. is having more of an effect than America’s duties. That will likely overshadow the proposed Dec. 1 summit meeting between President Xi and President Trump.

Source: Panjiva

The single biggest driver of the global growth in exports was semiconductors, which surged 53.6% on a year earlier and provides a positive sign for electronics supply chains more broadly. Exports of metals also jumped with steel up 21.3% and aluminum by 31.3%. That’s a sign that widening protectionism in the sector has yet to have a restraining effect on China’s exporters.

Source: Panjiva