Hurricane Harvey made landfall on the night of August 25 as a category four hurricane. The Port of Corpus Christi – the closest to landfall – remains closed by is undamaged. The Port of Houston will remain shut August 29 after the port authorities assess conditions and the risk of further inclement weather.

The challenge is not just the operations within the port, but the welfare of staff and access to the port by road and rail for loadings / unloadings. The threat of heavy weather conditions continues, possibly through Wednesday across Texas according to NOAA, including a second “landfall”.

The port of Houston’s closure for a fourth full day (four-and-a-half including Friday) will likely disrupt shipping for the c6,500 TEUs per day that is normally unloaded / loaded at the port and may need to find alternative routes. That could include disruptions to shipping operations elsewhere on the gulf and eastern seaboards.

Panjiva data shows Port Houston is the fifth largest container handling port in the nation following a 13.9% annualized growth rate in the past three years. There will be a significant impact on imports from Mexico, which represented 27.3% of activity in the past year while shipments from the EU (20.2%) and China (17.8%) may be diverted elsewhere. The largest consignee for Mexican freight by number of shipments is General Motors, while the largest handlers of incoming freight from China are Expeditors and Schneider.

Source: Panjiva

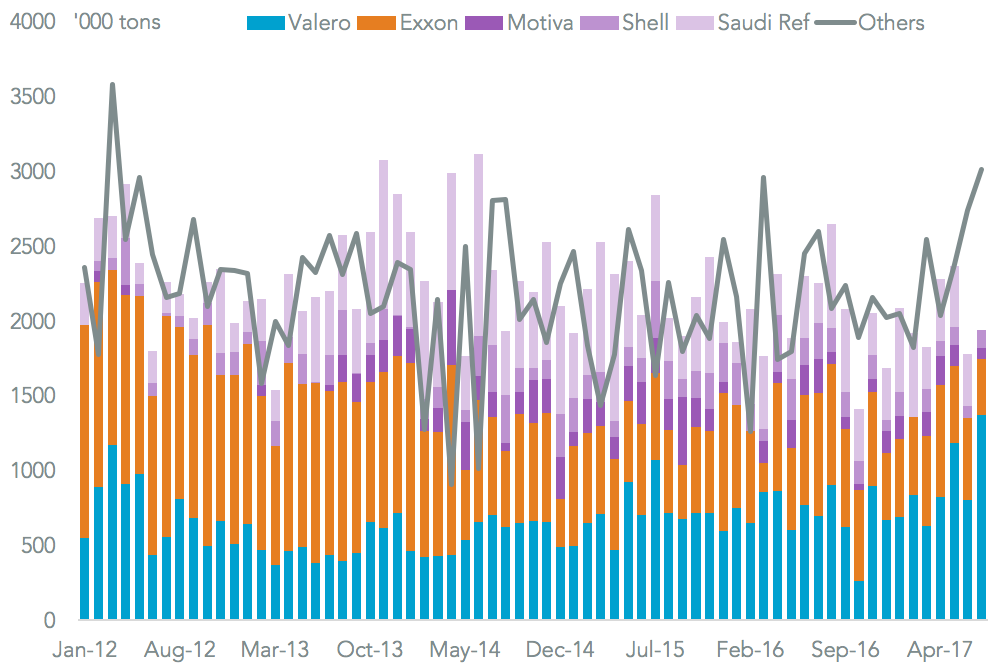

Disruptions to oil imports will also continue, and by extension to gasoline supplies. The gulf coast broadly accounted for 74.9% of eastern U.S. crude oil imports in the past quarter, with Houston accounting for 17.6% and Corpus Christi 7.3%. The largest consignee at Corpus Christi is Valero, and at Houston is ExxonMobil.

Source: Panjiva