President-elect Biden has indicated that there will be no rapid moves with regards to China, stating “I’m not going to make any immediate moves, and the same applies to the tariffs“, the New York Times reports. The President-elect also noted that “it’s going to be a major priority for me in the opening weeks of my presidency to try to get us back on the same page with our allies” with regards to dealing with China.

That confirms the President-elect’s previously stated tough-on-China stance stated ahead of the elections, as discussed in Panjiva’s research of Nov. 2. There is still a risk that the outgoing Trump administration may seek to force a more hawkish stance on the Biden administration by withdrawing from the phase 1 trade deal and pushing tariffs upward. That appears to be a low probability risk at the moment with the administration instead focused on incremental measures such as a potential ban on Chinese firms listing on U.S. stock exchanges reported by Reuters.

The survival of the phase 1 trade deal depends at least upon delivery of its core terms of purchasing by the Chinese government of U.S. farm goods, energy products and manufactured items.

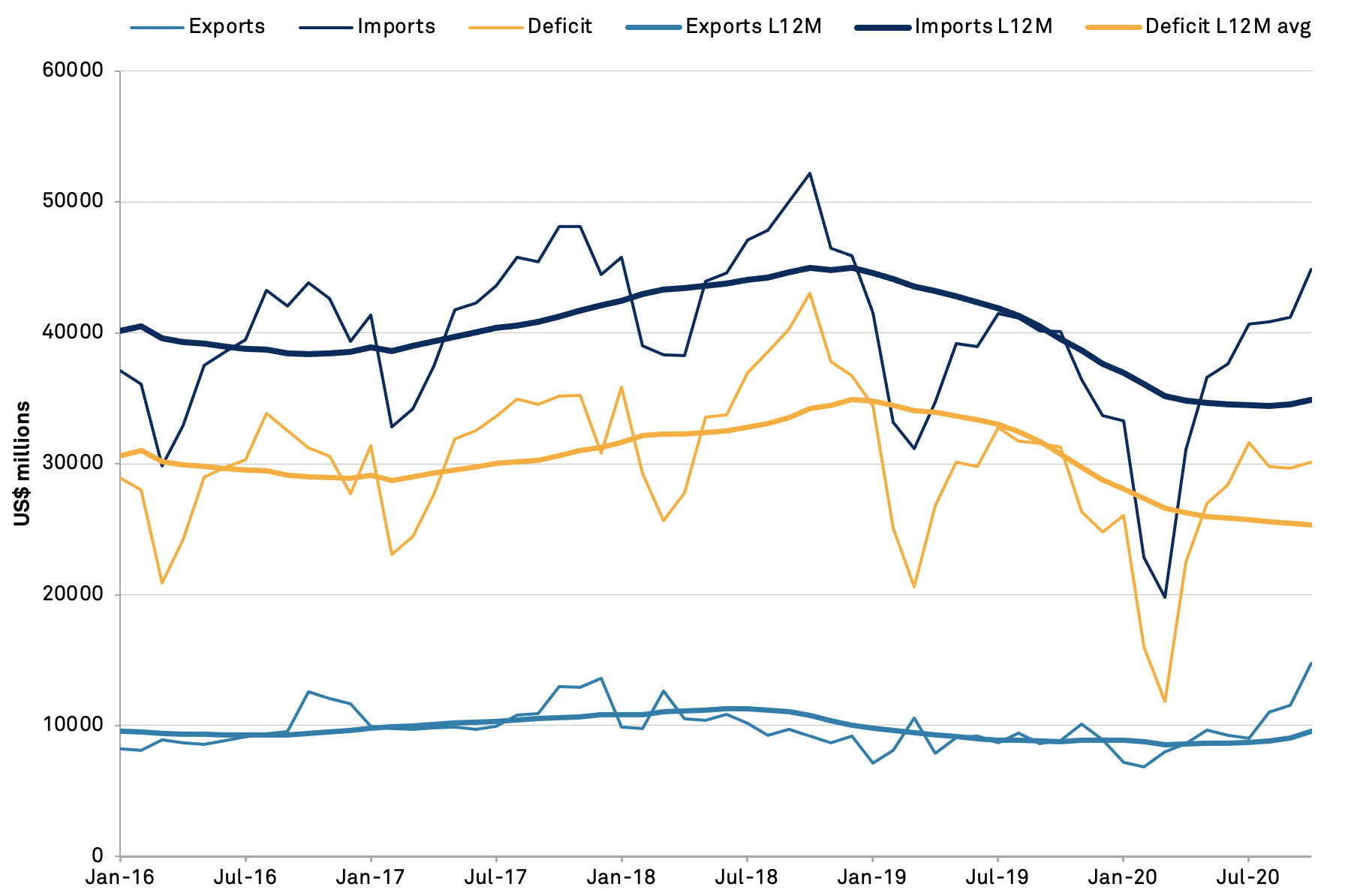

At a high level, Panjiva’s data shows that U.S. exports to China surged 66.3% year over to reach $14.7 billion, the highest since 2002 but only 13.6% above the same month of 2017 – the baseline for the phase 1 trade deal. There’s also been a surge in imports from China, linked in large part to consumer goods, to reach $44.8 billion with the result that the trade deficit is currently increasing.

Source: Panjiva

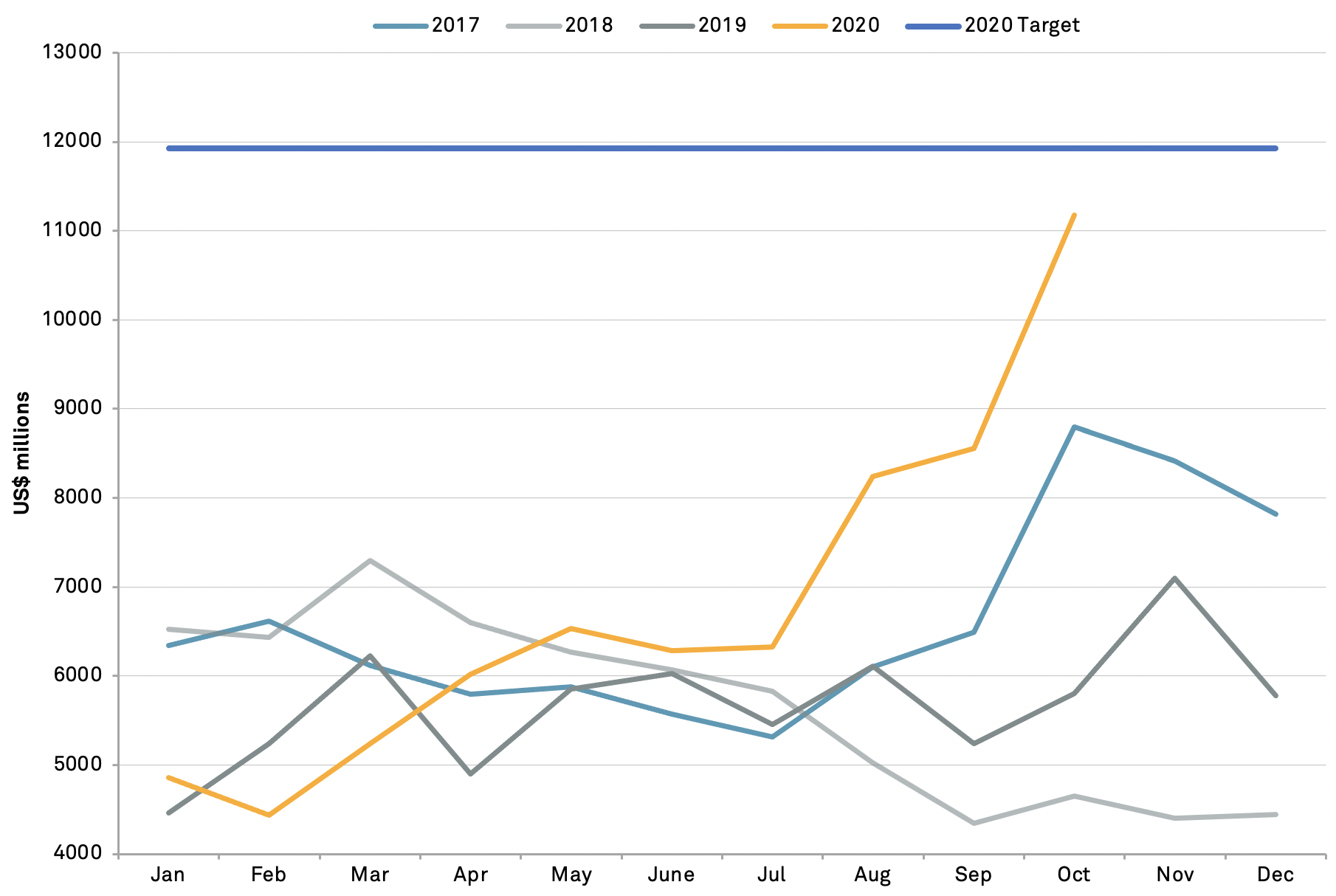

Panjiva’s analysis shows that U.S. exports to China covered by the phase 1 trade deal reached their monthly run-rate target for the first time in October, with $11.1 billion of shipments compared to the $11.9 billion implied by the targets set in January.

Exports of agricultural products have led the way, reaching $4.84 billion, up by 308% compared to 2017 and led by the delivery of soybeans worth $3.50 billion. It should be noted though that weekly deliveries in November may have slowed, raising the risk that momentum may be lost.

Energy exports climbed by 146.6% versus 2017 to reach $1.25 billion, well below the $2.18 billion run-rate implied by the deal, though a slide in global oil prices may have been a drag.

The slowest rate of development has been in manufactured products, which rose by 11.9% year over year and by 15.3% versus 2017. The growth rate implied by the trade deal should be nearer 57.8%, or $6.97 billion per month versus the $5.09 billion out-turn.

Source: Panjiva

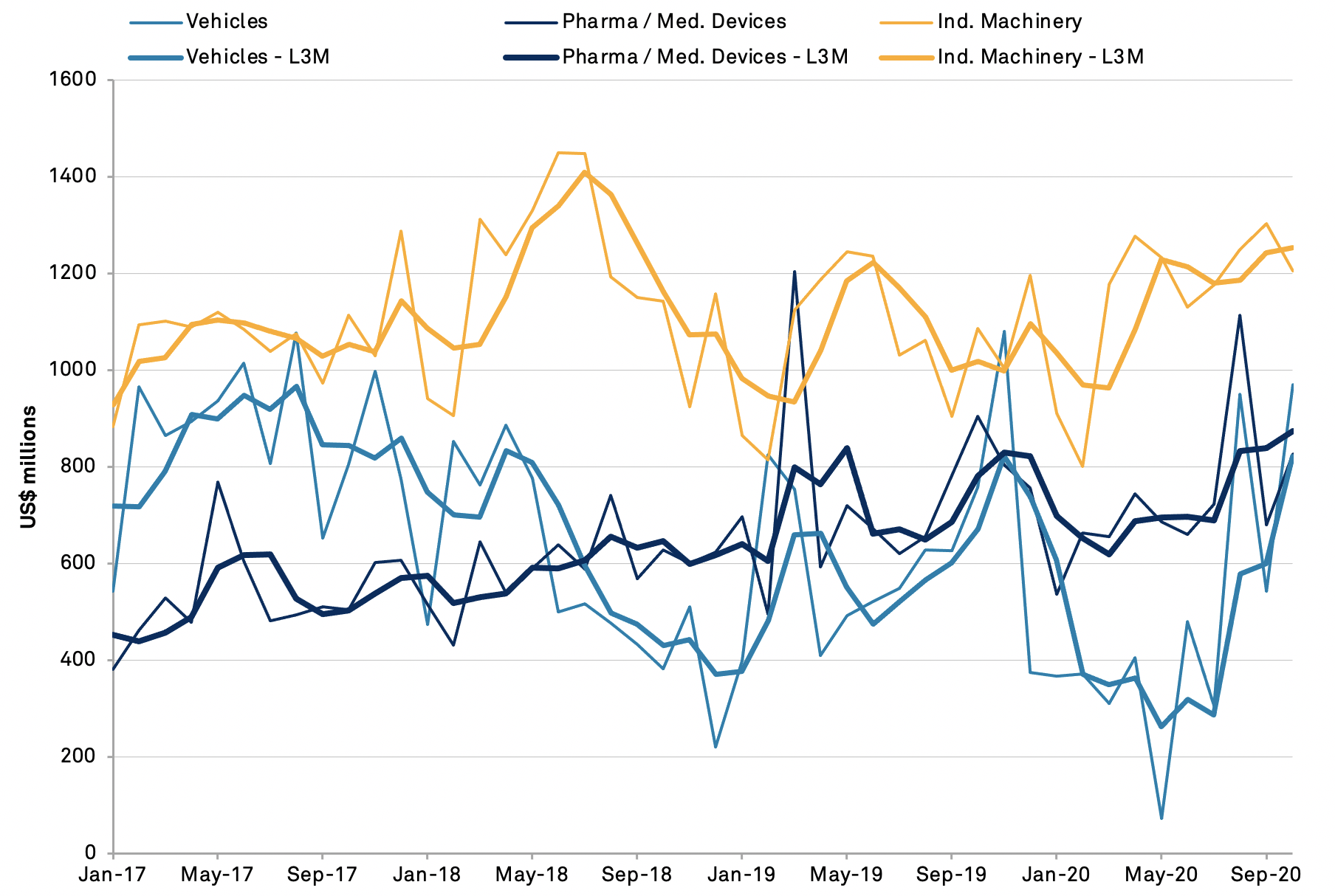

The expansion in manufactured goods has been driven in large part by a 153% year over year expansion in exports of vehicles, led by shipments of General Motors vehicles by local partner SAIC as well as shipments of vehicles for Honda.

Exports of pharmaceuticals and optical / medical devices having increased by 46.9% and 19.7% respectively. The latter are likely linked at least in part to treatments for the pandemic as well as other medical requirements. The largest leverage for additional growth will likely come from the aerospace industry as well as industrial machinery where there’s been an expansion of just 5.5%.

Source: Panjiva