The big three container shipping alliances have cut 24 sailings around the lunar new year holidays, S&P Global Platts reports. That follows a surge in demand that has clogged ports and left equipment out of place. Hapag-Lloyd has stated the blanked sailings are because they “have no choice but to implement a comprehensive schedule recovery plan to get vessels back in their intended positions“.

While allowing for a clearance of port congestion and equipment imbalances – which should lead to improved reliability – the blanks won’t address increased demand nor will they potentially allow the normal seasonal decrease in shipping rates that follows the lunar new year holiday, discussed in Panjiva’s 2021 Outlook.

Furthermore they may attract the attention of regulators with the governments of China, India, South Korea and the U.S. all in the process of various types of investigation or legislative changes in the sector.

While China-to-U.S. west coast shipping rates are 80.6% above the year earlier level as of the week to Jan. 22, their performance in the past few weeks is similar to – though still slightly stronger than – prior years from a seasonal perspective with a 12.3% increase since week 49, Panjiva’s analysis of Shanghai Shipping Exchange data shows.

Source: Panjiva

The elevated demand looks set to continue. Hapag-Lloyd’s Americas President, Uffe Østergaard, has stated “I would expect that the market would come down after Chinese New Year. But that does not look to be the case right now” in part because “we definitely, first half of this year continue to see quite strong demand and continued supply chain challenges“, ShippingWatch reports.

While care is needed with analyzing short time periods of shipping data, there are signs that shipping into the U.S. has continued at an elevated rate in January. Panjiva’s data shows that total U.S. seaborne imports rose by 9.6% year over year in the first two weeks of January, though shipments into LA and Long Beach already slowed to a 2.5% increase due to heavy congestion.

The major container lines face significant service disruptions in part due to the west coast congestion and also, in the case of Maersk and ONE, due to storm conditions in the Pacific that have delayed early-month sailings.

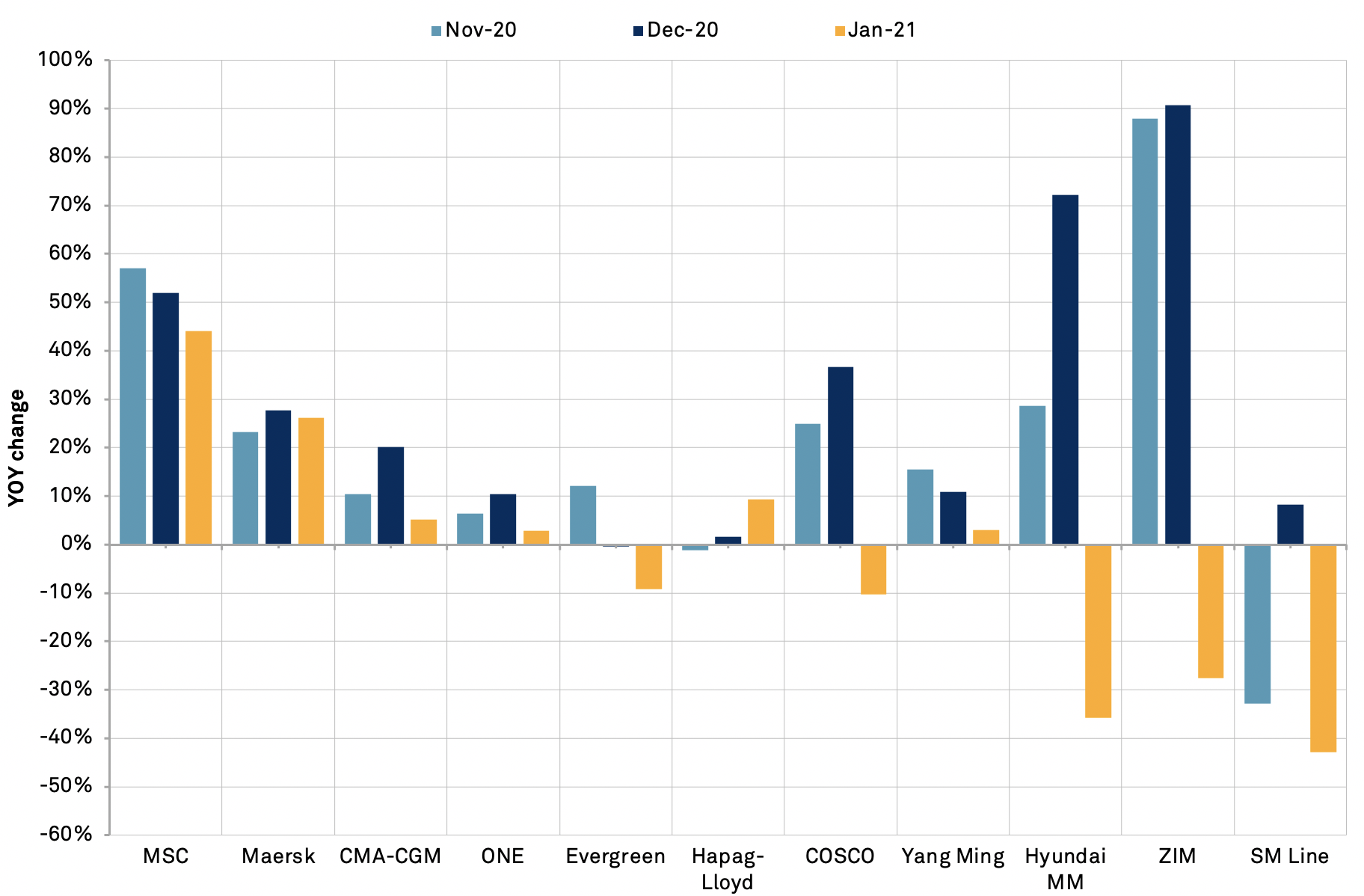

The delay in Maersk Essen has not had a noticeable effect on Maersk’s growth in shipments into the U.S., which rose by 26.1% year over year in the first two weeks of January after a 27.7% surge in December. Similarly its 2M partner MSC climbed by 44.0% in January. ZIM Shipping, affiliated with 2M, experienced a 27.5% drop though again, as noted, that may reflect normal sailing conditions for a smaller liner.

There’s been a notable slowdown in shipment growth for CMA CGM and ONE to 5.1% and 2.8% respectively. The latter may reflect the impact of the ONE Apus sailing which had to return to Japan after storms. Shipments linked to COSCO Shipping (including Orient Overseas) and Evergreen meanwhile have declined by 9.2% and 10.3%, suggesting a loss of traction for the Ocean Alliance of shipping firms more broadly.

Hapag-Lloyd meanwhile has sailed in a very different direction, with a 9.3% expansion in volumes shipped to the U.S. in the first two weeks of January compared to a 1.6% rise in December and a 1.3% dip in November.

Source: Panjiva