This report uses Panjiva data via the S&P Global Xpressfeed product to analyze the risks to Malaysia’s export economy. Similar reports on other political and corporate topics can be found at panjiva.com/research/category/xpressfeed.

Malaysia’s Prime Minister, Mahathir Mohamad, has expressed concerns that the country’s export expansion to the U.S. may cause the country to “be a target for sanctions” Reuters reports. That would likely come in the form of a section 301 review similar to that applied to China. Prime Minister Mahathir’s concerns are similar to those expressed by the Vietnamese government, as outlined in Panjiva’s research of Jun 14.

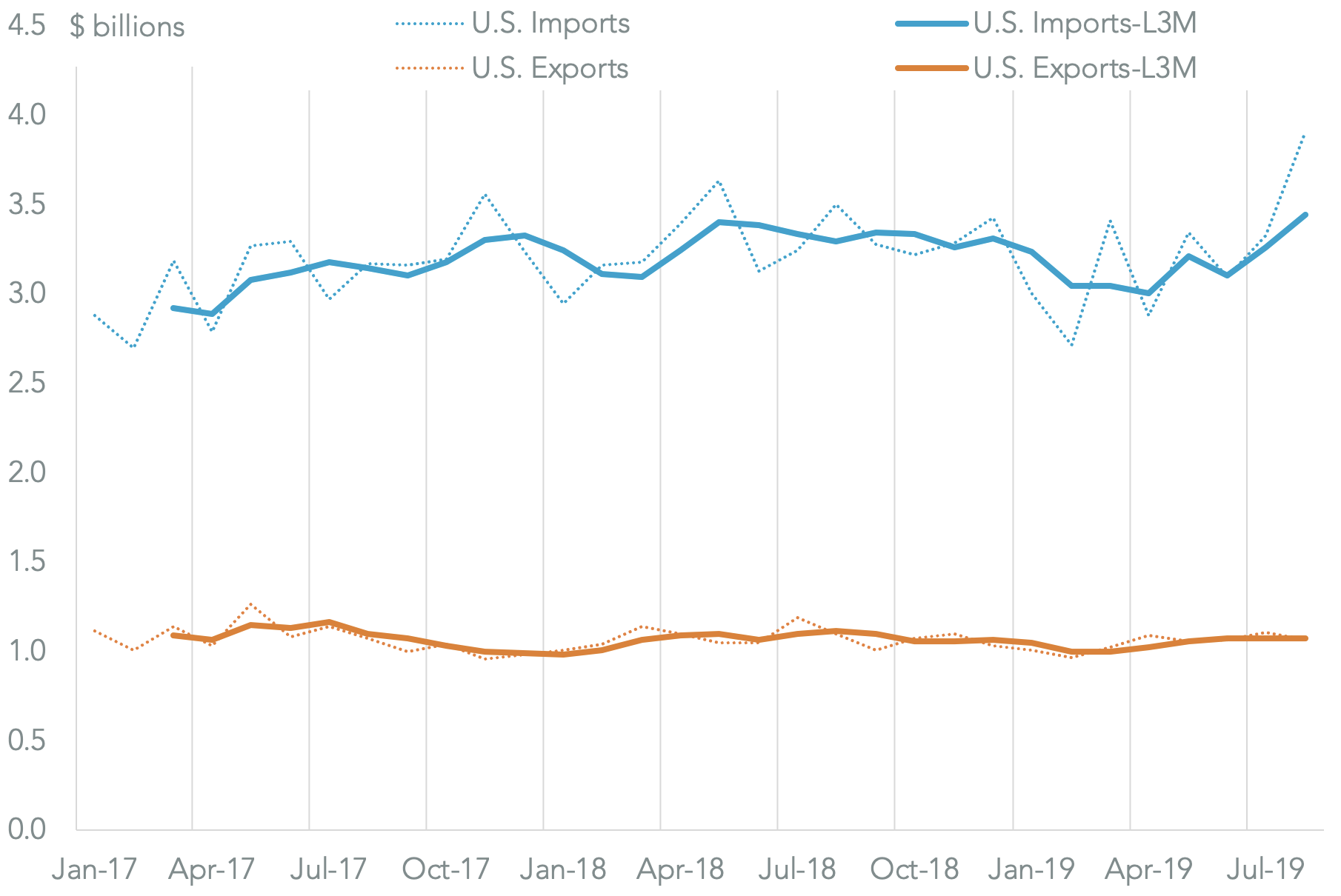

Mahathir’s concerns may be well founded, as Panjiva’s data shows that the U.S. trade deficit with Malaysia reached $26.3 billion in the 12 months to August 31. That was driven by a 4.6% year over year increase in Malaysian exports to the U.S. in the three months to Aug. 31, while U.S. exports to Malaysia fell 3.2% over the same period.

The trade deficit is one of the Trump administration’s preferred trade metrics, as noted in Panjiva’s 4Q Outlook, and it is likely that some of the increase in imports can be attributed to countries leaving China, defying wishes by the Trump administration for manufacturing to move back to the United States.

Source: Panjiva

The electronics sector drove a significant amount of Malaysia’s growth. Imports to the U.S. from Malaysia of semiconductors made up 38.1% of total imports by value in 2018. They subsequently increased by 8.4% year over year in the three months to Aug 31, totaling $4.09 billion over the three month period.

U.S. imports from Malaysia of related electronics subcomponents – including diodes and transistors – also increased by 93.6% year over year to reach $837.7 million. The increase in components were partially offset by a decline in imports of phones, which fell 38.6% year over year to $655.0 million.

Source: Panjiva

At the corporate level, Samsung Electronics may have played a large part in Malaysia’s success. Panjiva data shows that imports associated with Samsung rose by 15.3% year over year in the third quarter. Samsung recently shifted production away from China and Vietnam, and Malaysia may be another beneficiary of that move.

Other companies that may be at risk of U.S. attention on Malaysian imports include food distributor Global Agri-trade – whose exports to the U.S. rose 108.6% year over year in 3Q – as well as appliance maker Dyson whose shipments surged 66.6% higher over the same period.

Source: Panjiva

Recreating this analysis with S&P Global Xpressfeed

Identifying the companies that source products from Malaysia uses the U.S. imports dataset for 2017, 2018, and 2019. 2016 or earlier years can be added using the same format. HS codes are joined in to provide product level resolution, and then the three tables are unioned together into a master source table that includes the date of the shipment, the bill of lading for shipment counting, the companies involved, and the teu. This is then used as a subquery and joined with a generic company lookup to identify the CIQ company associated with that supplier. The results are then reduced and aggregated using the group by.