President Donald Trump may shortly direct the U.S. Trade Representative, and presumably the Commerce Department, to launch a “section 301” case against Chinese trade practices, the New York Times reports. This could potentially meet two objectives for the administration: find policy levers to reduce the U.S. trade deficit with China; provide leverage in talks to convince China to take a more hawkish stance with North Korea.

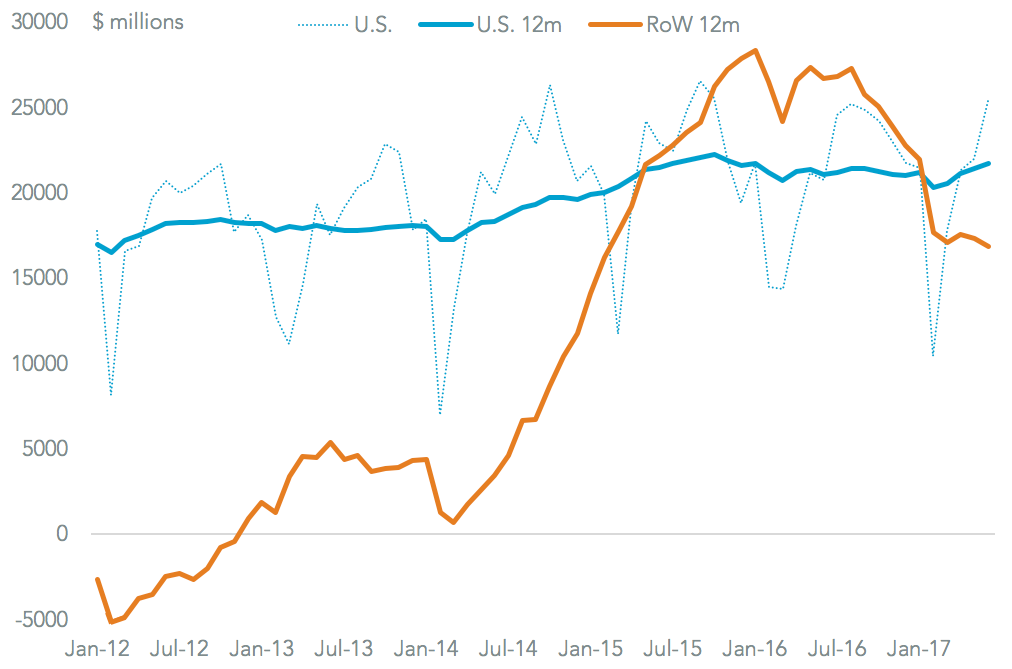

In terms of the former the Chinese trade surplus with the U.S. has expanded to its highest since October 2015 in June, Panjiva data for imports and exports shows. It is now 1.3x its surplus with the rest of the world combined on a trailing 12 month basis.

Source: Panjiva

Another issue to consider is deliverability of action. The Trump administration has already launched several trade investigations and policy analyses, as outlined in Panjiva research of July 19, which have not yet resulted in policy actions. For example, the section 232 reviews of the steel and aluminum industries were required to be delivered “expeditiously”, but still appear to be at the consultative stage.

The background has already been completed via the annual USTR section 301 report on intellectual property protection published in April. China is already a subject of “longstanding and new IP concerns”. The report identifies several areas of concern, and requirements for improvement, but does not include an “or else” component.

A restriction on high technology exports from the U.S. would prove counterproductive – that would actually increase the U.S. deficit. A more generic embargo on imports from China would likely be challenged via the WTO, and directly invite retaliation. Even assuming that route would be followed, there are a limited number of targets that could make a meaningful difference to the U.S. trade deficit.

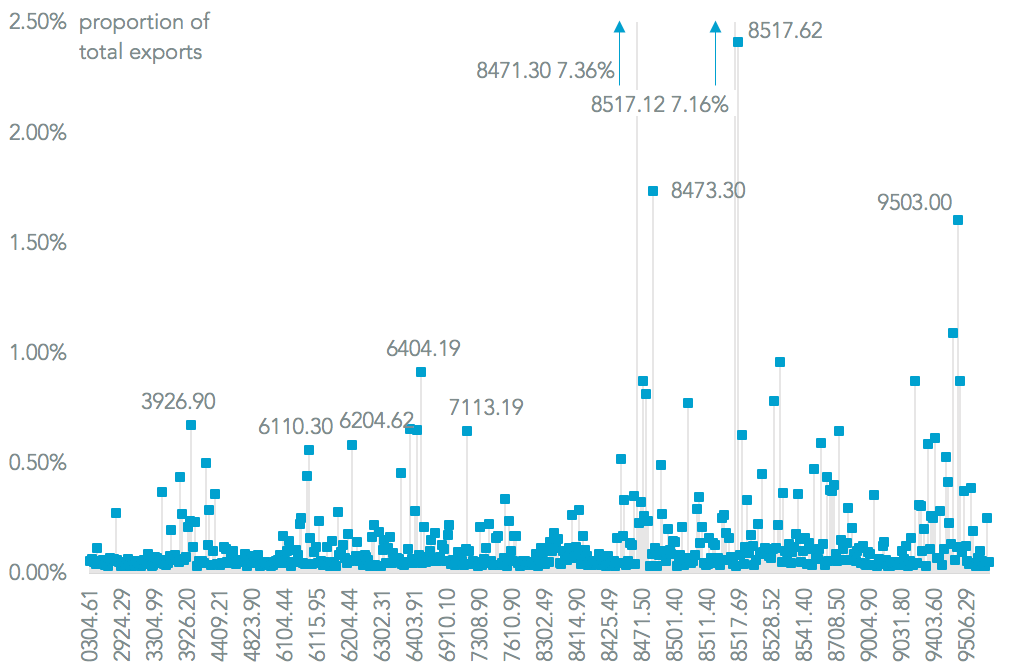

Panjiva analysis of the top 500 export lines from China to the U.S., which could be subject to trade sanctions, are heavily skewed towards consumer goods. These include electronics (phones and computers equivalent to 20.5% of exports in the past year), apparel (11.7% including footwear and leather goods), furniture (7.0%) and toys (3.8%). Limiting imports – either through tariffs or quotas – would raise costs for retail consumers, cutting effective incomes.

Source: Panjiva