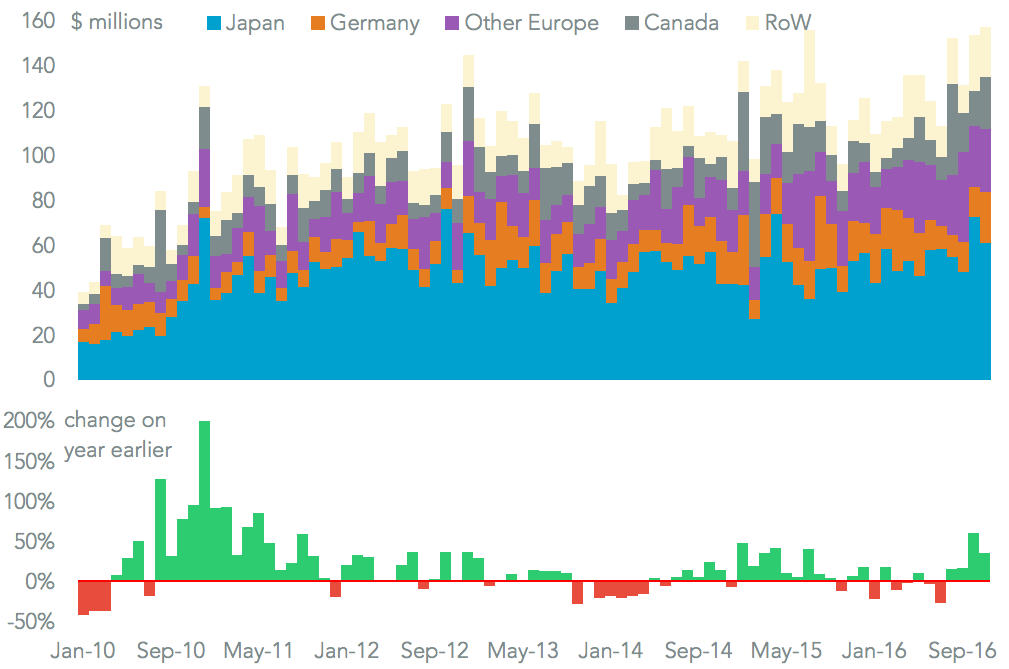

There has been much discussion from the new U.S. administration of bringing jobs back to America, likely using protectionist trade measures as discussed in Panjiva research of January 3. One risk is that tariffs lead to ‘onshoring’, but that companies invest in automation rather than simply moving jobs from one country to another. U.S. imports of industrial robots increased 36.0% in the three months to November 30, Panjiva data shows, with 41.1% of imports coming from Japan and 32.6% from Europe.

Source: Panjiva

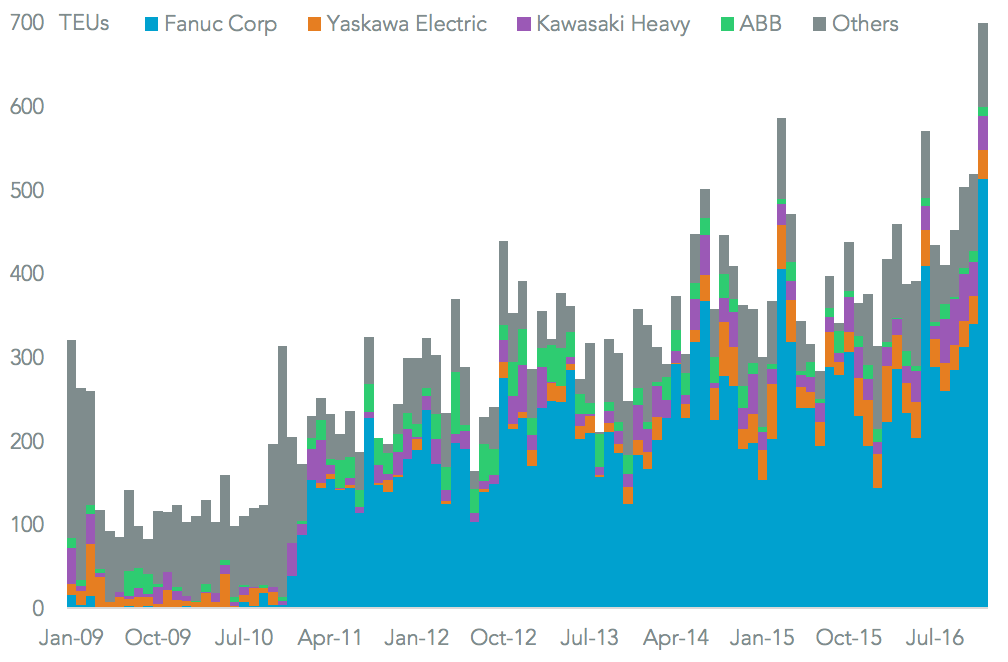

That trend was shown by the 86.2% jump in shipments on a year earlier in December, suggesting total imports could reach another new high. This was led by a 164% growth in imports by Japanese manufacturer Fanuc. That brought fourth quarter shipments to 59.4% ahead of the company’s quarterly report due January 26. Among the mid-sized players Kawasaki Heavy’s exports to the U.S. climbed 31.4%, beating out Yaskawa Electric’s 18.7% decline.

Source: Panjiva

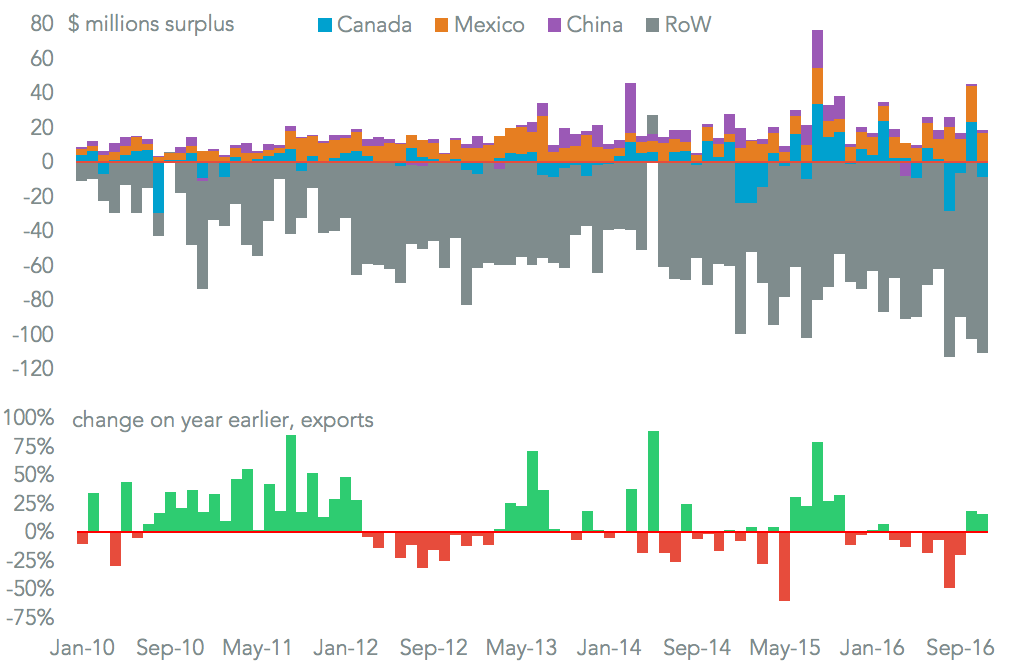

While imports are growing, so are exports. These climbed 15.3% in November led by a 73.3% jump in shipments to Mexico. The U.S. runs a surplus in industry robots with Mexico and Canada of a total $175 million over the 12 months to November 30. This raises the risk that the industry becomes a target for trade retaliation during forthcoming NAFTA renegotiations.

Source: Panjiva