The administration of President Donald Trump spent much of its first 100 days in office commissioning new trade reports and setting the groundwork for future action, as outlined in Panjiva research of April 26. Many of these reports, and related policy actions, will come to fruition in the next three months. Not all will result in tariff actions – which Commerce Secretary Wilbur has said is only part of the equation in correcting the U.S. trade deficit – but many will. The dates to track include:

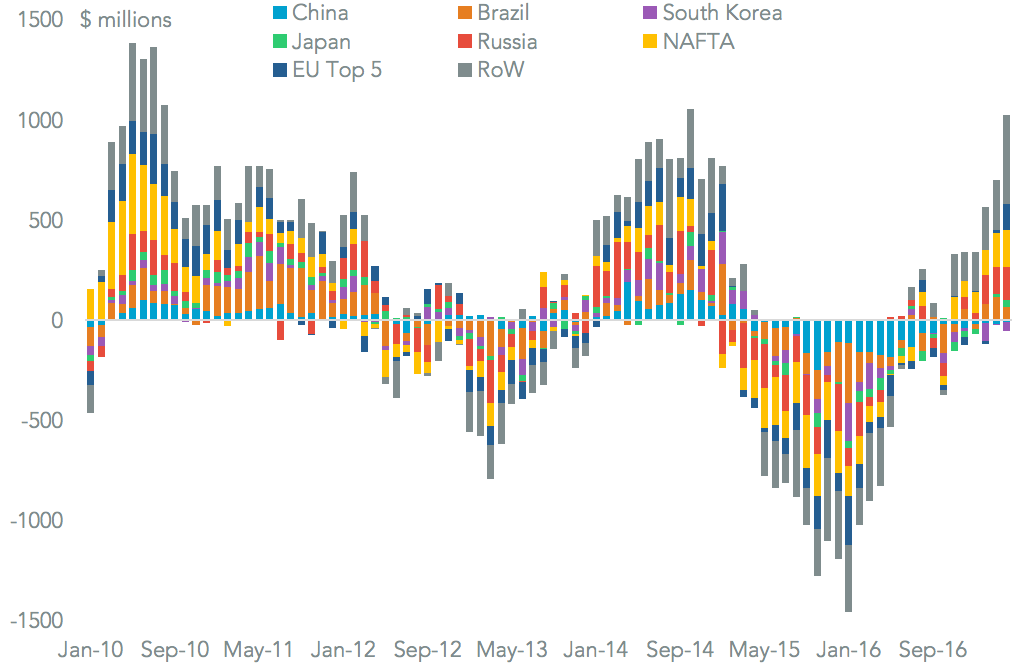

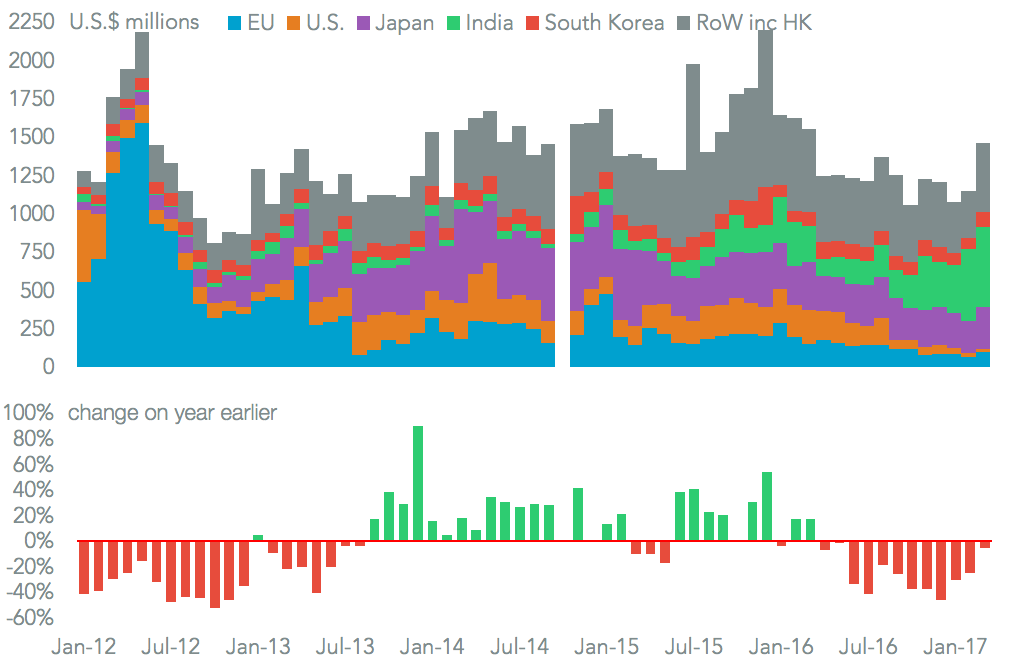

June 16 – The administration’s Section 232 review of the steel industry seeks to determine whether there are broad, national security threats to the steel industry. Imports in total have been rising, driven by Russia, Canada and Mexico, though the scope may be limited. This could be as narrow as defense-related materials, but could be broadened to include “national interest” items such as infrastructure.

Source: Panjiva

June 23 – A similar Section 232 study of the aluminum industry was started a week later than the steel review. The administration has committed to completing the report by the end of June. Imports of aluminum have also been increasing in aggregate, led by Canada and China. Again, there are choices to be made on products to be sanctioned, and whether a mixture of tariffs, quotas or outright bans are put in place.

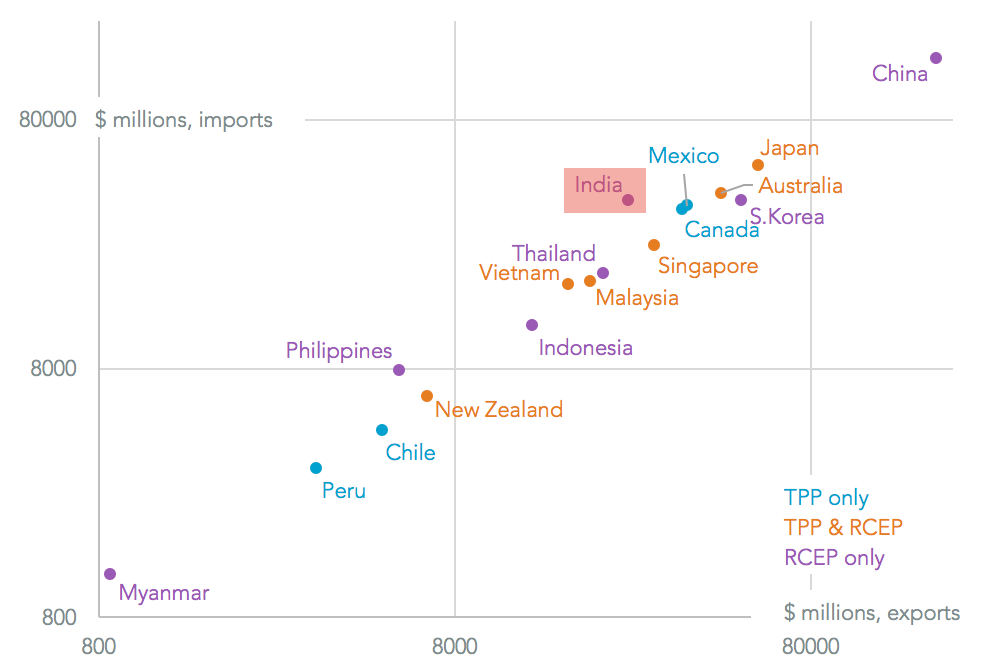

June 26 – President Donald Trump has yet to hold a meeting with Prime Minister Narendra Modi. The focus of the visit is more likely to be on the services side of trade – particularly visas – rather than goods. However, India is a potential signatory to the RCEP trade deal with China, and the administration may want to ensure it remains open to improving trade links with the U.S. too.

Source: Panjiva

June 29 – A central plank of the Trump administration’s economic philosophy is that trade deficits are a sign of unfair trade deals. The Omnibus review of the causes of the trade deficit will therefore likely provide the evidence to back up future trade actions. Vietnam has been a major contributor to the rising trade deficit, in part because of a transfer of manufacturing capacity from China. A review of the effectiveness of collection and enforcement of duties, due on the same day may also flag ‘ country hopping’ issues.

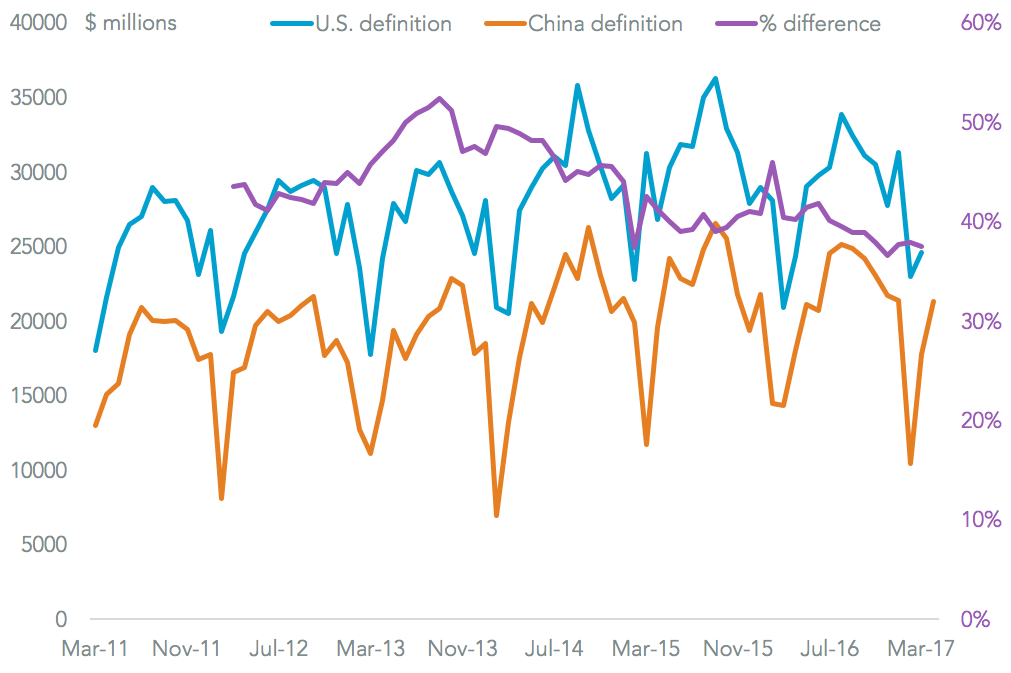

July 16 – The largest component of the U.S. trade deficit is China. That has led the administration to implement a 100 day plan to find ways to increase U.S. exports with the Chinese government. So far only two goods-related projects have been implemented, relating to beef and LNG. However, these could already add $2.4 billion to U.S. exports and may be supplemented by other deals, for example on soybeans.

Source: Panjiva

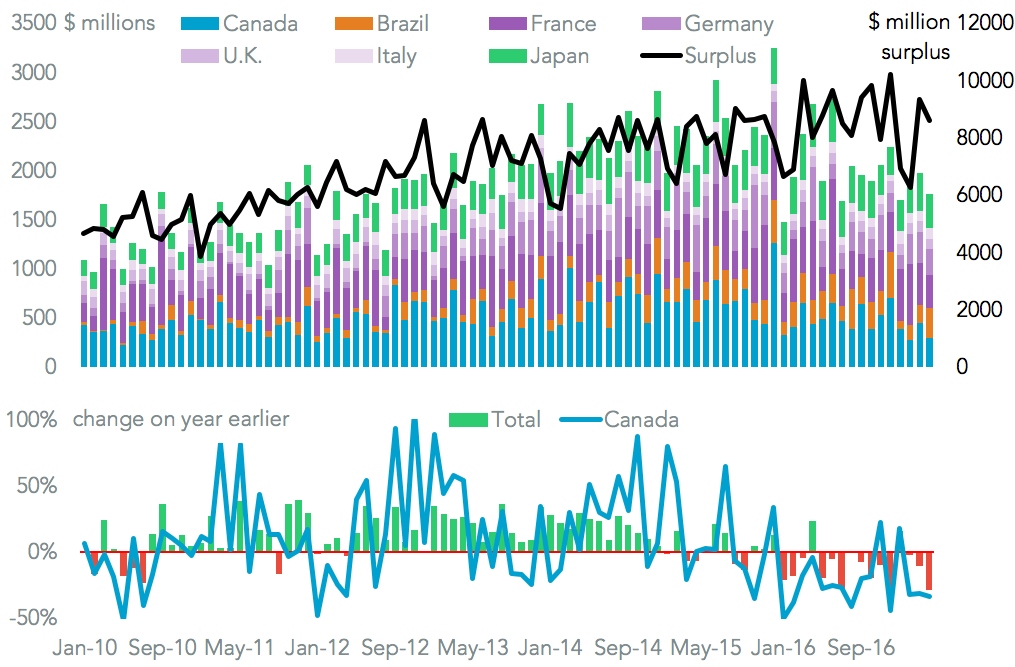

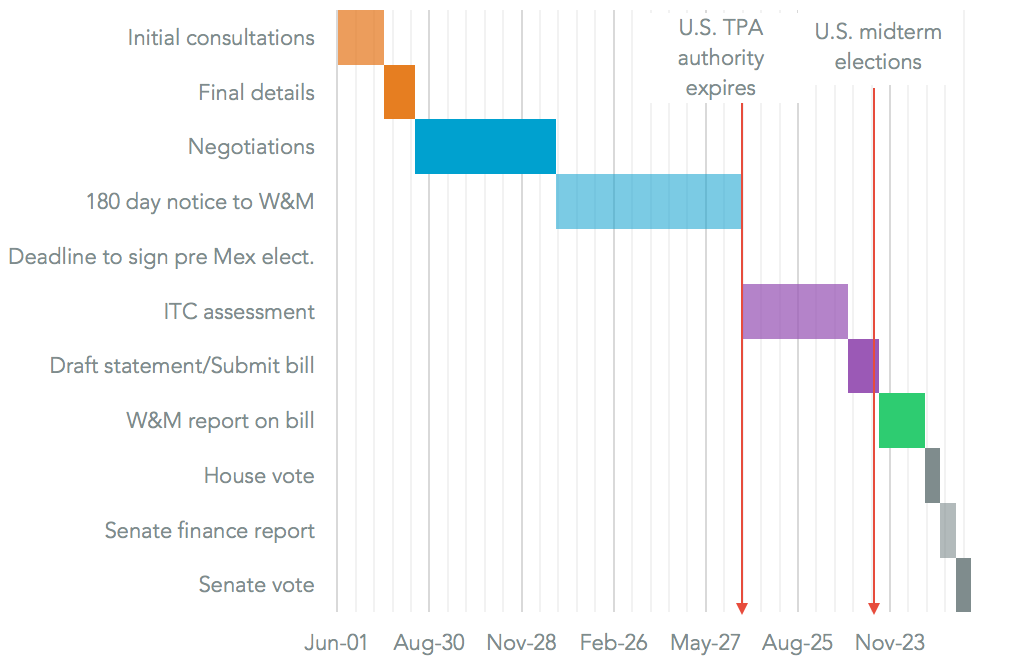

July 17 – The Trade Priority and Accountability Act has fixed deadlines for negotiating trade deals if a rapid passage through Congress is desired. The deadline for submitting detailed NAFTA renegotiating plans by the administration is 30 days before negotiations can actually start. It is worth noting that both Mexico and the U.S. face hard deadlines in the form of elections in July and November 2018 respectively. That may put Canada in control of the pace of negotiations.

July 21 – Regular trade cases may also have an impact on broader trade deals. A section 701 review of Canadian aerospace exports to the U.S. has the potential to raise tensions in the same way that the ongoing softwood lumber dispute between the two countries has.

Source: Panjiva

August 7 – There was a high level of activity in signing trade-related reviews around the 100 day mark after the inauguration. The 200 day mark may come with similar activity, particularly given the proximity of the start of NAFTA renegotiations

August 16 – The formal start of NAFTA renegotiations may prove a technical affair given the U.S. negotiating will already be public. In order to ensure a completion of talks in time for Congress to review legal changes required to the deal, which takes 180 days, a completion of discussions is needed within 138 days. For context a renegotiation of the sugar suspension agreement between the U.S. and Mexico took over eight months.

Source: Panjiva

September 15 – The “Buy American” principle is likely to feature highly in the administration’s infrastructure program. That may significantly change the purchasing of raw materials, including steel and other building materials, for construction projects.

September 22 – The first use of “safeguarding” trade cases is the Section 201 review of solar panel imports. These may prove attractive to the administration as they can result in immediate executive action, rather than protracted Congressional or duty implementation. It will also likely have a knock-on effect for Chinese solar manufacturers as production from Malaysia and elsewhere could be diverted away from the U.S.

Source: Panjiva

September 28 – A section 201 review of washing machine imports is also underway. That may particularly impact upon Samsung Electronics’ production in Vietnam and Thailand. It could accelerate a move by the company to set up a factory in the U.S. instead.initial report (Vietnam, Thailand)

October 29 – The administration’s performance review of trade deals covers much of the same ground as the Omnibus review of the causes of the trade deficit, but will provide ammunition to reopen trade deals other than NAFTA. The KORUS trade deal with South Korea is a likely target.

January 1 – Arguably the signature policy in trade for the Trump administration is the renegotiation of NAFTA. If a deal is to be signed ahead of the mid-term elections, negotiations need to be completed by the end of the year. If not, it will not be TPA-compliant and could be unpicked by a less friendly Congress at a later stage.

Source: Panjiva