Panjiva’s 2018 Outlook series identified 30 issues to watch during the year – inevitably some generated “surprises”. This report looks at why we got some prognostications wrong and what might happen next.

RCEP – China’s big trade deal is still pending

What we expected: The Regional Comprehensive Economic Partnership (RCEP) including China, India, Japan, South Korea and ASEAN states among others had the potential to be a major trade policy success, as outlined in Panjiva research of Dec. 29, 2017.

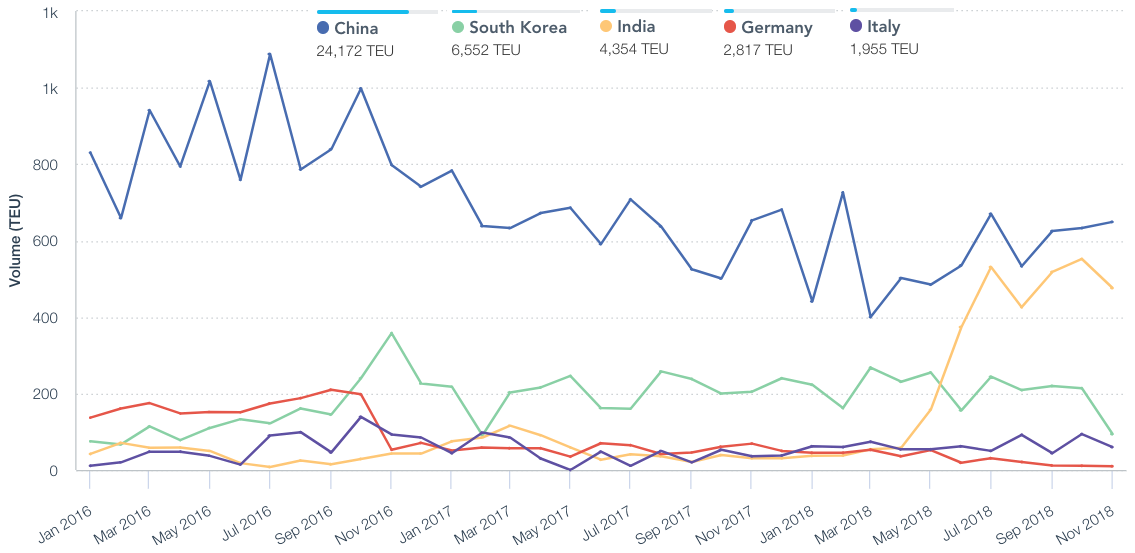

What actually happened: The deal had several rounds of negotiations, the latest of which committed to reaching a conclusion in 2019. While the agreement continues to be focused on cutting merchandise tariffs it foundered on the rocks of India’s unwillingness to cut back its “Make in India” duties. We did expect China to cut its own duties unilaterally – that has happened though more for domestic stimulus reasons.

What happens next: India may actually raise rather than reduce its electronics industry tariffs in response to a 12.8% rise in electronics imports in the 12 months to Sept. 30, Panjiva data shows. That would further reduce the likelihood of RCEP passing in 2019. Additionally South Korea and others may choose to instead join the CPTPP deal which reached a conclusion during the year.

Source: Panjiva

NAFTA / USMCA – Review delivered despite the, weighted, odds

What we expected: As 2017 ended negotiations to review the NAFTA trade deal appeared to be foundering. Our skepticism about the ability of the U.S., Canada and Mexico to complete a deal before the end of January – allowing a vote in the U.S. Congress ahead of the midterm elections – led us to believe negotiations could fail, leading President Trump to withdraw from NAFTA.

What actually happened: NAFTA became the U.S.-Mexico-Canada Agreement in October, though we were right to expect its completion to be contingent on reaching an agreement on rules-of-origin for the automotive sector.

What happens next: The deal needs to be ratified by all three countries’ legislative bodies. Progress through the U.S. Congress could be held up by the new Democratic Party-led House of Representatives. The clock is ticking in Canada too with federal elections scheduled for Oct. 21 2019. Additionally the reaction of the automakers in terms of their U.S. operations as a result of USMCA could color and complicate the ongoing section 232 review of the automotive industry. General Motors has caused controversy with its plans to close manufacturing capacity in the U.S. and is increasing its sourcing of parts from outside the USMCA area.

Source: Panjiva

Taking the initiative – America’s use of trade cases

What we expected: The commitment by Commerce Secretary Wilbur Ross to use self-initiated trade investigations, similar to one launched regarding aluminum plate, led us to conclude the Trump administration would use more of the same to try and bring countries to the trade negotiating table.

What actually happened: Aside from the launch of the section 232 review of the automotive industry in May there have been no other major trade policy initiatives launched during most of the year. Yet, we were partly right in that the automotive review has likely been instrumental in forcing the EU and Japan to start negotiations towards wide-ranging free trade negotiations.

What happens next: A temporary tariff truce has been reached between the U.S. with Japan and the EU while those negotiations continue. The section 232 review may be revived in the near year, though given the EU and Japan accounted for 21.4% of U.S. auto-parts imports in the 12 months to Oct. 31 and with Chinese shipments (12.8%) already covered by other duties and Mexico and Canada (48.2%) exempt under USMCA it isn’t clear how effective it may be.

Source: Panjiva

Logistics consolidation – Temptations resisted, new approach emerging

What we expected: The third-party logistics companies (3PLs) looked set for consolidation after 2017 saw DSV complete a major acquisition and companies including K+N suggested they would look to expand to build their geographic footprint.

What actually happened: Mergers between major 3PLs haven’t occurred, though bolt-on purchases of smaller specialist operators have. One reason may have been a bumper year for volume growth – removing the need for external drivers of growth. That came alongside a slide in profitability – EBITDA margins fell to 10.5% in the 12 months to Sept. 30 from 11.1% a year earlier – leading companies to look at internal efficiencies rather than outside complications.

What happens next: The next phase of corporate activity may be focussed on integration with container-lines. That’s already underway with Maersk’s restructuring of Maersk Line and Damco, and CMA-CGM’s closer integration with Ceva Logistics.

Source: Panjiva

Black swans – No disaster-eggs hatched

What we expected: We’d identified a series of low probability, high-impact “ black swan” events, thankfully none of which came to fruition.

What actually happened: The risks of conflict in the South China Sea continue, especially with China’s continuing development of island facilities. America’s reintroduced sanctions against Iran haven’t lessened risks to the straits of Hormuz. The container-lines have fixed their profitability – to a certain extent – with fuel price increases. None of the major U.S. ports faced major labor disturbances during peak season – indeed the resolution between the ILA and east coast ports have removed that risk for several years to come.

What happens next: Global supply chains remain critically exposed to geopolitical risks both to physical connectivity as well as policy intervention. The biggest risk for industrial supply chains in 2019 though may be the most mundane – the risk of a global economic downturn.

Source: Panjiva