The potential section 232 “national security” review of the automotive industry, ordered by President Trump as outlined in Panjiva research of May 25, is already drawing a hostile response from both governments and corporations.

Canada has confirmed that it sees the threatened review as part of ongoing NAFTA negotiations, S&P Global Market Intelligence reports. Both the European and Chinese governments have stated that they do not believe the automotive industry has a national security aspect according to Inside Trade.

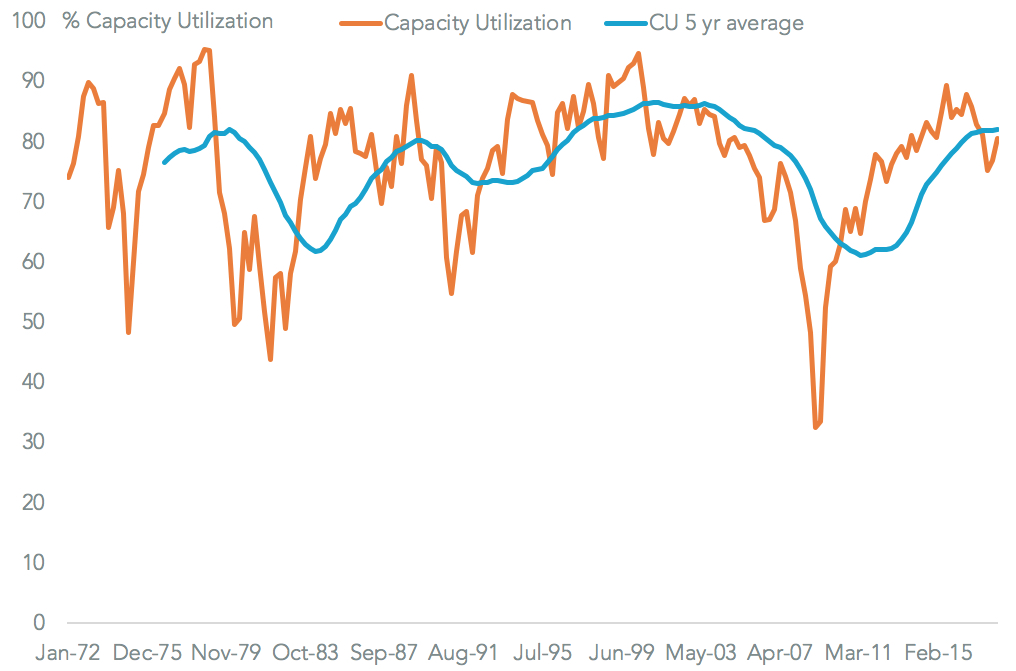

Arguably the U.S. has little choice than to use s232 as a safeguarding review is difficult to justify given (a) sales of domestically manufactured vehicles are 3.3x that of imports and (b) capacity utilization at American factories of 80.6% is above the 20 year average of 77.0% and the 40 year average of 76.5%, Panjiva analysis of Federal Reserve data shows.

Notably 80% capacity utilization was the benchmark used as being sustainable in the steel and aluminum reviews. That would suggest a focus on parts would be more justified.

Source: Panjiva

The South Korean government meanwhile has stated it will “respond to the move along with other major nations” Yonhap reports, suggesting a WTO reference is a possibility. Among corporations the most vocal so far has been Toyota which has indicated any resulting tariffs “could hurt American jobs and raise consumer costs”, suggesting it may restructure its supply chain and increase prices to pass through higher duties.

Toyota’s comments under-score some of the options the automakers have including (a) increase prices (b) relocate vehicle assembly and / or parts manufacturing / purchasing to the U.S. or (c) reduce activities in the U.S. in favor or lower-cost manufacturing centers.

The latter will be a function of whether a specific country has an exemption from the duties, as has been the case for steel and aluminum, and which parts are imported.

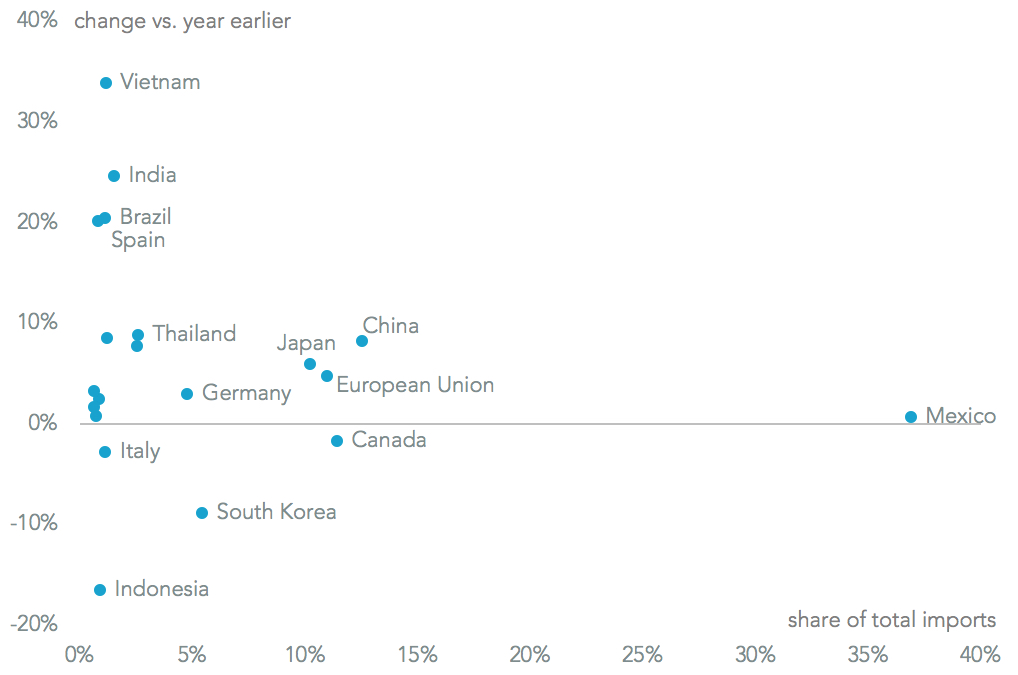

Panjiva data shows that a large part of the supply chain for U.S. based-automakers could be protected from the new duties if Canada, Mexico and South Korea are exempted (as they are from s232 metals duties) given they accounted for 53.4% of auto-parts imports in the 12 months to March 31. Indeed, the case may be aimed mainly at China (12.4%), the EU (10.9%) and Japan (10.1%).

Source: Panjiva

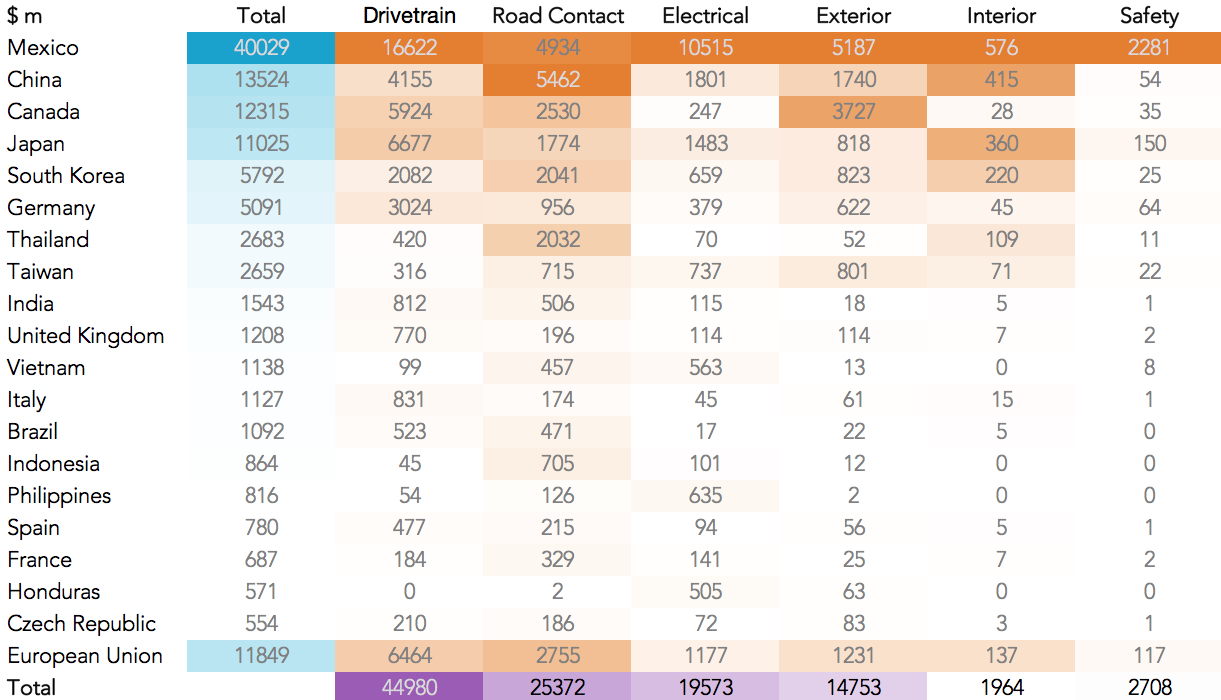

The largest export category from China relates to road contact systems (tires, wheels and suspension) that were worth $5.46 billion in the past 12 months vs. $7.46 billion. Steel wheels and tires either are, or have been, subject to separate trade investigations. Yet, that didn’t prove an issue in the s232 steel and aluminum case. Imports road contact products from China were followed by drivetrain (engines, transmissions, cooling and brakes) systems worth $4.16 billion.

Drivetrains are also the single largest category worth $45.0 billion. Aside from NAFTA ($22.6 billion) the largest supplies of drivetrain components came from Japan ($6.7 billion) and the European Union ($6.46 billion)

Source: Panjiva

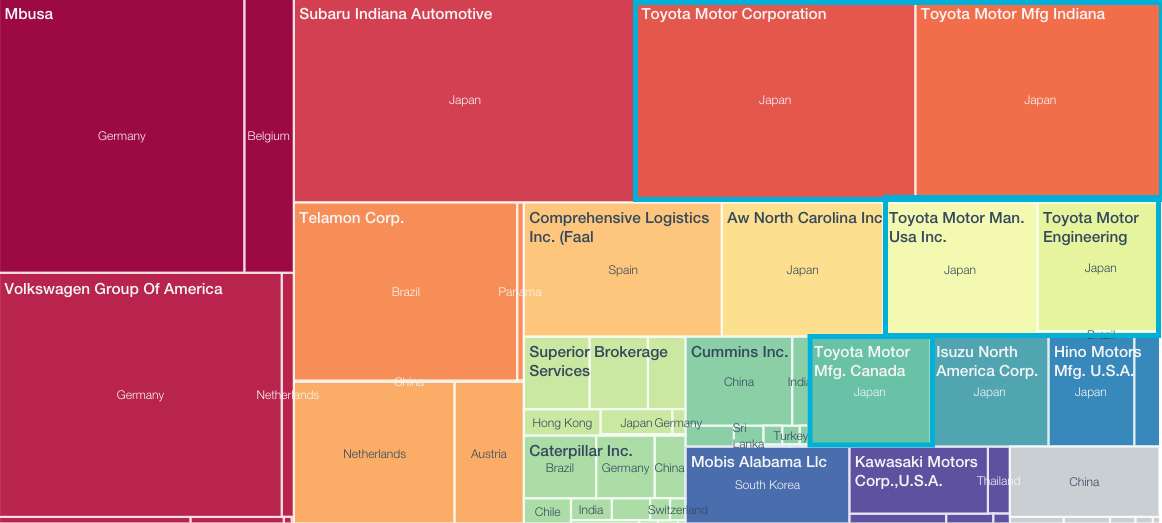

Looking at engine and transmission parts, specifically from non-NAFTA countries, Toyota certainly has plenty to be concerned about. It was the largest importer of those components by sea in the 12 months to May 24, accounting for 8.9% of total shipments across its four main subsidiaries. That was well ahead of Daimler (via its Mercedes Benz subsidiary) at 4.5% and Volkswagen’s 4.1%.

Source: Panjiva