This report avoids the usual “top 10 of the year” countdown to instead pick one of the most read Panjiva Research reports from each month to provide insights into the challenges, and opportunities, faced by industrial supply chains in 2017. You can find a year’s worth of most-read research drawn from over 1,700 reports on a month-by-month basis here. Did we miss anything you want to know more about – email us via support@panjiva.com and let us know.

#1 Trump trips on Toyota facts (Jan 6)

President-elect Trump has threatened Toyota with border taxes on a new Mexican factory that will produce cars for the U.S. market. He identified the wrong factory, and in any event it will displace Canadian production not U.S. plants. Toyota so far has followed a different strategy to its Japanese peers. Panjiva data shows 85% of its exports to the U.S. are parts, whereas for Nissan 92% are completed autos and for Honda 91% are finished cars. It is also the smallest of the big seven automakers in exports of cars from Mexico to the U.S., and is just 8% the size of Ford, the largest exporter. The bilateral, interventionist policy approach is one the auto sector will likely face throughout 2017.

Source: Panjiva

#2 Samsung’s Trump-inspired move (Feb 2)

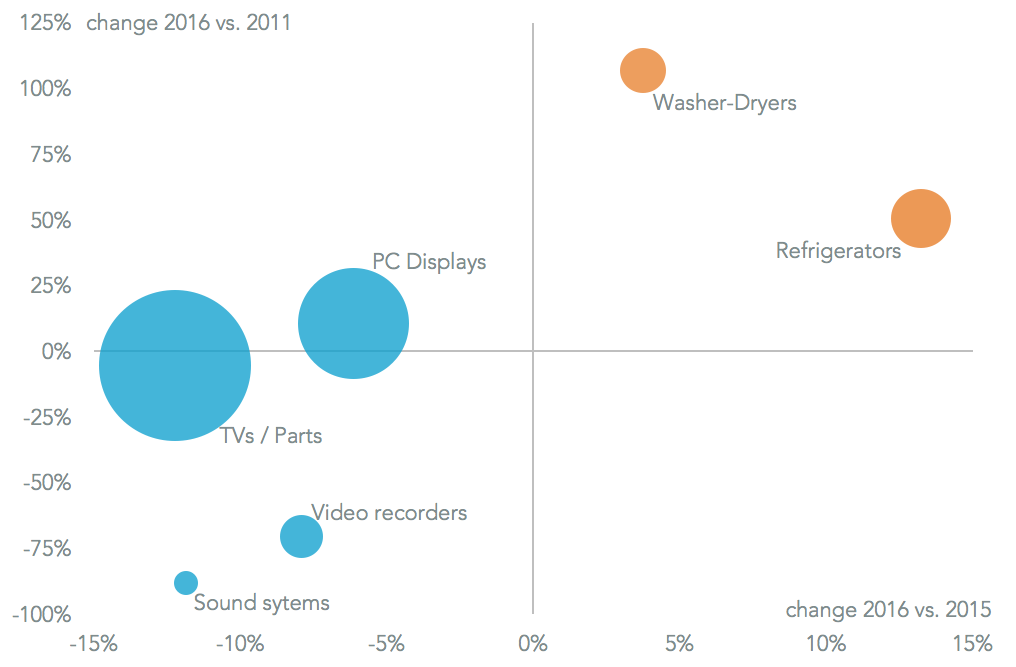

Samsung Electronics is considering building a U.S. factory in response to the Trump administration’s protectionist stance, Reuters reports. This would likely come at the expense of Mexican manufacturing of home appliances. Panjiva data shows total Mexican exports of consumer electronics – including TVs and PC displays – to the U.S. already fell 10% in 2016 vs. 2015 to $39 billion, while shipments of appliances such as fridges and washers climbed 10% to $6 billion. Samsung Electronics is likely the largest exporter in a group that includes Sony and Whirlpool among others.

Source: Panjiva

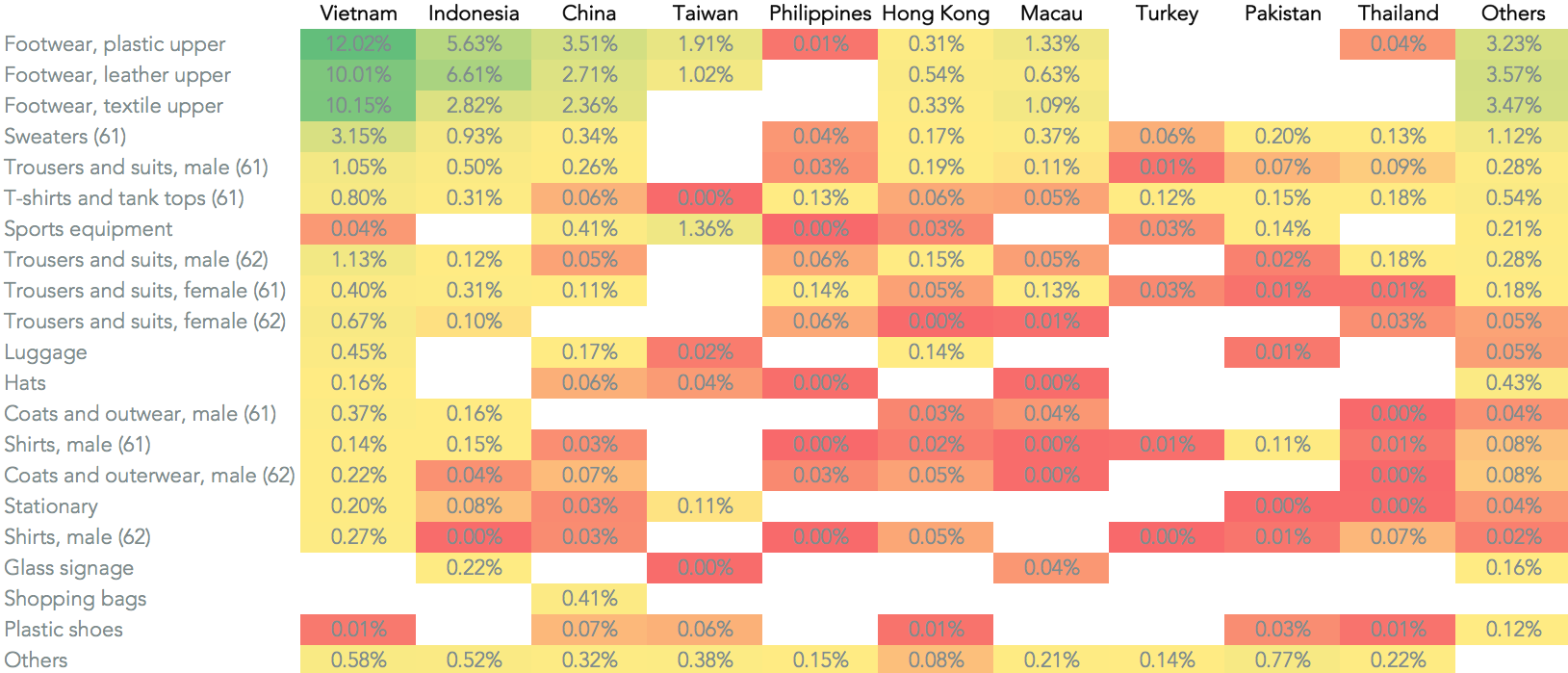

#3 Adidas sourcing teardown (Mar 2)

Adidas is scheduled to report fourth quarter results on March 8. Panjiva data shows a 108% growth in its U.S. imports on a year earlier. That likely reflects supply chain shifts as third quarter sales in North America only increased 19%. The bigger issue in 2017 is how to adapt its supply chain strategy under the Trump administration. That could include a border-adjustable tax. So far Adidas management statements suggest they don’t see big problems.

Panjiva’s analysis of over 500 product and country import combinations shows a high degree of diversification in its supply chain. Over 32% of its sourcing comes from Vietnam, so Adidas will have lost out from the U.S. withdrawal from TPP. All three of its top supplying countries product all of its top six products. It also sources plastic-upper shoes from 27 countries and T-shirts from 30 countries. It isn’t standing still – a new U.S. factory is on the way.

Source: Panjiva

#4 How port strikes sank Gymboree (Apr 12)

Kids’ clothing retailer Gymboree may file for Chapter 11 bankruptcy according to Bloomberg. That follows the recent failure of footwear chain Payless Shoesource citing supply chain disruption in 2015. Panjiva data shows a similar effect for Gymboree, with a 51% drop in U.S. imports in February 2015 on a year earlier representing the fallout from west coast port strikes. That was followed by three quarters of falling revenues.

More recently Gymboree imports fell 13% in the quarter to January 31 – after a general malaise in kids clothes imports nationally – and revenues dropped 7%. The three months to March 31 show a further 5% decline in imports. Analysis of 225 country-product supply chain pairs shows a diverse mix, with no combination exceeding 8% of the total. However, 90% of Gymboree’s sourcing is handled by the logistics operations of Orient Overseas.

Source: Panjiva

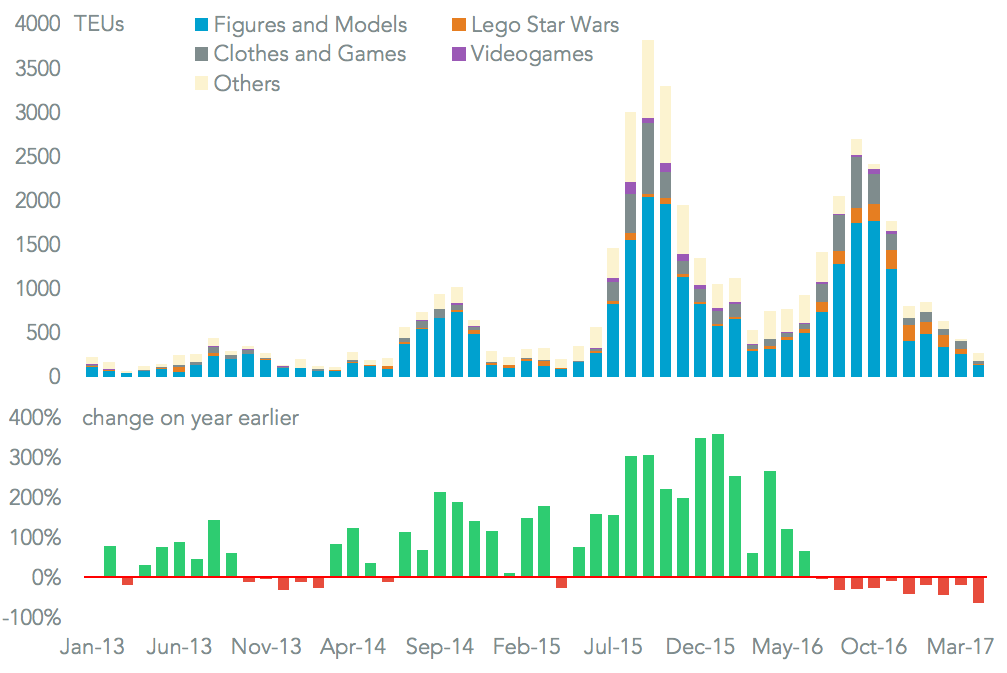

#5 The last Jedi didn’t bring strength to the Force (May 4)

The Star Wars franchise has seen a marked step-back, with Panjiva data showing that merchandise imports to the U.S. fell 22% in the 12 months to April 30. That included a 13% drop in figures and models, a 12% decline in costumes and a 69% slump in videogames. The latter is common across the videogame industry, and is partly offset by a 270% rise in Lego tie-ins. The decline is likely due to the most recent film, “Rogue One” having half the dedicated merchandise items as “The Force Awakens”. The next film in the canon, “The Last Jedi”, is a return to the main series and may bring more imports. Those will ramp up ahead of September 1, aka Force Friday, when the new merchandise lines are released for sale.

Source: Panjiva

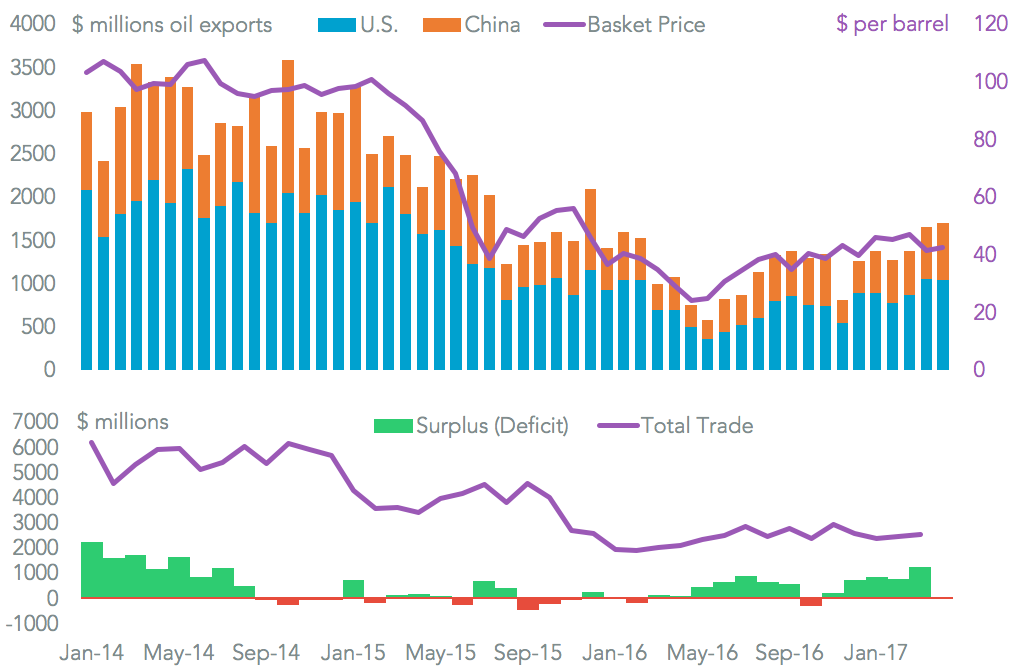

#6 $10 billion of sanctions an option for Venezuela (Jun 5)

The U.S. government may be at an early stage of considering sanctions against the Venezuelan government, including restrictions on trade with PdVSA. Panjiva data shows U.S. and Chinese imports of oil from Venezuela totalled $16 billion in the 12 months to April 30, with the U.S. accounting for 61%. Without sales to the U.S. the country would have a trade deficit of $3 billion rather than a surplus of $7 billion. Venezuelan oil only accounted for 6% of U.S. supplies in the year to March 31. However, replacement choices for U.S. refiners including Chevron and Valero may be limited due to the heavier-than-average grade of the product.

Source: Panjiva

#7 Americans buy “made someplace else” furniture (Jul 19)

The U.S. furniture retail industry is becoming ever-more reliant on imports, with shipments as a proportion of furniture retailers’ sales reaching a new high on an annualized basis in June at 48%. Imports from China have led the way, with a 14% increase in May and accounting for 48% of total imports. Vietnamese imports have also accelerated, growing 20% in May and repeating a pattern seen in other consumer-oriented manufacturing industries.

The U.S. also runs a $8.5 billion “furniture deficit” with Mexico and Canada, suggesting room for an export push as part of NAFTA negotiations. The increase in imports also reflects the growing success of foreign retailers, in particular Ikea. The Swedish retailer increased imports by 13% in the second quarter, outperforming smaller importers including Bob’s and BigLots.

Source: Panjiva

#8 Trump’s terror strategy and Pakistan’s apparel industry (Aug 22)

President Donald Trump’s military strategy for dealing with terrorism in the Middle East and Afghanistan includes putting pressure on Pakistan. While specific reference was made to aid, the President may also utilize trade measures – or at least the threat of them – as has been the case in the ongoing North Korea crisis. Pakistan ran a $858 million trade surplus vs. the U.S. in the 12 months to June 30, so cutting its exports to the U.S. would also meet the administration’s trade policy targets.

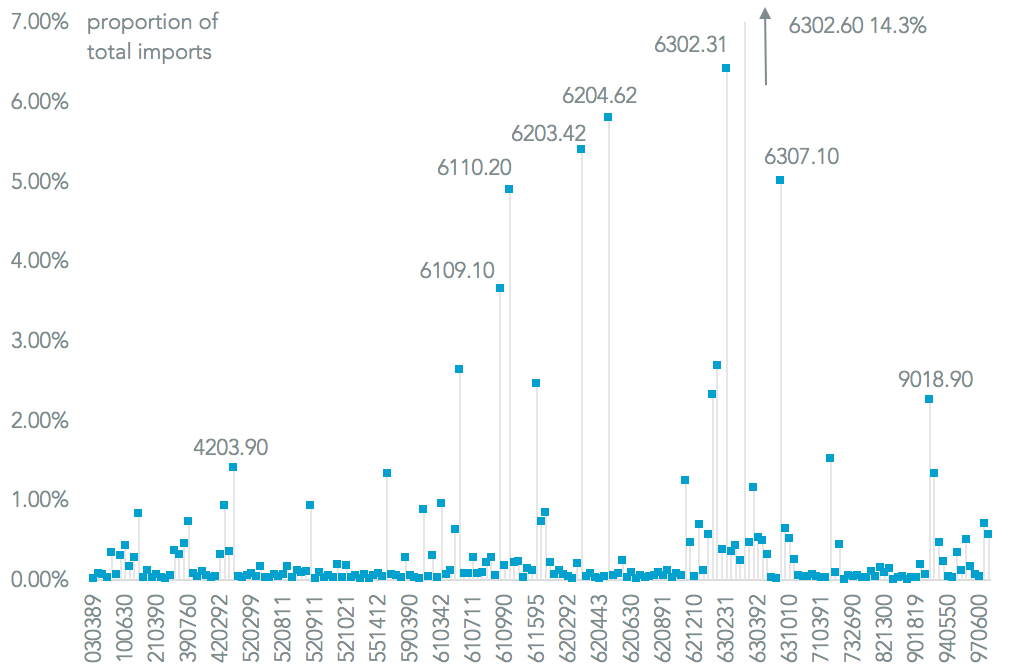

Panjiva analysis of Pakistan’s top 200 exports to the U.S. show apparel and textiles each account for 37% of the total, making them prime targets for tariffs or quotas. Other product areas of prominence include leather goods (3%) and medical instruments (2%) which might be targeted in more focussed measures.

Source: Panjiva

#9 $704 billion of Indian trade (Sept 21)

India’s total trade reached $704 billion in the 12 months to July 31, with a 10% annualized decline over the past five years reversing partly with a 13% bounce in the past quarter on a year earlier. That’s a similar pattern to that seen in South Korea, though in scale terms India is closer to Mexico – which is now 10% bigger having been similar in 2014. The country runs a $134 billion deficit in goods, but this is partly offset by a $70 billion services surplus and in any event is not a driver of policy as it is in the U.S. Its top four trading partners (China, the EU, the U.S. and the UAE) account for 74% of all trade, while neighboring Bangladesh is its fifth largest export customer.

Among the top 500 import lines oil is the most significant, accounting for 15% of the total, followed by phones and network equipment (14%). Notably it has a low dependence on food imports, at just 2% of the total. On the export side top manufactured products include apparel (15%), autos/parts (7%) and pharmaceuticals (5%), while commodities are led by steel (4%), rice (3%) and fish (2%).

Source: Panjiva

#10 Tesla tests the mold in Shanghai (Oct 23)

Electric vehicle manufacturer Tesla may receive permission to build a factory in Shanghai’s free trade zone without a local partner. If confirmed that would be a first in the autos sector, but may not obviate the need for Tesla to pay tariffs of 25% once the vehicles leave the FTZ. China is one of Tesla’s fastest growing overseas markets.

Panjiva data shows imports by Tesla Beijing in the quarter to August 31 (approximating 3Q sales) rose 22% sequentially to $432 million, whereas group revenues are expected to rise by just 5%. The challenge will be extending Tesla’s supply chain. If it builds a “gigafactory” for batteries it will be competing with Chinese domestic manufacturers for local lithium supplies, as well as imported resources that rose 2.6x in the past 12 months on a year earlier.

Source: Panjiva

#11 187 ways to grow $35 billion of Chinese exports (Nov 27)

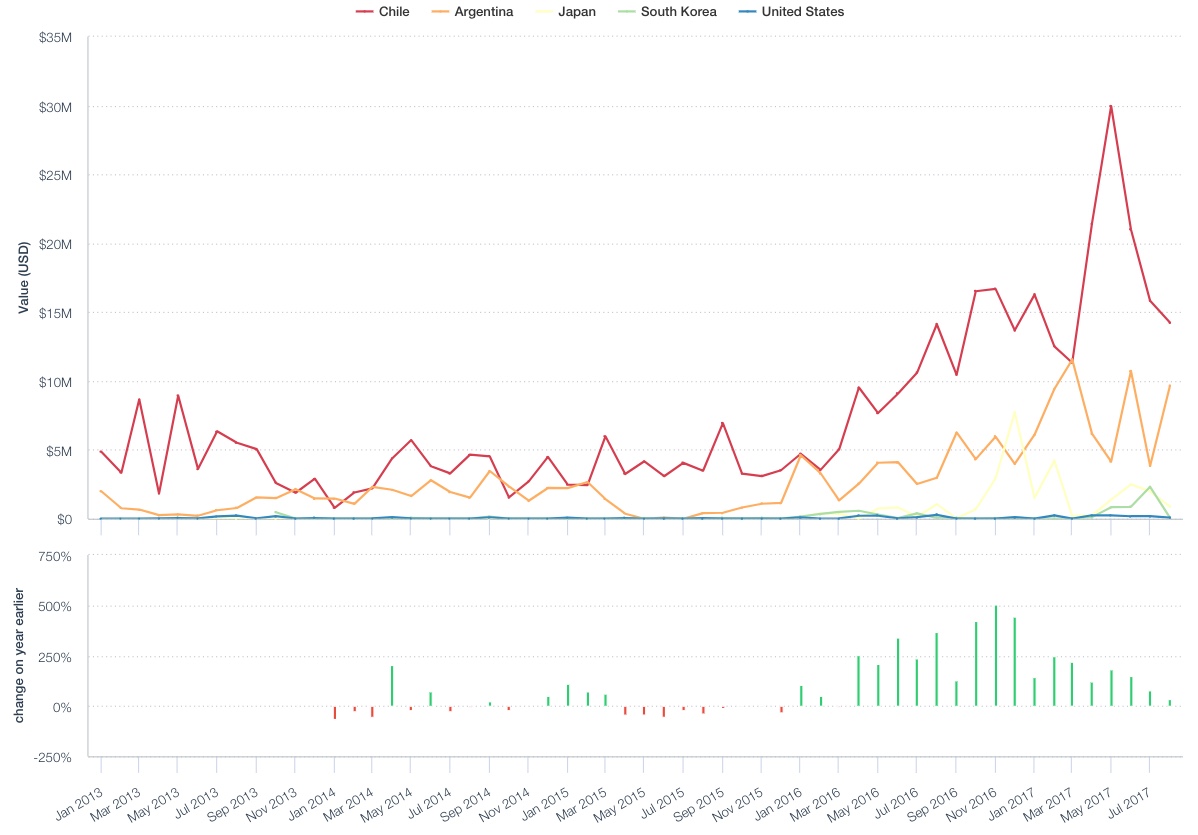

The Chinese government has cut import tariffs on 187 retail product lines to boost consumer activity. The cuts in tariffs average 10% points, and are applied to products that are generally not produced in large volumes in China. While it is tempting to assign the move to President Trump’s recent visit, the cuts are part of ongoing economic policy. Panjiva data shows imports of the products concerned already grew 34% in the third quarter to reach $35 billion in the past year, and reached a new record in September.

Growth was led by food and beverages (80% growth in the past quarter), which in turn was led by imports of baby food and infant formula (44% and 20% of the total respectively). Pharmaceuticals grew 11%, reaching $16 billion in total. While currently led by shipments from Germany, the U.S. government will likely lobby strongly for increased access. The tariff cuts in that segment are small though at around 4% points. Home appliances may have the largest opportunity, with average tariff cuts of 16% and highly fragmented supplies currently.

Source: Panjiva

#12 Spotting the sweet opportunities in China (Dec 20)

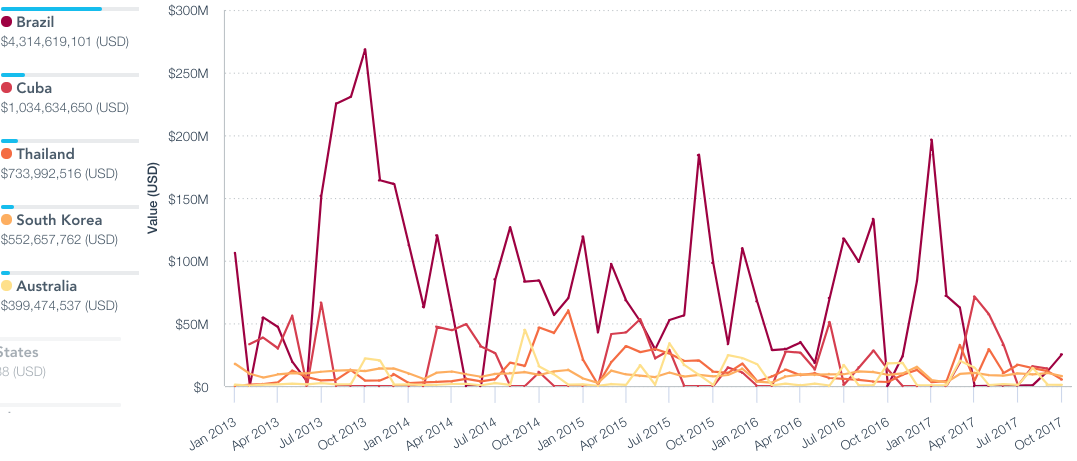

The Chinese government’s Central Economic Work Conference has committed to cutting tariffs in order to boost imports and achieve “balanced trade”. Evidence of that has already been seen in cuts to 187 tariff-lines in consumer electronics. Further cuts are more likely to be tied to the RCEP trade deal or bilateral arrangements rather than simple unilateral cuts. Chinese imports have already jumped 22% this year, though that is partly due to increased commodity imports. Panjiva analysis of China’s WTO MFN tariff rates shows the biggest opportunities are in sugar (29% duties on average), beverages/tobacco (24%), apparel (16%) and transportation (11%).

Imports of sugar have fallen 8% in the past year, with a cut in tariffs potentially helping politically with Cuba (the number two supplier) and the U.S. (China is just 5% of U.S. sugar-product exports). Cutting the average 25% tariff on automotive imports would help relations with the U.S. (the leading supplier with $13 billion of supplies in the past year), though it is German manufacturers that lead in mid-size vehicles and Japanese producers at the luxury end.

Source: Panjiva