The withdrawal of the U.K. from the EU under the auspices of the Withdrawal Agreement Bill’s transitional period begins at 23:00 GMT on Jan. 31. The Agreement should minimize customs disruptions and kicks off the process for negotiating post Brexit terms of trade for 2021 and beyond.

The risk of a hard Brexit remains – as outlined in Panjiva’s 2020 Outlook there’s really only a matter of a few months available to complete the negotiations.

The U.K. government plans to publish negotiating objectives “in due course after the 31st” according to Brexit Secretary Stephen Barclay, MP but with no formal timetable, Reuters reports.

The government’s threats to use higher tariffs, first reported by The Times ring somewhat hollow given the scale of its trading counterparties and given Britain’s dependence on imported goods. It does suggest, however, that the British government is looking at goods first and foremost.

A Feb. 25 European Council meeting may be earliest opportunity for the EU to agree its negotiating position, the Financial Times reports, while the end of June is the last opportunity for Britain to request an extension to the negotiating period beyond the end of 2020. The clock is indeed ticking.

Two major challenges for supply chain operators during the transition period will involve (a) managing consumer confidence which will inevitably fluctuate and (b) deciding whether to continue serious business investment while the long-term policy background remains in flux.

Both come as some parts of the British export economy are already looking weaker. The autos sector is a particular concern give total production fell 14.2% year over year in 2019, the Associated Press reports, while production for export slumped 14.7%.

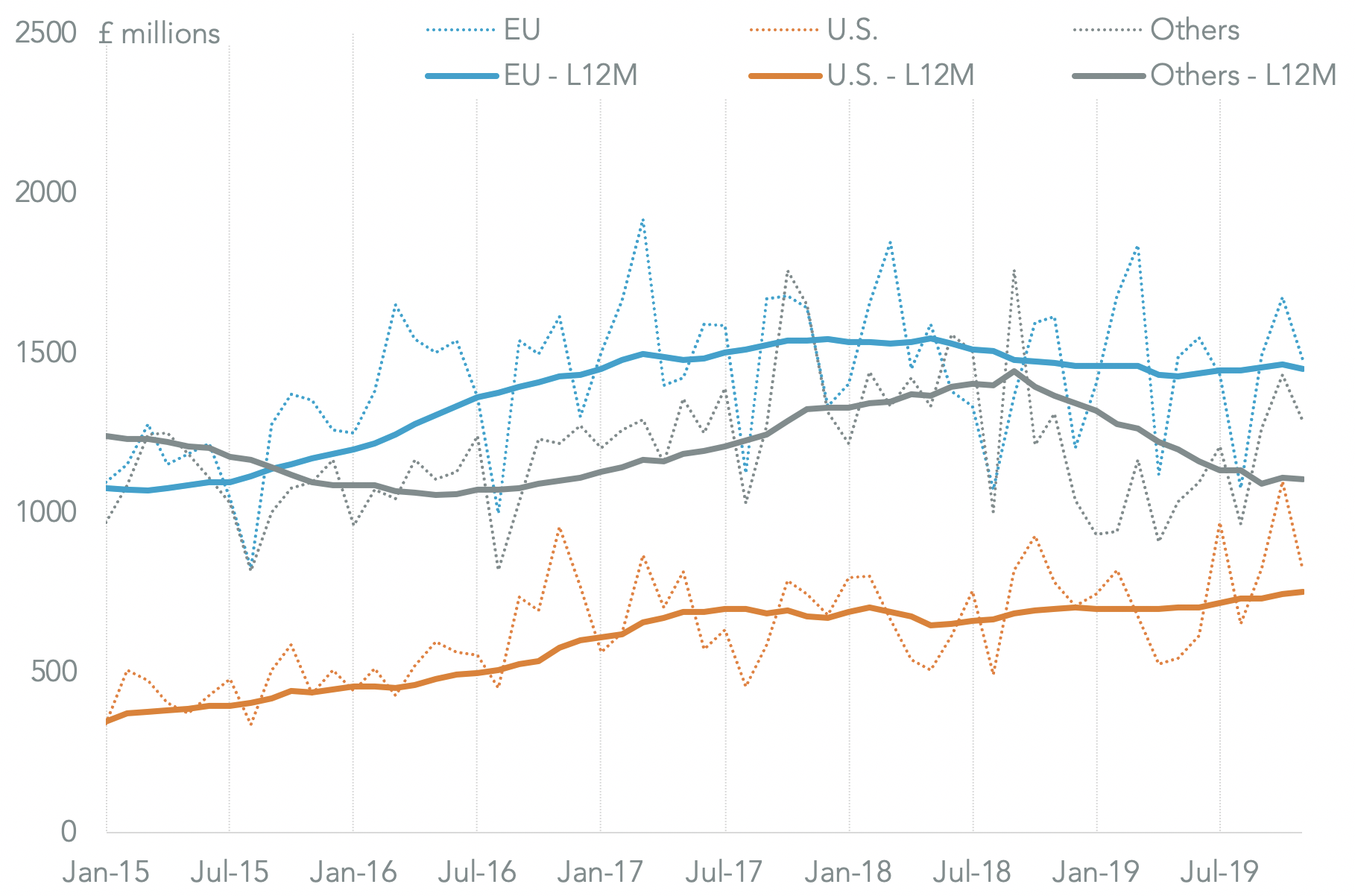

Panjiva analysis of official data shows 43.8% of the U.K.’s £39.7 billion ($52.0 billion) automotive exports went to EU in the 12 months to Nov. 30 while 22.6% went to the U.S.

Shipments to the U.S. are becoming increasing important after rising 7.3% year over year whereas shipments to the EU fell 1.3% and those to the rest of the world slumped 19.1% on weaker car sales.

With President Trump having returned to the concept of using automotive tariffs to leverage trade negotiations, the coming months could prove particularly fraught for U.K. exporters. Panjiva data shows those include Tata Motor’s Jaguar and Land Rover, BMW’s Mini and Honda’s shipments of the Civic.

Source: Panjiva

Aside from the EU, the most important trade deal for the U.K. government to nail down is that with the United States. Both sides are likely focus on goods, suggesting a mini-deal like that signed between the U.S. and Japan rather than the more extensive TTIP previously agreed with the EU or even the USMCA deal.

While a largely 20th Century type trade deal, relations between the two countries face 21st Century issues. The first is the application of a digital services tax. The British government may include that in the forthcoming Budget, while the U.S. has already shown a willingness to use tariffs in response to France’s recent announcement.

Another, less tractable, issue is the use of Huawei telecoms equipment for Britain’s 5G network. While the storage layer is excluded in British plans there is still the potential that the U.S. may restrict intelligence sharing as a result. It may also hurt Britain’s position in the personality-driven politics of the Trump administration.

Britain is in a tough spot – even the current plans for Huawei equipment will raise investment costs, Reuters reports.

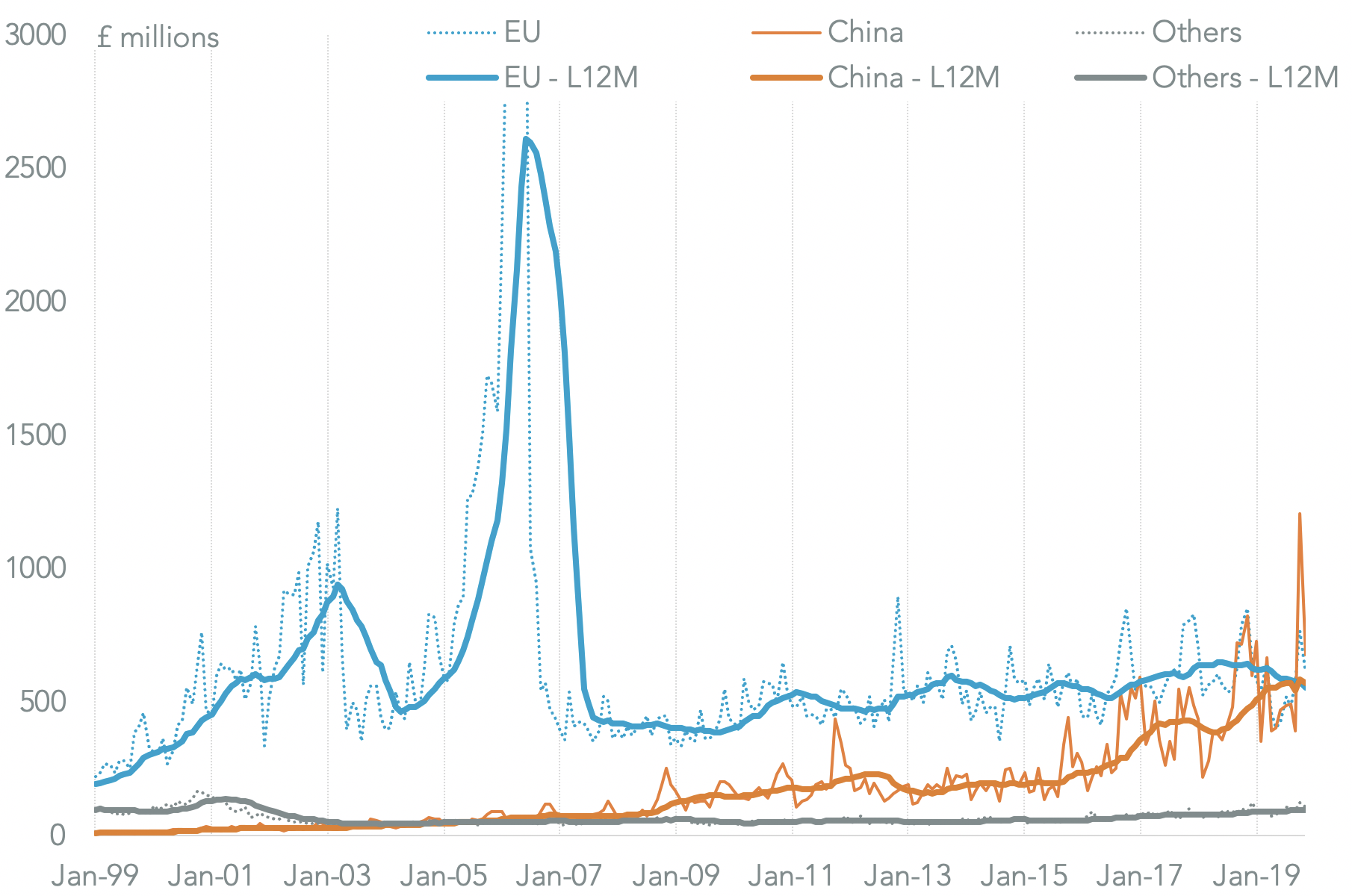

The total cost of a 5G roll out could take at least two years to take effect. The rollout of 3G networks started in 2003 but imports of telecoms equipment peaked in 2006 at £36.3 billion annually in the 12 months to June 2006. At that stage European providers including Nokia and Ericsson represented 86.5% of the total while China’s suppliers were just 2.3%.

There was less of a crest after 4G launched in 2012 with peak annual investments reaching £13.8B in the 12 months to April 14. European suppliers represented 49.2% of the total and China 17.1%. The latter included Huawei, which represented 38.4% of China’s exports in that 12 month period according to Panjiva data, while Sercomm represented 30.5%.

It’s possible that the 5G rollout will feature a steady investment like 4G rather than the 3G surge. Imports of telecoms equipment in the 12 months to Nov. 30 reached £19.8 billion with 33.6% from the EU, 34.7% from China, the U.S. just 5.9% and the remainder including cellular and backbone systems from across South East Asia.

With tough trade negotiations and significant spending on infrastructure ahead, the challenges from Brexit are only just beginning.

Source: Panjiva