The meetings between President Moon Moon Jae-in and President Donald Trump from June 29 will likely focus on trade. South Korea had a trade surplus vs. the U.S. of $24.1 in 12 months to April 30. The two countries also already have a trade deal in the form of KORUS. Vice President Mike Pence already raised concerns about the size of the surplus, as outlined in Panjiva research of April 18. The deal is also under review as part of the U.S. administration’s “ performance review” of trade deals due to report October 26.

The mixture of a high trade surplus and existing trade deal may mean South Korea will be treated more like Mexico in the meeting rather than, say, China, India or Japan. The latter three don’t have trade deals and have ongoing trade improvement dialogues. Heads-of-state meetings have therefore focussed on areas for growth rather than review. Mexico meanwhile is facing the renegotiation of NAFTA.

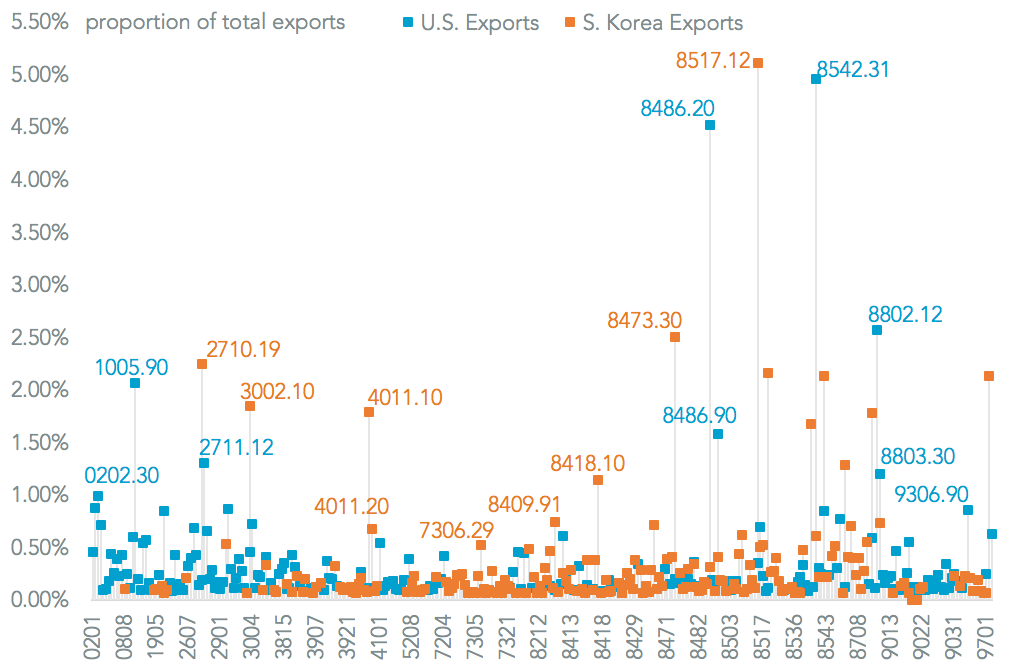

Panjiva analysis of the top 200 export lines from the U.S. to South Korea shows the leading industries are are led by aerospace (12.3%), agriculture / food (11.9%), semiconductor supply chain (6.4%) and energy (3.4%). South Korean exports to the U.S., and hence areas of potential tariffs or other protectionism include passenger vehicles (24.6%), PC components (6.8%) mobile phones (5.1%).

Source: Panjiva

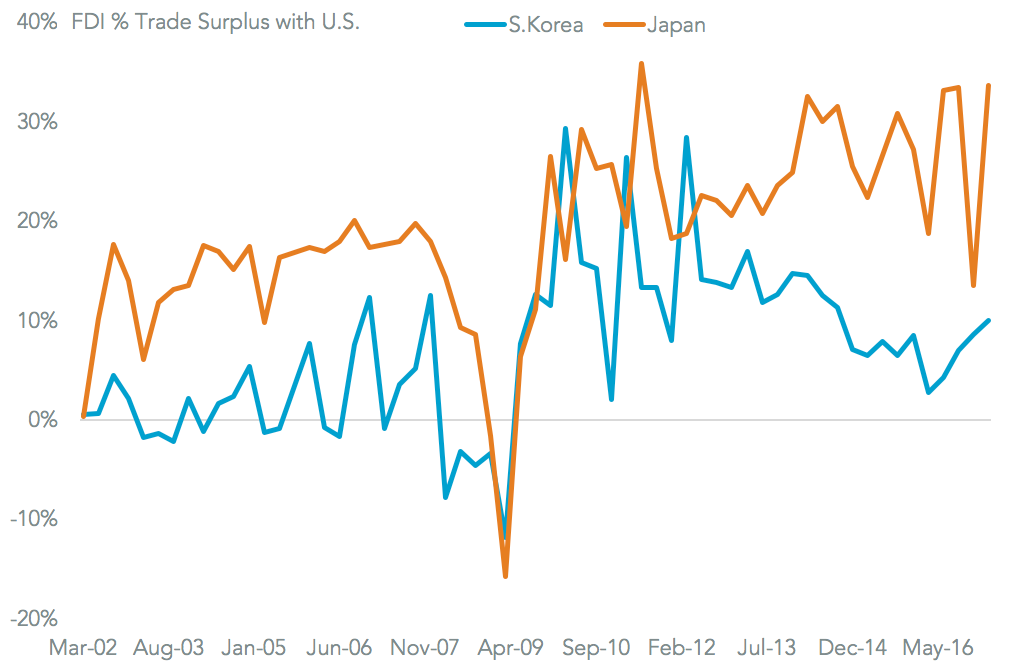

Aside from a deal renegotiation, and finding ways to increase U.S. exports to South Korea, the country may also commit to increasing its direct investment in the U.S. A potential home appliances factory investment by Samsung Electronics, with 52 companies forming a trade delegation that coincides with President Moon’s trip.

Panjiva analysis shows that so far South Korea’s foreign direct investment to the U.S. has been equivalent to 7.1% of the trade surplus (based on U.S. import and export data) in the 12 months to March 31. That is well below Japan’s 28.1%. A rebasing to Japan’s level would imply an additional $5.4 billion of annual FDI by South Korean companies in the U.S.

Source: Panjiva