U.S. crude oil independence from OPEC – a key commitment of President Trump’s “ America First Energy Plan” program – is still a long way off, but came a step closer in February. Panjiva data shows exports of crude oil jumped 187% on a year earlier to their highest on record. That left them equivalent to 17.3% of imports, which in turn had only increased 5.2% on a year earlier. EIA data for March suggests the process may have continued as imports only increased 0.2%.

Source: Panjiva

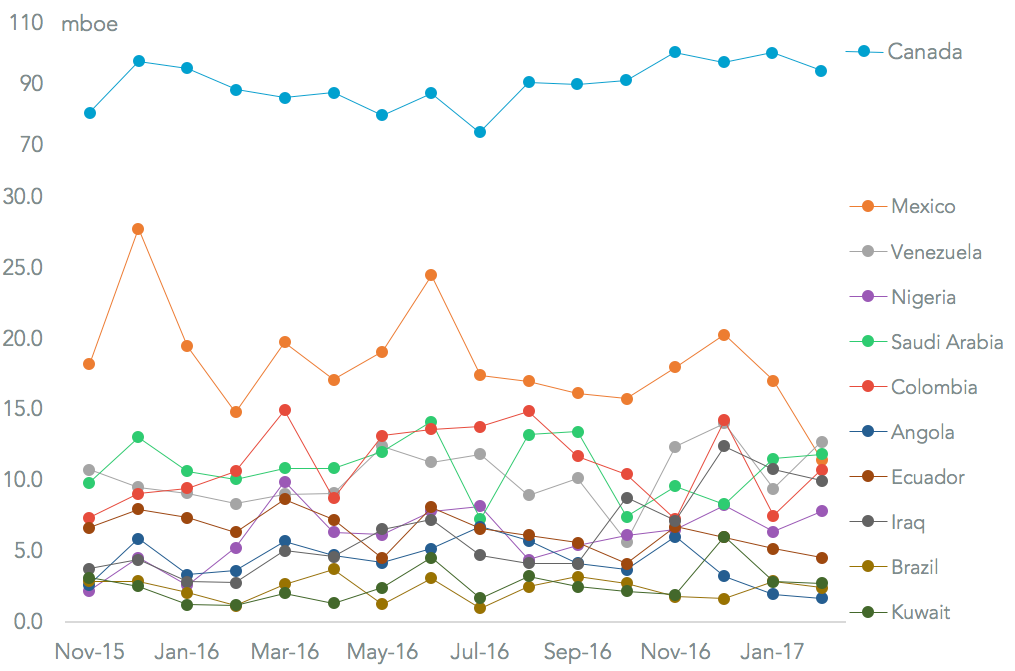

Unfortunately in the context of the “OPEC independence” concept, imports from Mexico fell significantly, with a 22.7% fall on a year earlier. That resulted in the lowest exports to the U.S. since at least 2009. That was exacerbated by a drop in Mexican exports to other countries with the result that total shipments fell 25.7%. While Canada remained the largest shipper, imports from OPEC members increased too including Saudi Arabia (17.4% higher) and Venezuela (52.8% above year-earlier levels). That was despite a reduction in OPEC output in January, which may be extended through the second half of the year according to Bloomberg.

Source: Panjiva

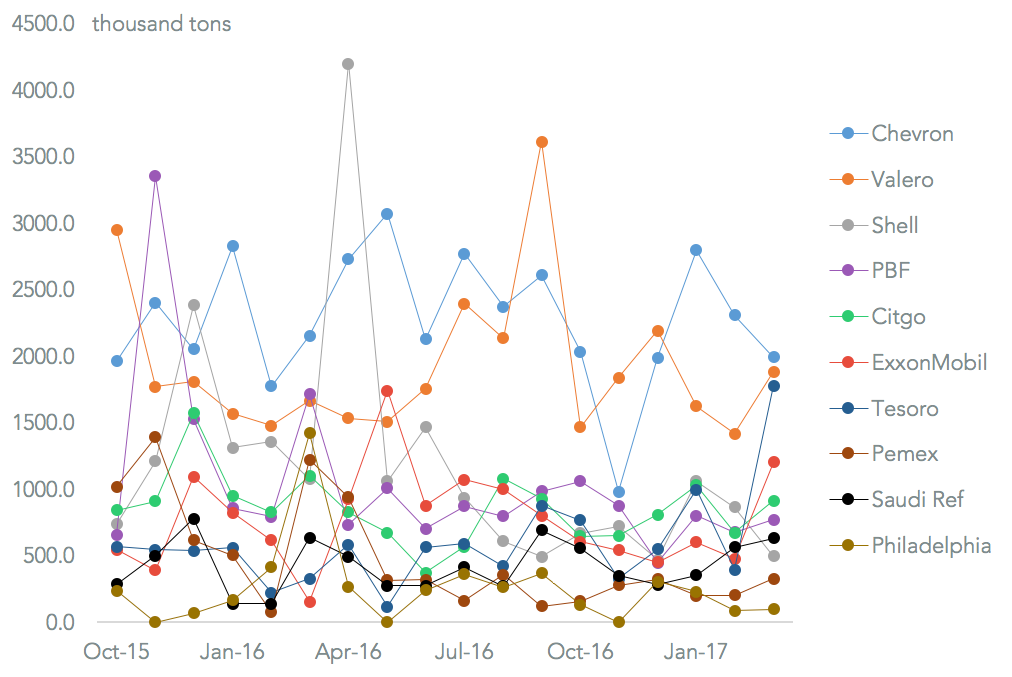

Imports from outside Canada and Mexico may have lost out significantly in March. While seaborne shipments rebounded 26.0% vs. February they were 23.4% lower than a year earlier. Among major consignees the reduction was led by Shell (53.9% down) and PBF Energy (55.0% below a year earlier). The outlier, however, was Tesoro which 5.45x as much as a year earlier to reach its highest on record. That came as it completed its acquisition of Western Refining

Source: Panjiva

Among the key shippers MISC-owned AET lost market share after its volumes fell 27.0% on the month, though it still increased handling by 5.5% on a year earlier during the first quarter. Number two operator Teekay saw a 26.5% rise in handling in the month but just a 1.5% increase for the first quarter overall. The company is scheduled to report 1Q revenues on May 18, with analysts surveyed by Reuters expecting revenues to increase 2.4% on a year earlier.

The fastest growth was delivered by Tsakos, which increased 425% on a year earlier to reach third place. That may relate to delivery of new shipping capacity, though most of its growth in the rest of the year will be focussed on products tankers.

Source: Panjiva