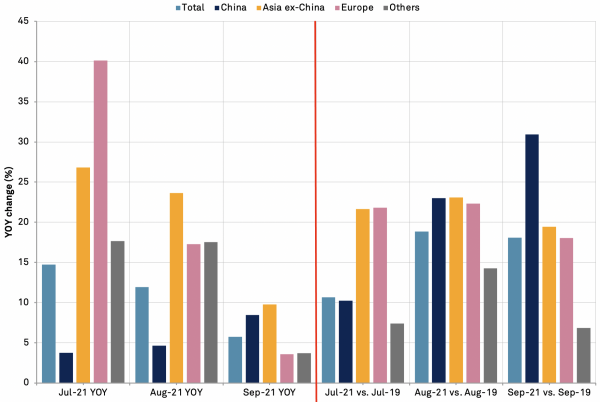

Ships continue to queue outside major ports even though U.S. imports have slowed, as noted in Panjiva’s research of Oct. 6, increasing by 5.1% year over year in September. Imports have been at peak-season levels since March, while last year’s numbers build towards a holiday peak. This may be exposing the capacity of U.S. logistics networks, with the bottleneck in LA getting the attention of the Biden administration. The slowdown in growth versus 2020 makes sense when looking at the year, as imports fell during the COVID-19 pandemic before surging afterwards. Compared to 2019, September imports climbed 17.4%, representing sustained growth.

For carriers and forwarders, large volumes mean increased revenues and profits, as noted in Panjiva’s Q4’21 Outlook. Carrier activity in aggregate can be tracked by looking at the ports of lading of U.S. goods. The largest growth in ports of lading came from Asia excluding China, which were up 9.8% year over year in September but down from August, when imports increased by 23.7% year over year. Imports loaded in Europe also saw falling import growth, down from 17.3% in August to 3.6% in September. China‘s ports saw positive momentum, with imports loaded in the country increasing from 4.7% in August to 8.4% in September. This likely represents the reopening of ports such as Yantian and Ningbo.

Comparisons against September 2019 show a more consistent increase in imports, reflecting the current surge. Imports loaded in China increased by 30.9% and those loaded in Asian ports excluding China increased by 19.4%. Meanwhile, imports loaded in Europe grew by 18.1% while those loaded in other ports climbed 6.8%.

Source: Panjiva

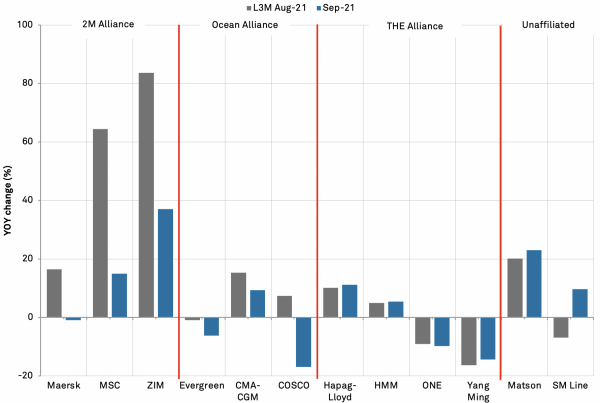

The sluggish growth is starting to show in carrier performance as well. Carriers associated with the 2M Alliance show large negative import momentum, with the activity of the alliance as a whole increasing by 7.9% year over year in September. Growth associated with MSC and ZIM fell by 49.5 percentage points and 46.7 percentage points, respectively, in September versus the three months to Aug. 31. Maersk‘s import growth turned negative, falling from 16.5% in the same three months to a loss of 1.0% in September. The only other carrier to show the same switch from positive to negative was COSCO, with imports associated with the firm increasing by 7.4% in the three months to Aug. 31 but falling by 16.9% in September.

COSCO’s contracting imports drove the Ocean Alliance‘s associated imports to fall by 3.6% year over year in September, down from an 8.5% year-over-year increase in the three months to Aug. 31. Imports associated with THE Alliance showed positive import momentum, up from a decline of 3.2% in the three months to Aug. 31 to a slightly lower decrease of 2.8% in September. Unaffiliated carriers saw an increase in activity, with Matson up 23.0% year over year in September, the second-highest growth in the sample.

Source: Panjiva

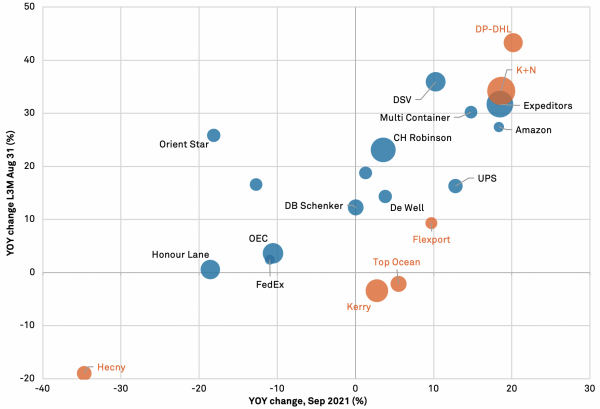

Forwarders have also seen a slowdown in growth, with momentum falling across most companies except Kerry, Top Ocean and Flexport. Kerry and Top Ocean both saw import growth flip from negative in the three months to Aug. 31 — down 3.4% and 2.1% year over year respectively — to growth of 2.7% and 5.5% respectively in September. Flexport saw a smaller swing, up from 9.3% growth in the same three months to 9.7% growth in September.

DP-DHL and K+N saw the highest import growth, up 20.2% and 18.6% year over year in September, although showing falling momentum. On the other end of the scale, Hecny saw associated imports fall by 34.7% year over year in September after declining 19.0% year over year in the three months to Aug. 31.

Source: Panjiva

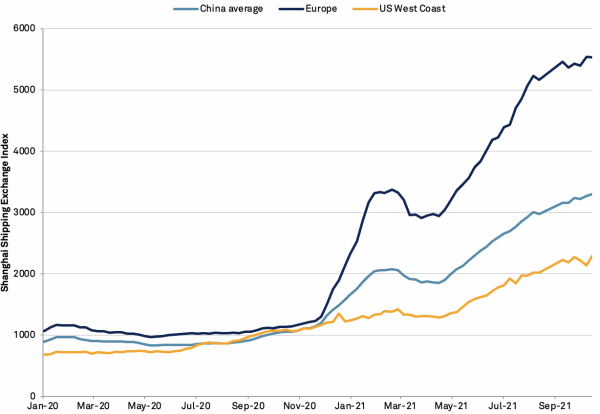

Lagging momentum in both carriers and forwarders may be starting to show in rates as well. During the week of Oct. 15, containerized prices out of China increased by only 0.9% week over week, bringing the total increase since the end of 2020 to 99.0%. Shanghai specifically fell by 1.3% week over week and China to the U.S. East Coast fell by 5.2%. This trend did not hold across the board, however, as rates from China to the U.S. West Coast increased by 7.5% from the prior week. This brings the critical route to a total increase of 84.9% since the end of 2020, likely unwelcome to U.S. importers trying to get goods into the country for the holiday season.

Source: Panjiva