2017 was another tumultuous year for global supply chains, with major shifts in global trade policy, a remaking of the logistics landscape through consolidation and a slew of corporate failures and strategic realignments in trade-sensitive industries. Looking back at Panjiva Research’s prognostications for 2017 we got plenty right (slow NAFTA and Brexit negotiations, a proliferation of trade deals elsewhere in the world, container-line pricing discipline, the rise of the Panama Canal) as well as some missteps. Here’s five topics that didn’t go as planned.

#1 President Trump Didn’t Tackle Europe’s Trade Surplus

We correctly called the Trump administration’s total focus on the trade deficit as a metric for trade deals. However, we saw the number two contributor to the deficit – the European Union – as a potential target for defensive policy. Instead the administration has been focussed almost exclusively on NAFTA and Asian countries.

In hindsight the EU is too big, and does not have an existing trade deal in place, for the administration to leverage. Panjiva data for U.S. goods imports and exports shows the deficit vs. the EU has increased by 0.8% in the 12 months to October 31 vs. calendar 2016 to reach $147.9 billion. Looking into 2018 the EU has become an ally rather than adversary.

Source: Panjiva

#2 No Return For The Environmental Goods Agreement

The World Trade Organization certainly remained at the (controversial) heart of the debate over multilateral trade in 2017. However the signature Environmental Goods Agreement did not return to life at the hands of China’s broader trade policy as we had hoped. China’s other “issues” with the WTO may have made it less willing to promote EGA. Yet, the Chinese government has stated an intent to include environmental considerations in its ongoing development plans.

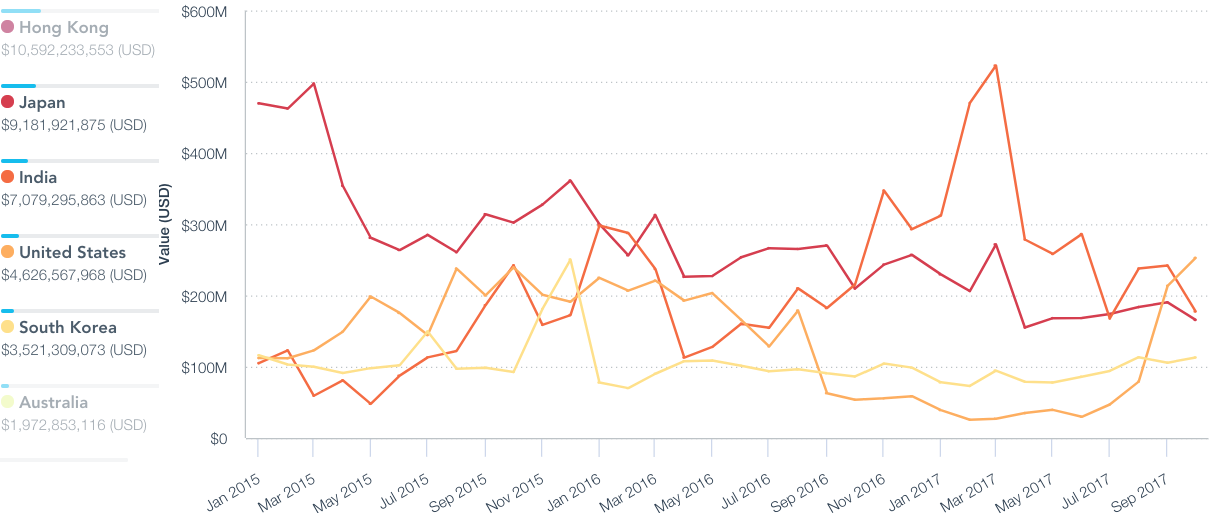

Chinese exports of solar- and wind-power equipment have fallen 18.9% in the past 12 months to $17.6 billion. That’s been partly due to a drop in shipments to India not having been offset by a resurgence in sales in the U.S. ahead of forthcoming restrictions under the section 201 review of the industry.

Source: Panjiva

#3 Getting Together Was Easy To Do

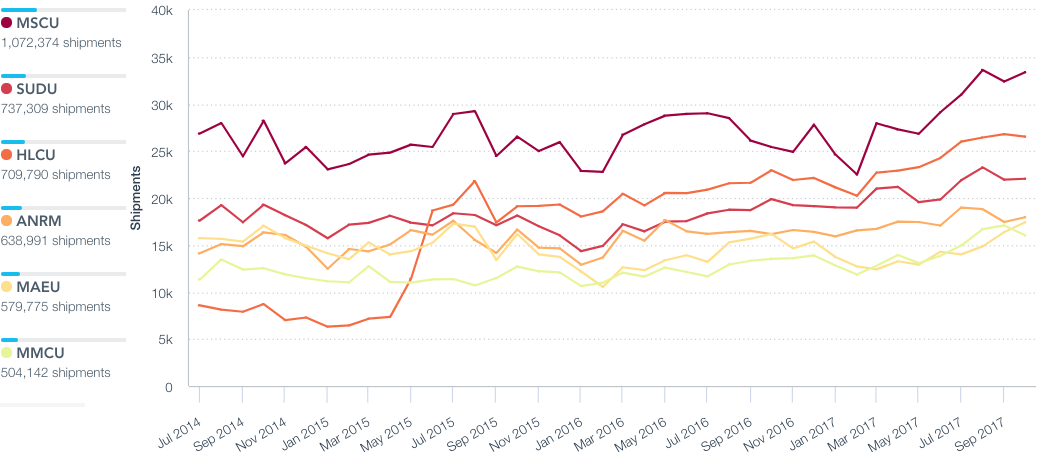

We had flagged antitrust risks for Maersk’s takeover of Hamburg Sud and the three-way merger of the container operations of the three Japanese container-lines as a reason to suspect those deals may not go ahead. The fragmentation of the container-line industry – even in Brazil where the top five “post deal” shippers had a 82% market share in the past three months – was clearly less of a concern for regulators than we had expected. The rapid passage of the COSCO Shipping-Orient Overseas deal later in the year shows consolidation may have further to go in 2018 before regulatory hurdles become too high.

Source: Panjiva

#4 Small Wasn’t Beautiful For Consolidation, But Fundraising Was

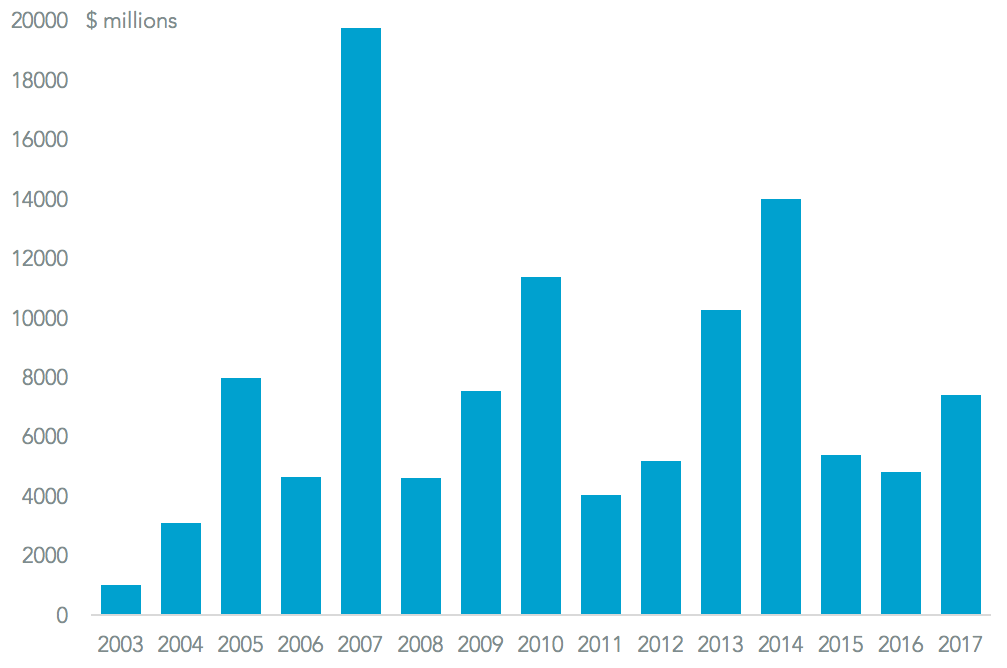

The corollary of our previous error was that we had expected infill acquisitions to be the way forward for the shipping industry. While CMA-CGM made good on that with its purchases of Mercosul and Sofrana, the COSCO Shipping-Orient Overseas and Euronav-Gener8 deals both show the big deal is still alive and well. For good measure we also missed the market’s appetite to provide new equity capital to the shipping industry. That reached $7.4 billion, 53.7% higher than a year earlier, and was likely supported by the recovery in shipping rates and associated improvement in earnings.

Source: Panjiva

#5 Toy and Telephone Tariffs Didn’t Play Out

The U.S. government’s focus on the trade deficit led us to suspect a risk of tariffs being applied to toy imports as a route to cutting imports. They didn’t emerge. Similarly a threatened tariff on smartphone imports from before the 2016 elections came to nothing. That was a surprise given China represents 86.5% ($5.28 billion) of toy imports and 78.7% ($40.7 billion) of smartphones.

Yet, we overestimated the willingness of the administration to impose direct costs to consumers to implement trade policy. Heading into 2018 though broad-ranging protectionist policies – including on consumer products such as washing machines – remain on the agenda. Taxing kids’ toys won’t be a vote-winner ahead of the midterm elections of course.

Source: Panjiva