Rapidly evolving trade policy is by no means the sole purview of the Trump administration, with significant upheaval coming to Europe via Brexit, in Latin America via Mercosur, across Asia and globally with WTO reform. This report, along with the accompanying report focused on U.S. trade policy, provides a guide for what to expect in the remainder of 2019.

Brexit – And now for something completely the same, more negotiations

The policy seen is evolving on a daily basis, but the current position is that if a new Withdrawal Agreement for the U.K. to leave the EU is not agreed by Oct. 17 then the British government is required – by law – to request an extension to the Brexit deadline to Dec. 31. If it is accepted by all EU members – which is by no means guaranteed – then there’s likely to be a new round of elections in the U.K. followed by further negotiations to reach a final Withdrawal Agreement.

The main sticking point – at least for the administration of Prime Minister Boris Johnson is the question of a customs border in the island of Ireland. While the current plan is to have a backstop position indefinitely where Northern Ireland remains part of the EU from a customs perspective, that will limit the British government’s ability to sign new trade deals after Brexit.

The latest suggestions, according to the BBC, are the creation of “customs clearance zones” across Ireland and Northern Ireland to obviate the need for a hard border, or the creation of a “two borders” system that would maintain regulatory alignment under the purview of the Northern Ireland Assembly, the FT reports.

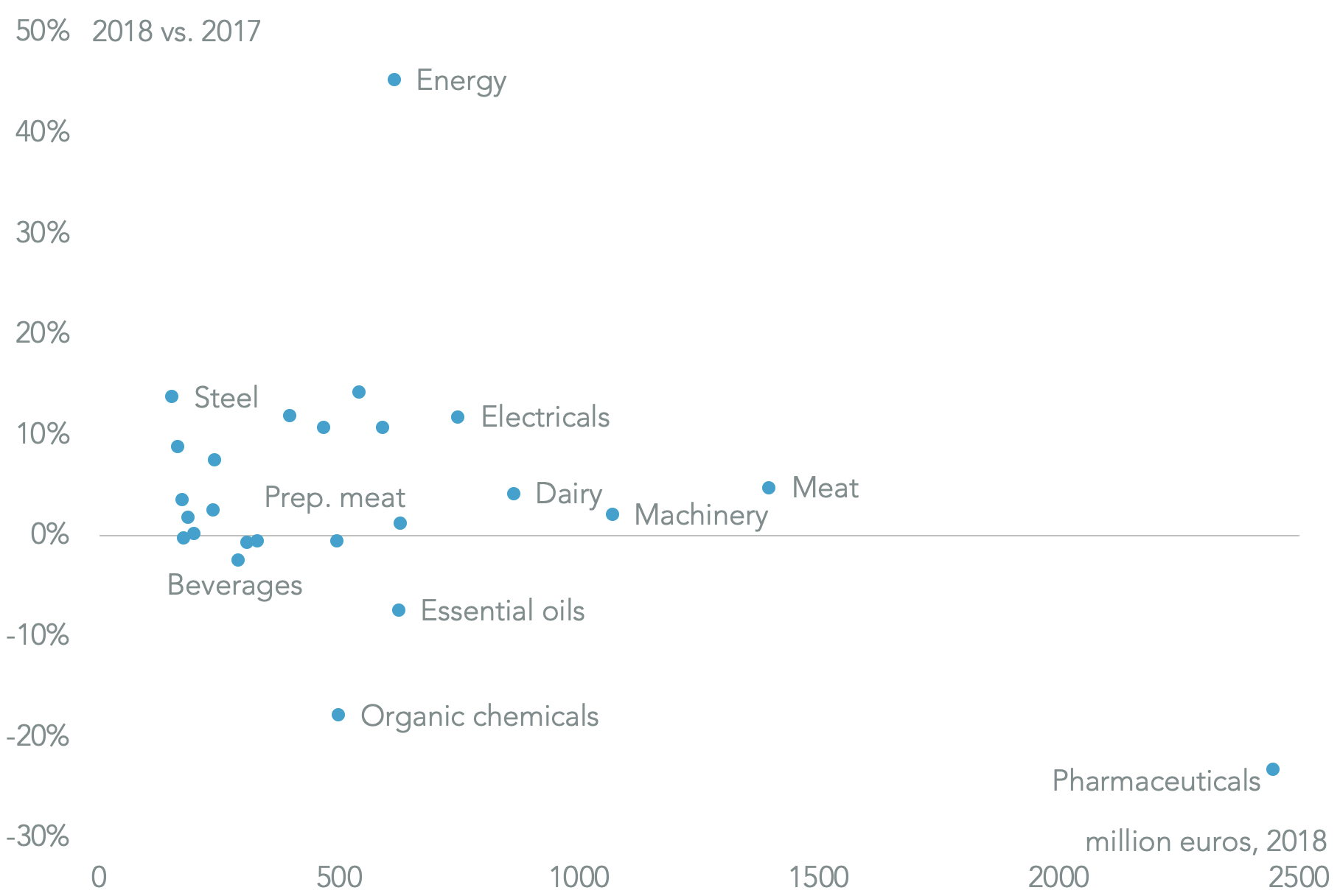

Both are theoretical constructs at this stage, and the Irish government has already stated that the customs zones are a non-starter. Even ahead of Brexit there has been a decline in Irish exports to the U.K., with a 1.0% slip in 2018 versus 2017, Panjiva’s analysis of Eurostat data shows.

That’s largely been down to weaker pharmaceutical shipments which have slumped by 23.1%, offset only partly by better shipments in agriculture with a 4.9% rise in meat and a 4.3% increase in dairy. There was also an improvement in shipments of capital equipment including electrical equipment which rose 12.0% and machinery up by a more modest 2.2%. The fastest growing sector was energy with a 39.4% rise in refined oil shipments and a 159% surge in electricity supplies – the latter of which shouldn’t be affected directly by customs issues.

Source: Panjiva

WTO Reform – Dec. 10 will be last orders for new complaints

The World Trade Organization may become ineffective from Dec. 10 due to the term of office ending for one of its three remaining dispute settlement panelists. While the panelist has yet to decide whether to remain in office, Inside Trade reports, it’s possible that existing cases may be completed subsequent to that, though new cases are unlikely to be brought.

A solution seems unlikely before the end of the year. The EU’s incoming Trade Commissioner, Phil Hogan, has outlined plans to push for a comprehensive reform of the WTO in late 2020 with a view to completing the process in 2022. The timeframe may be designed to bridge the forthcoming U.S. elections – as flagged in Panjiva’s research of Sept. 27 the Trump administration’s calls for reform have led it to block new appointments to the WTO’s dispute panel.

The EU may want to work more quickly though – should the panel become inquorate it may not be able to enact its own retaliation against U.S. aerospace subsidies – the U.S. will be able to do so by the end of October.

There are 30 remaining WTO dispute cases where a panel has been composed, including 13 against the U.S. which has been the main proponent of widespread WTO reform – and the blocker of new appointments to the dispute panel. Of those 13 cases, seven relate to U.S. section 232 steel and aluminum tariffs. On the other side of the coin the U.S. has six cases outstanding where it is complaining about the retaliation against its steel and aluminum duties.

The U.S. steel duties appear to have worked, with steel industry capacity utilization having risen to 76.2% in the 12 months to June. 30 compared to 69.1% in 2015. Meanwhile imports of steel have fallen 19.3% in the 12 months to Jun. 30 compared to the level reached in 2015. For the aluminum industry there may be a need to increase duties where the 10% rate has meant utilization has fallen to 74.1% from 82.1% in 2015 and imports have risen by 15.2%.

Source: Panjiva

Latin America – Brazil’s Mercosur mess

The Brazilian government faces a combination of trade policy challenges and opportunities during the fourth quarter. The deal which has been signed with the European Union and Mercosur is being held up, with Austria among others refusing to sign the deal because of the Bolsonaro administration’s position on deforestation, the BBC reports.

A potential trade deal with the U.S. has been hinted at but not yet initiated. It could – as has been the case with the EU deal – prove to be controversial if focused on agriculture, potentially leading to a more focused deal with the U.S. including the recently increased wheat import quota.

On a similar tack the South Korean government is looking to sign a trade deal with Mercosur, according to Yonhap. South Korea’s seaborne exports to Brazil have been in decline, with a 12.1% year over year drop in 2018, though they have since recovered by 23.7% year over year in the past three months to July 31.

There’s been a steady improvement in imports of plastics, which have climbed by 11.1% year over year in the past three months and were the largest import group at 15.7% of the total.

Capital goods have also seen a surge including a 134.9% jump in shipments of transmission systems for the automotive industry. There are still areas of decline of course including those relating to textile materials including synthetic yarns and fabrics which have declined by 5.5%.

Source: Panjiva

Global tensions – Lots that could go wrong, a few that could go right

The biggest opportunity in terms of new trade deals at this stage could be the Regional Comprehensive Economic Partnership, which the ASEAN group still wants to deliver in 2019. That seems highly unlikely due to a swathe of geopolitical issues in the region.

Not least of those is the ongoing skirmish between Japan and South Korea where the two countries have cut each others trusted trader status. That’s yet to have a meaningful impact on trade between the two countries – which has been in decline anyway due to regional economic weakness.

The Korean peninsular will also continue to be in focus as the U.S. and North Korea seek to address denuclearization, though China remains central to that debate. U.S. leverage over South Korea is somewhat limited given the KORUS trade deal is already signed an active, though new arms sales seem likely.

More serious geopolitical issues are already interrupting trade flows. India and Pakistan remain at loggerheads regarding the Kashmir, and India has had significant tariff barriers in place since the start of 2019. Little seems likely to change there.

Middle East tensions – exemplified by the recent attack on Saudi oil facilities – look set to continue with both regional and global effects. They could also provide a curve ball for the shipping industry – the physical glue that holds global trade together – as it looks to navigate new fuel rules from the start of 2020.

All this uncertainty comes around 17 months into a global slowdown in export growth that headed into a reversal with contracting global export activity since February. Panjiva’s analysis of S&P Global Market Intelligence data shows there was a 2.2% year over year drop in exports from 37 countries plus the EU in the three months to Jul. 31.

There’s likely been more of the same with 14 out of the 22 countries that have reported August data showing a decline with an average fall of 2.3%.

It’s worth noting though that the current downturn is nowhere as severe as the Europe-led downturn of 2015, never mind the more widespread full economic recessions of 2009 and 2002 – yet.

Source: Panjiva