As outlined in Panjiva research of July 19, President Donald Trump’s first six months in office there has been significant activity in, and delivery upon, trade commitments made during the pre-election campaign. These included launching several trade reviews, pulling out of TPP and launching renegotiations of NAFTA and KORUS as well as carrying out bilateral talks that yielded extra export sales. However, little progress was made on import-centric investigations, and a great many processes set in motion are either “overdue” or in progress. Broadly speaking for the next 100 days or so until the anniversary of the election there are six broad trade projects to address.

1. Act on “overdue” reviews

Three significant reviews have been commissioned that could provide the evidentiary backing for significant trade actions. The “Omnibus Report” on the causes of significant trade deficits is driven by the central tenet of the administration’s trade policy – namely that a trade deficit is inherently “bad” and a sign of unfair trade. By identifying both the offenders and causes it should provide detailed policy prescriptions.

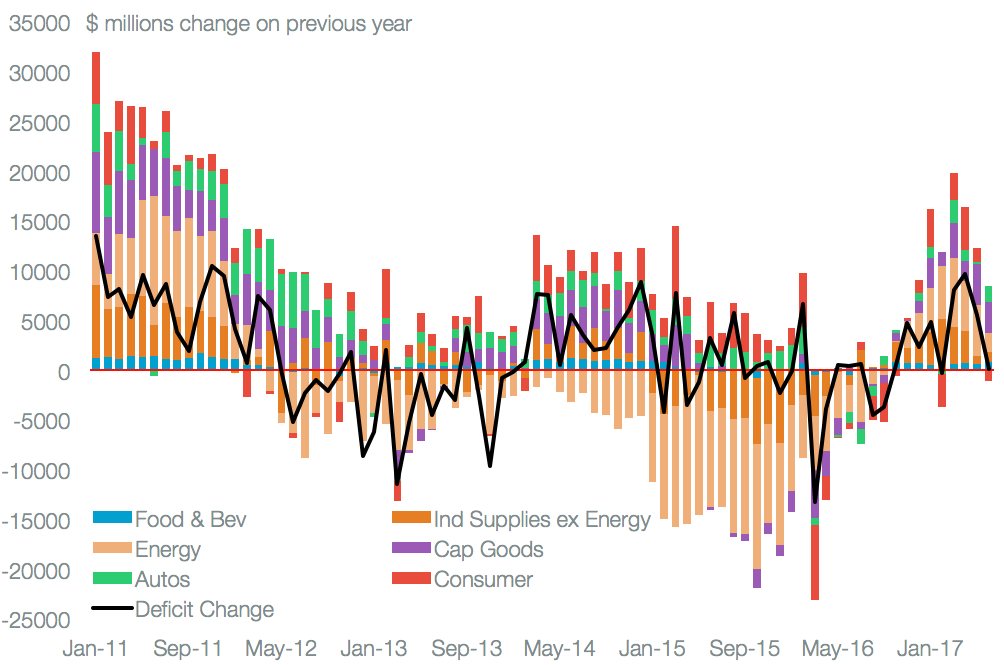

A report to the president was scheduled for the end of June, but no public sign of its conclusions is apparent so far. The U.S. trade deficit in goods has risen for eight straight months, most recently by 0.2% in June, Panjiva analysis of official data shows, after an energy-driven 4.5% rise in imports.

Source: Panjiva

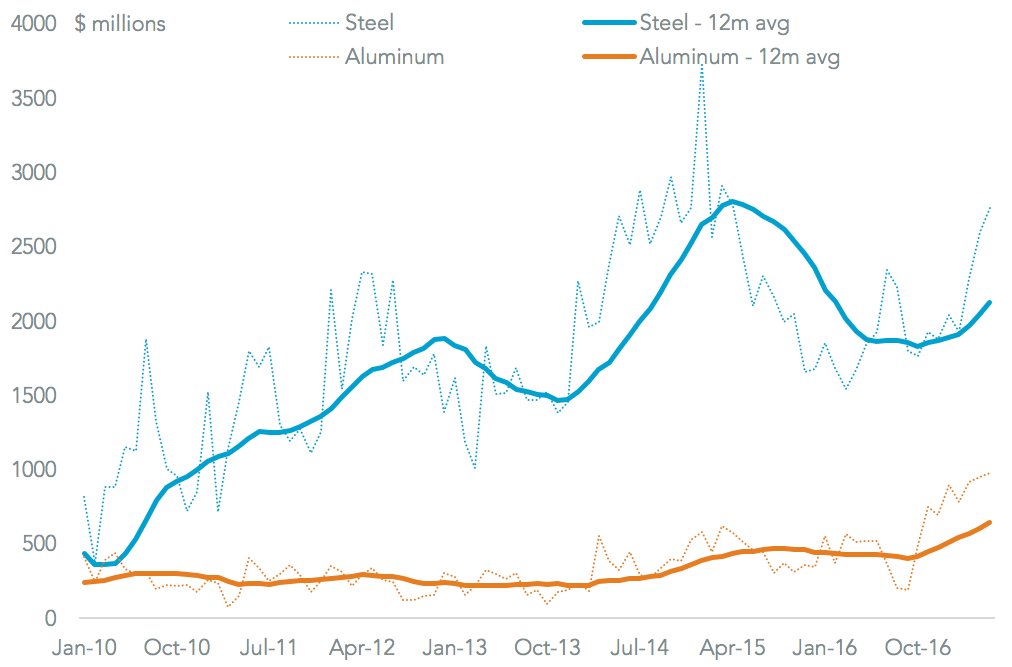

The section 232 “national security” reviews of the steel and aluminum sectors were similarly designed to provide detailed causes of, and remedies for, the U.S. deficit in the metals industries. The report, on steel at least, appears to have been completed and presented by Commerce Secretary Wilbur Ross to House Ways & Means. Action on its conclusions appear to have been delayed while targets that avoid “friendly fire” are identified. The delay may be costly for the industry – the U.S. “steel deficit” ( exports less imports) reached $25.5 billion on an annualized basis at the end of May, the highest since March 2015, Panjiva shows.

Source: Panjiva

2. Complete, then act, on in-progress reviews

The administration has also commissioned several major reports are not yet scheduled to report. The first will look at the impact of free trade deals and WTO membership on “ Buy American” policies, and should be completed by September 15. The second will investigate the performance of existing trade deals and identify abuses / violations within them while providing suggestions for remedies.

That report is due by October 29, but may have limited targets given the NAFTA and KORUS trade deals are already under review (see item six below). Panjiva data for U.S. imports and exports shows that the only “failed” (in terms of a higher trade deficit) FTAs aside from NAFTA and KORUS are with Israel and Panama.

While not specifically a trade review, the recently issued defense industrial base review will perforce review the international trade components of military equipment supplies. That will likely be a longer-term project – the review has up to 270 days (i.e. April 17 2018) to make recommendations.

Source: Panjiva

3. Complete outstanding trade cases

The Commerce Department currently has 36 active section 701/731 cases outstanding that are investigating alleged dumping or subsidization of exports by 24 countries. China features in 14 of the cases. At least eight of the cases (softwood lumber, aluminum foil, silicon metal, tool boxes, passenger jets, mechanical steel tube, steel wire rod and biodiesel) have been delayed, typically at the request of the petitioner. That may be in the hope that a harsher result may come out of one of the other Trump administration reports already highlighted.

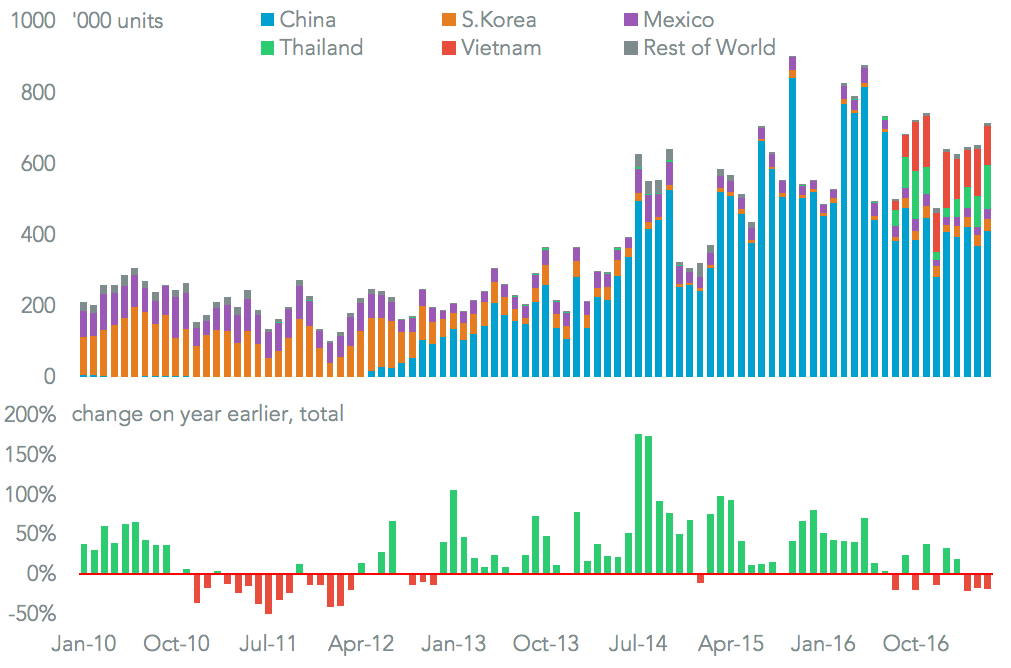

Those cases have a defined process which can take around a year to complete. Two reviews however offer significantly more Presidential latitude to act. The section 201 “safeguarding” reviews of the solar power industry (due to report August 15) and washing machines (September 7) can be acted on directly by order of the president. That may provide some easy wins for the administration in showing action on “unfair” trade. Delays could be costly – while washing machine imports fell 19.4% in the three months to May 31, they have increased more recently and are 50.2% above their December trough.

Source: Panjiva

4. Leverage scale in bilateral deals

As promised during the pre-inauguration period the Trump administration has looked to leverage the United States’ economic scale to carry out bilateral negotiations. These have typically taken the form of ongoing dialogues or working groups, for example with China, Japan, Malaysia, Taiwan, the U.K. and (informally) India, rather than formally heading towards new free trade deals. The heads-of-state talks have been largely transactional in nature, resulting in increased exports of specific product lines (especially in agriculture and energy).

The challenge in the coming months is to maintain momentum – for example the Japanese dialogue is headed by Vice President Mike Pence – and to how act if the transactional approach doesn’t work. The first example of the latter will be a potential section 301 investigation of China’s trade practices with regards to intellectual property rights.

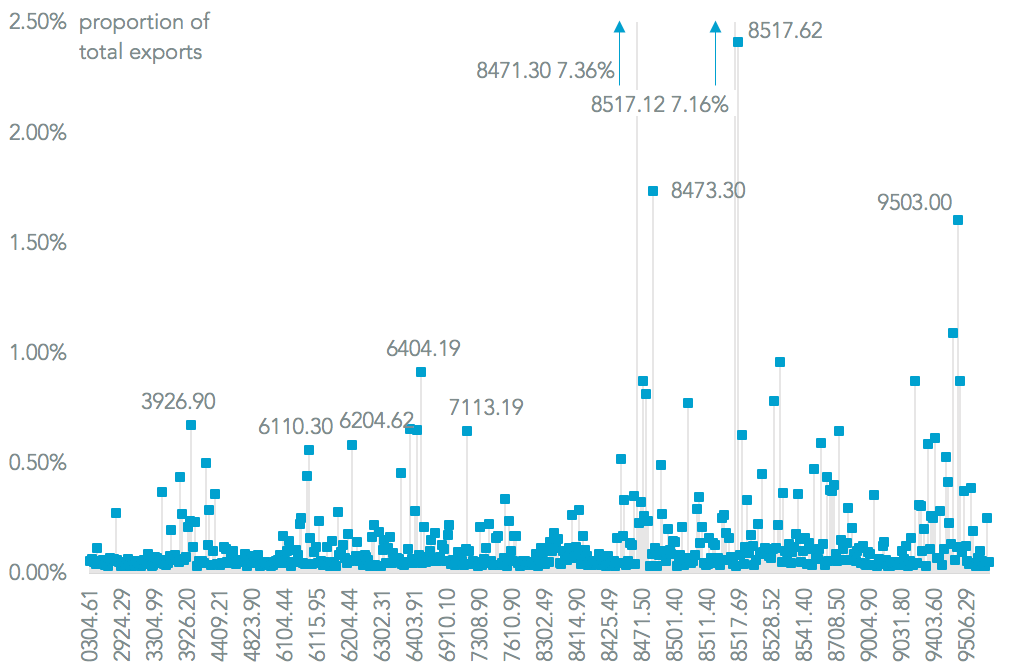

That can be seen as being, in part, a reaction to the perceived failure on China’s part to “control” North Korea as well as the low-key end to the initial phase of the Comprehensive Economic Dialogue. However, the “or else” needs to be trade sanctions in areas that are material to trade. In the case of China/U.S. the top four import categories, accounting for 43% of total trade, are consumer-related goods, Panjiva analysis of 500 export lines shows. Tariffs or quotas would potentially hit American consumers hardest.

Source: Panjiva

5. Act, or don’t, on trade sanctions

The administration has not yet chosen to impose trade-related sanctions against other countries. In the coming months actions may be needed in relation to: political upheaval related to the Maduro regime in Venezuela; and action against Russia following recent legislative changes by the U.S. Congress against President Trump’s will.

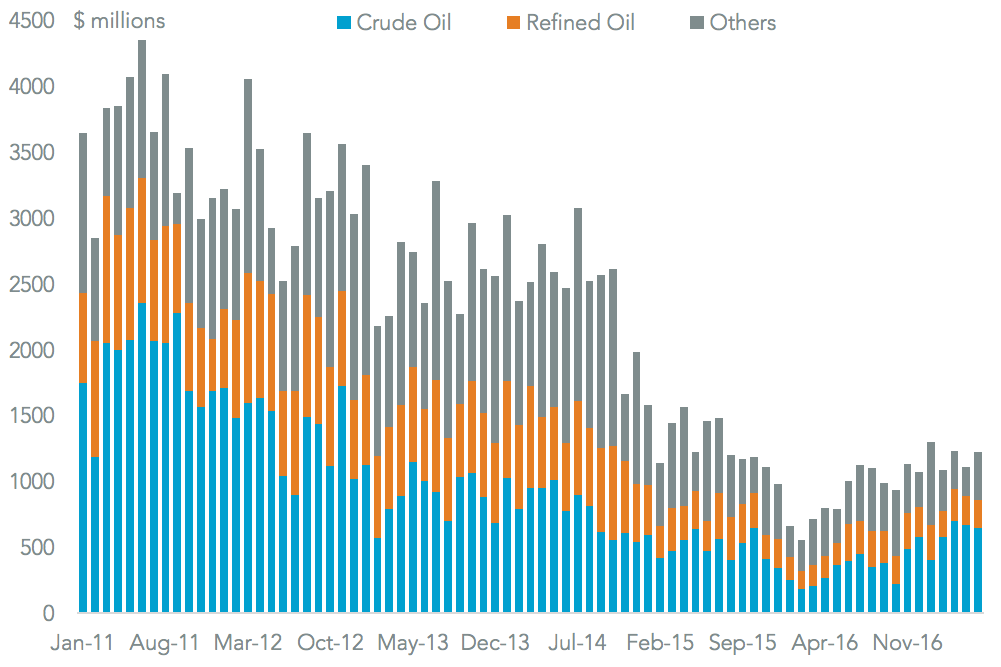

In both cases the U.S. has significant energy industry trade those countries that could be acted upon. Both also have unpalatable consequences. In the case of Venezuela there would be humanitarian implications of cutting America’s $9 billion of annual oil purchases on Venezuelan government food programs.

Source: Panjiva

With Russia there may be indirect problems. If the cuts are made to oil drilling equipment rather than crude oil or related products there could be an impact on European Union energy companies. Government officials in both France and Germany have already warned they do not see the U.S. moves so far as being legal and may retaliate. U.S. exports of energy exploration equipment totaled $340 million in the 12 months to May 31.

Source: Panjiva

6. Crack on with trade deal negotiations

Lastly, and most importantly the administration has scheduled full or partial review negotiations of the NAFTA and KORUS trade deals. The NAFTA talks have a contracted timetable, with 28 days of talks scheduled between August 16 and year end. While there are no “artificial” deadlines, according to U.S. Trade Representative Robert Lighthizer, from a practical perspective signing a deal before the Mexican elections will require the U.S. element of talks to be wrapped up by year end under Trade Promotion Authority rules. That may require a focussed approach, perhaps avoiding changes more complex areas such as dispute settlement.

Talks regarding the KORUS deal have been requested, but a timetable has not yet been set. These could be more open-ended from a timeframe perspective, but would have to be very limited in scope to avoid being defined as a renegotiation under TPA rules.

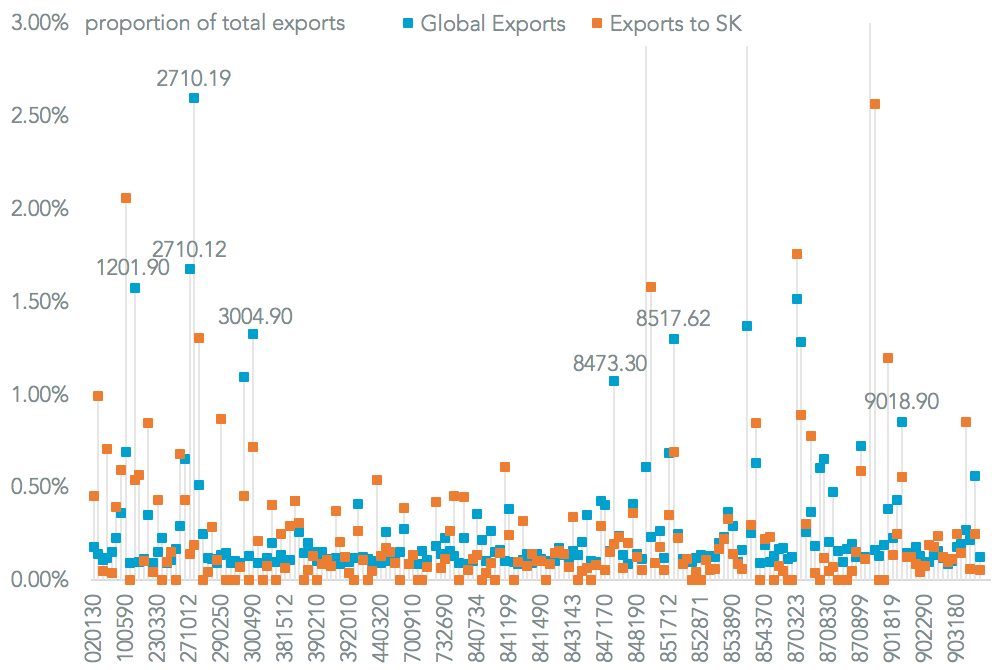

Panjiva analysis of the top 200 export lines globally by the U.S. vs. those to South Korea shows South Korea is under-represented in commodities (refined oil and soybeans), healthcare (pharmaceuticals and medical equipment) and telecoms equipment (where South Korea is also an exporter).

Source: Panjiva