Spanish port workers may go on strike from May 24 through June 9, Europa press reports, after unions rejected a government liberalization decree. The decree, which will allow privatization of stevedoring operations, was required by the European Commission and the government has not indicated a willingness to compromise. Earlier disruptions, mostly impacted Asia-Europe shipping, as outlined in Panjiva research of March 3, though continued action will inevitably lead to broader problems.

Panjiva data shows March was the worst in four years, with a 15.8% drop in seaborne export volumes to the U.S. on a year earlier. That followed four straight months of double digit growth. Expansion returned in April, indicating how even minor disruptions can have a significant impact.

Source: Panjiva

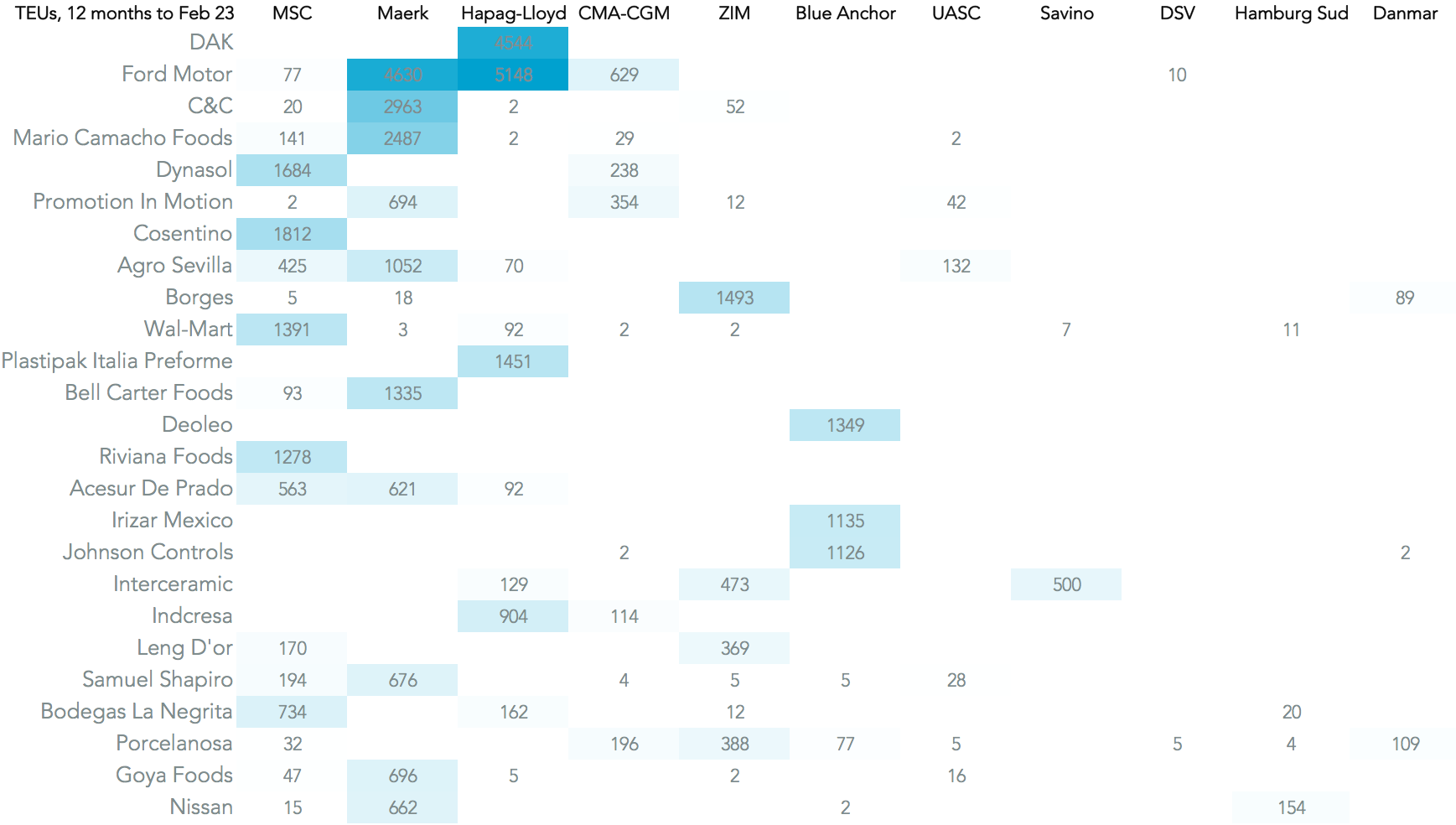

The most exposed consignees on Spain-to-U.S. routes in past 12 months to February 28 – ie ahead of the last round of strikes – are Ford Motor and plastics manufacturer DAK. Maersk was the largest shipper on the lanes, largely driven by its relationship with Ford, while Hapag Lloyd was a close second from working with DAK.

Source: Panjiva