Japan’s big three container liners – K-Line, NYK and Mitsui OSK – plan to merge their container shipping and non-Japanese port operations as a response to poor industry profitability. They expect the impact of merging the operations to improve profits by 110 billion yen ($1.05 billion). This is equivalent to 2.2% of the companies’ combined revenues in the 12 months to September 30.

The statement does not make any reference to how the 110 billion yen of improvements will be made – capacity reductions would seem to be a logical start. The new company will be sixth largest by capacity owned and chartered, Panjiva analysis of Alphaliner data shows.

Notably it would have the second highest proportion of chartered vessels (63.5% of vessels operated) after COSCO (70.5%) and the third largest orderbook as a proportion of operated vessels (26.2%). This would suggest is has flexibility to rationalize its capacity if it chooses to once it is formed in July 2017 and starts operations in April 2018.

Source: Panjiva

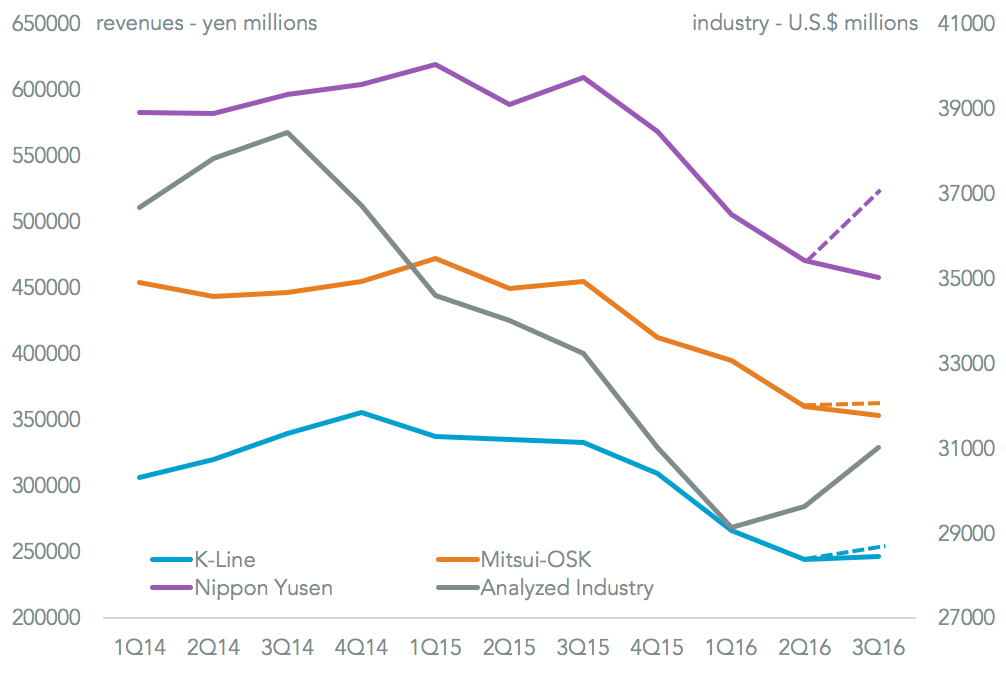

The challenging financial situation driving the deal was underscored by their fiscal second quarter (calendar third quarter) results. Revenues were 1.6% lower than the second quarter, but a full 24.3% below a year earlier. They were also 8.2% below analyst estimates gathered by Reuters. This was mainly the result of NYK’s results being 13.7% below those expected. Mitsui OSK and K-Line were both 3.5% below those expected, with the difference possibly being NYK’s airfreight business.

While NYK cut its financial forecast for the year, it stated that it sees the bottom in freight rates having been passed, with “some recovery” being shown. Despite these results being below expectations, when taking them with other companies that have already reported and analyst forecasts for those yet to report – particularly Maersk and the Taiwanese shippers – there is still the potential for a 4.8% recovery in shipping industry revenues in the third quarter vs. the second.

Source: Panjiva