Brazilian shipping traffic increased 9.9% on a year earlier in February, Panjiva data for exports and imports shows. That meant the first two months saw a 9.3% rise in TEUs on a year earlier, somewhat above the low single digit rate expected by Maersk, as outlined in Panjiva research of February 23. While Brazil’s trade activity took another step forward in March, this is proving to be largely dependent on the oil price.

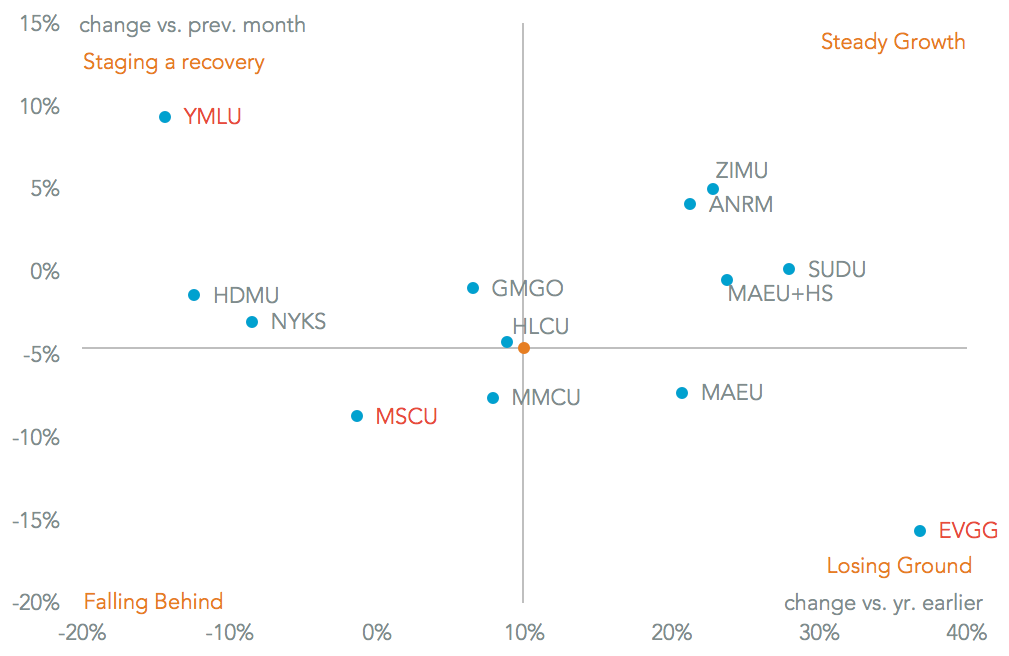

Among the major shippers MSC was an outlier, with its volumes handled falling 1.4% on a year earlier after a 22.6% jump in January. By contrast Maersk saw a 20.6% increase, the sixth straight rise. Among the second tier operators there was a marked contrast between Evergreen, which handled 36.8% more volumes on a year earlier and Yang Ming which saw a 14.4% drop. On a month-over-month basis however the roles were reversed.

Source: Panjiva

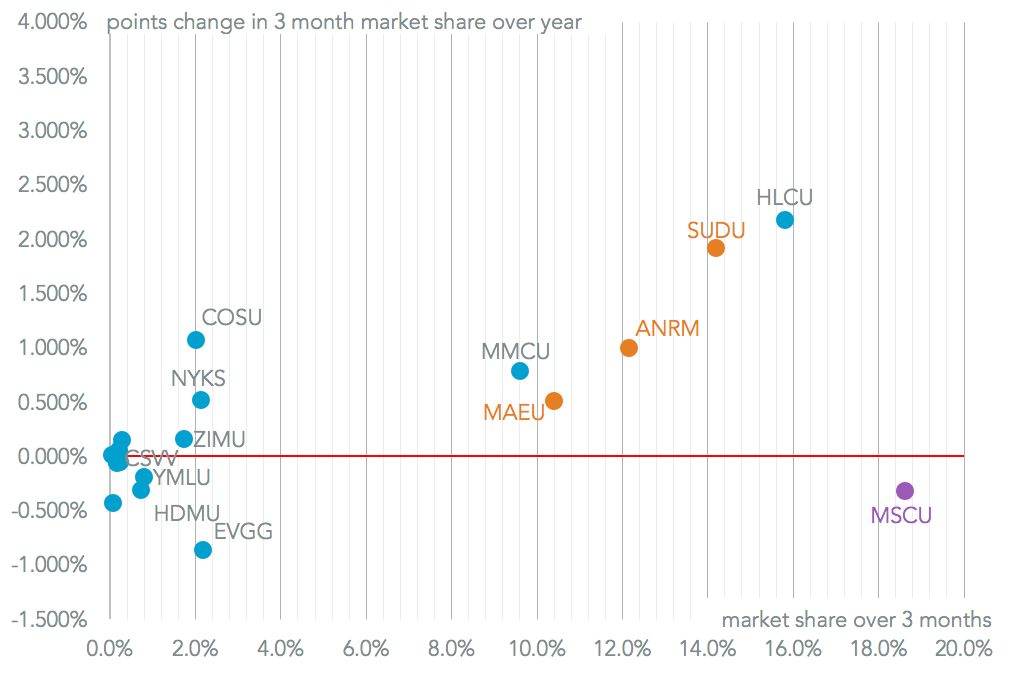

MSC’s decline resulted in a 0.32% point drop in its market share over the past three months on a year earlier to 18.63%. Maersk meanwhile, when taken together with Hamburg Sud, saw a 3.47% point rise to 36.8%. When taken together the top 10 shippers held a 92.1% market share in the 3 months to February 28, up from 89.0% for the same period a month earlier.

That degree of consolidation may lead to the European Commission making a reduction in market share by Maersk a condition of its acquisition of Hamburg Sud. MSC may be prevented from taking this on, and offsetting its decline, given it operates within the 2M Alliance with Maersk. CMA-CGM may be a more likely buyer given its aims to increase market share. A decision is due from the Commission by April 10.

Source: Panjiva