Cosmetics maker Revlon reported that its 3Q earnings had been negatively impacted by a $3.7 million increase in costs associated with “list 3” tariffs placed on Chinese exports by the U.S. For context the firm’s pre-tax profits in 3Q were $19.7 million according to S&P Global Market Intelligence.

The household and personal care (HPC) sector has been subject to list three tariffs since Sept. 2019, Panjiva’s analysis shows, with rates increased to 25% in May 2019. Major import lines associated with Revlon include cosmetics (HS 3304) and hair care products (HS 3305) with similar products from its competitors including dental care (HS 3306) and shaving suppliers (HS 3307).

Panjiva data shows shipments from China accounted for 14.9% of the total $7.85 billion of imports in the 12 months to Sept. 30. The industry overall appears to be in decline with total imports down by 5.2% year over year in 3Q. That included a 25.4% slide in imports from China in response to tariffs while shipments from the rest of the world were unchanged.

Source: Panjiva

For Revlon specifically, seaborne shipments to the U.S. linked to the company include styling as well as cosmetics imports. There was an 8.1% slide in imports in the three months to Oct. 31, including a 38.0% slide in shipments from China. Yet, China still accounted for 40.4% of the total in the 12 months to Oct. 30. Revlon has instead scaled up its imports from Europe to compensate, and they now represented 40.4% of the total

Revlon’s exposure to China, including Hong Kong, to cosmetics specifically was equivalent to 30.2% of its total in the 12 months to Oct. 30.

Source: Panjiva

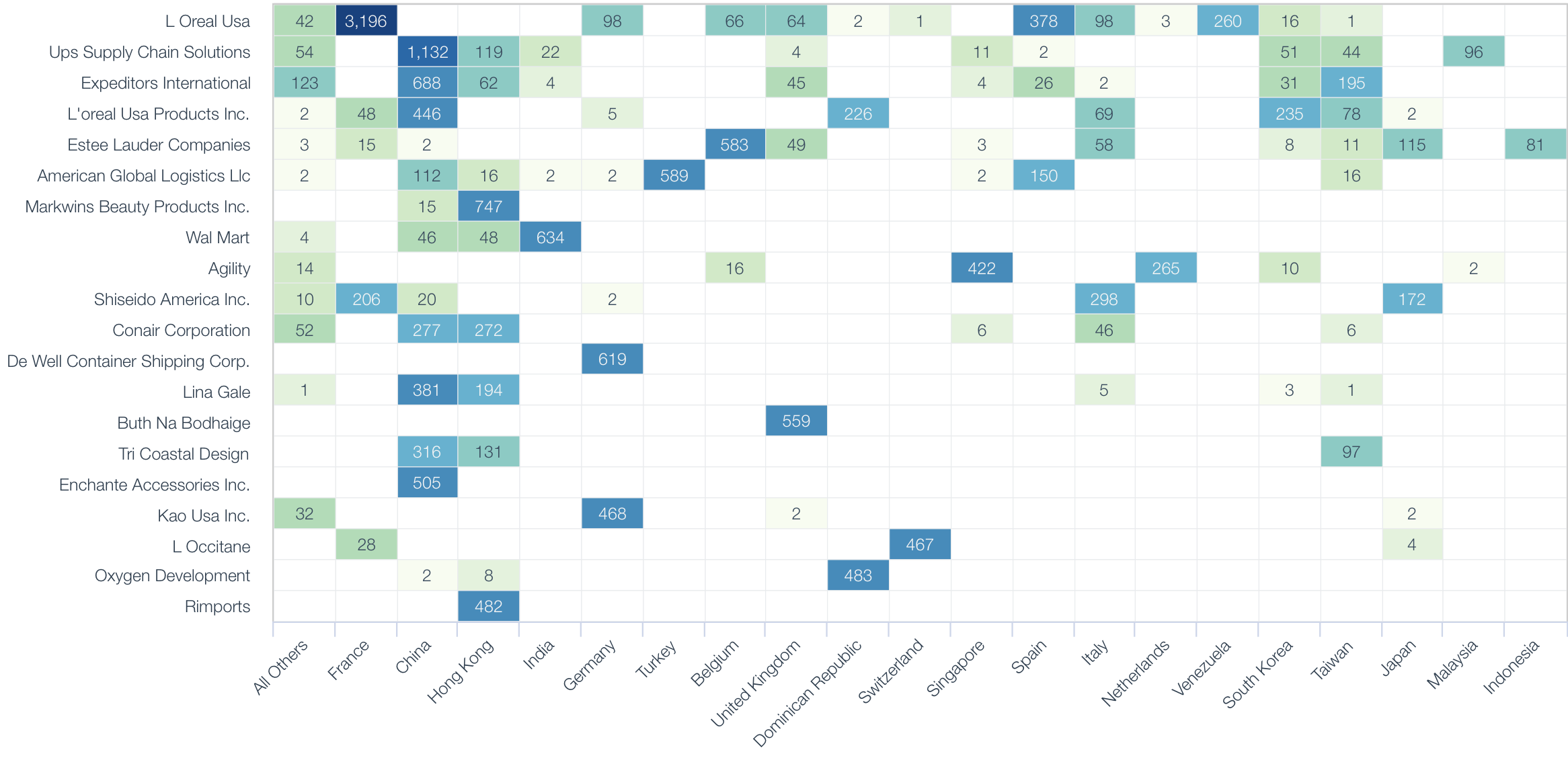

Most of Revlon’s competitors in the beauty sector, excluding perfumes, have a minor exposure to China – potentially putting it at a disadvantage to its competitors. The exception is Markwins, where essentially all imports associated with the firm came from China in the past 12 months. For L’Oreal, just 8.3% of its imports of cosmetics came from China, while for Shiseido the figure was 2.9%. Most other importers include Estee Lauder, Benefit and Sephora were all below 1%.

Source: Panjiva