Bicycles have been in strong demand in the wake of the COVID-19 pandemic. Bike manufacturer Giant reported a 22.9% year over year surge in sales in Q2, S&P Global Market Intelligence data shows. Similarly, diversified leisure goods manufacturer Dorel reported an 8.1% year over year increase in revenues in Q2 including an 18.5% surge in sales by Dorel Sports, its cycle manufacturing division.

The challenge for the firms has been meeting the short-term demand spike, with Dorel’s CEO Martin Schwartz stating “we could have sold more bikes had we had them” and that “demand is still very high and in-store inventory remains very low“. While the firm is getting orders that it originally made it can’t meet incremental demand as the “timeline to order bikes is anywhere from 90 to 150 days“. Manufacturers may be unwilling to add new factory capacity to meet what could be a short-term spike in demand.

A central challenge for U.S. bicycle sourcing is the heavy reliance on just two countries and the resulting disruptions caused by local lockdowns. Panjiva’s data shows that China and Taiwan represented 51.2% and 39.3% of total U.S. bicycle imports in 2019. Shipments from China to the U.S. slumped 34.0% lower in March and 32.2% lower in April compared to a year earlier in the wake of shutdowns but have since recovered. Shipments from Taiwan are still in decline.

Total U.S. imports of bikes are now recovering. Total seaborne shipments climbed 26.4% year over year in July. Those coming from China surged 42.7% higher year over year in July while those from the rest of the world excluding Taiwan jumped by 98.3% as supplies from Cambodia and Vietnam filled the gap. Shipments from Taiwan were still down by 14.5% in July, suggesting either a retasking of supplies or continued production challenges.

Source: Panjiva

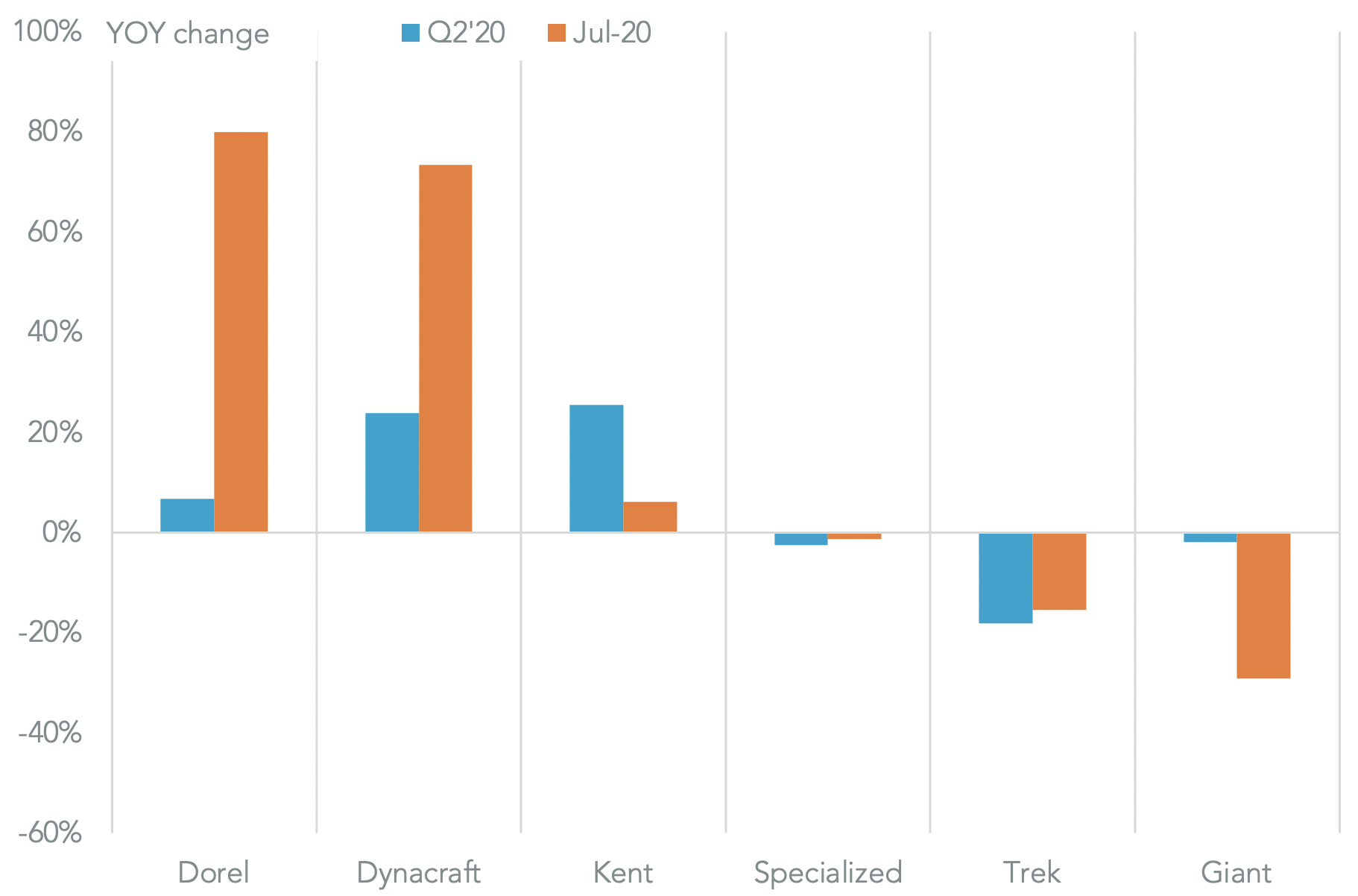

Dorel’s sourcing may be surging, with Panjiva’s data for U.S. seaborne imports linked to the firm having increased by 29.9% year over year in July after a 6.8% improvement in Q2. Privately owned Dynakraft has seen sustained growth with imports up by 73.4% in July after a 23.8% increase in Q2. Kent Cycles, which had previously redomiciled capacity as discussed in Panjiva’s Oct. 2018 report, saw a more modest 6.1% rise in imports in July after a 25.4% jump in Q2.

Not all importers have been increasing shipments, either because of availability or because of market targeting. Shipments linked to Specialized have been in a longer term slide and dipped 1.3% lower in July while those linked to Roth Holding’s Trek slumped 15.4% lower. The fastest rate of decline, however, has been a 29.1% slide in shipments linked to Giant, which suggests its growth in North America in Q3 may slow. A 2.0% dip in shipments in Q2 indicates it met increased supplies with available inventories.

Source: Panjiva