Maersk’s attempts to demerge its energy business may be on hold after the government failed to ratify a financial support plan for North Sea oil investment at Tyra, Borsen reports. In essence a key part of Maersk Oil’s expansion lies in the Tyra natural gas field. This requires government support, reported by TV2 to in the order of 5 billion kronor ($709 million), to support a 60 billion kronor investment to improve the gas transmission infrastructure.

This raises the issue as to how Maersk plans to finance its acquisition of Hamburg Sud. While that is not due to be completed until 2018. So far the focus has been on regulatory approval rather than discussions of financing, as discussed in Panjiva research of February 21, the company will want to line up financing ahead of time. It isn’t yet clear whether the disposal of Maersk’s energy business will be for cash or a demerger to shareholders, and whether the Hamburg Sud acquisition will be all-cash or include an equity component.

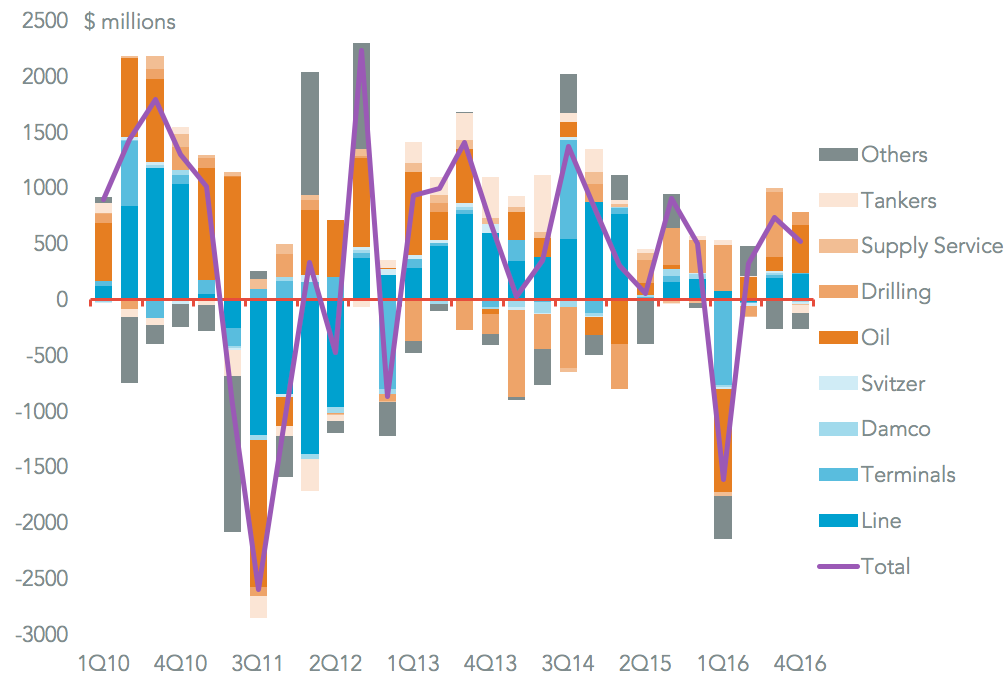

In 2016 the energy business accounted for 60.4% of Maersk’s operating cash flow (excluding “other” items) but only 49.4% of its capital expenditures, making it a net contributor to the group. While this may appear to mean a disposal would cut group cash flow near term, it would reduce the drag from future investments in assets such as Tyra. In any event, a solution on Tyra is needed before Maersk’s financial structure can become more defined.

Source: Panjiva