Retail device manufacturer Zebra Technologies has already felt a marked impact from U.S. tariffs on Chinese exports implemented under the “list 4A” phase in September. The impact was worth $100 million off of earnings in 2019 according to CFO Olivier C. Leonetti. That was equivalent to 17.2% of 2018 pre-tax profit, Panjiva analysis of S&P Global Market Intelligence data shows.

CEO Anders Gustafsson meanwhile has stated that strategically Zebra has “confirmed our decision to diversify the sourcing of most of our U.S. volumes out of China. This work, together with other actions we have taken, is expected to substantially mitigate the recently enacted Section 301 List 4 tariffs by mid-2020.”

The firm is significantly exposed to U.S.-China trade talks, though as outlined in Panjiva’s research of Oct. 15 the forthcoming “phase 1” agreement is unlikely to yield a significant roll-back of existing tariffs.

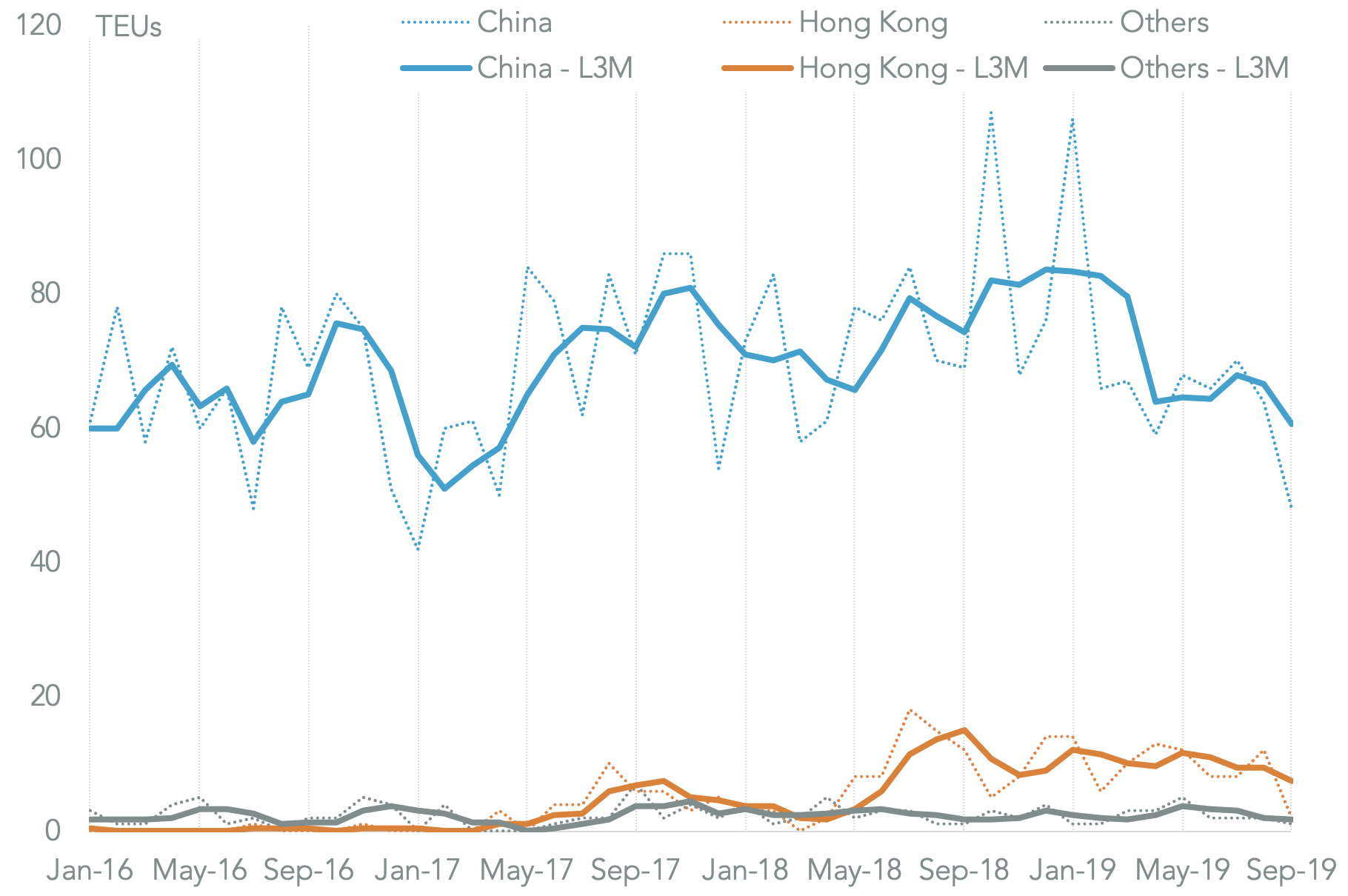

Panjiva’s data for U.S. seaborne imports associated with the firm collapsed by 23.4% year over year in 3Q after a slip of 2.9% in 2Q ended seven consecutive quarters of growth. At the product level imports of printers by all importers have been in steady decline due to consumer segment sales, with seaborne imports by all suppliers down by 9.6% in 3Q.

Source: Panjiva

Imports associated with Zebra are dominated by China, which represented 87.1% of total imports linked to the firm in 3Q. That was actually up from 81.6% in 3Q 2018 as the firm has cut its sourcing from Hong Kong to 10.5% in 3Q 2019 from 16.5% in 3Q 2018, with the remainder made up by shipments from Taiwan.

U.S. imports linked to Zebra have been dominated by those associated with Jabil Circuit, which accounted for 80.6% of all shipments and was dominated by shipments from mainland China. Zebra may also have completed imports from Vtech and Sanhua Tech from Hong Kong.

Source: Panjiva

Jabil Circuit may have room to increase exports from its Mexican facilities for Zebra. That may be a reaction to tariffs that its customers face more broadly. Jabil’s exports of printers from Mexico in 3Q 2019 were equivalent to seven-times Zebra’s U.S. seaborne imports in 3Q. There were almost entirely targeted at the U.S. after a 146% year over year jump in 3Q.

Source: Panjiva