U.S. auto sales continued their downward track in May, Panjiva analysis of official data shows, with a 0.5% year over year decline following an average 2.8% slide in the prior three months. Foreign-built vehicles have borne the brunt of the downturn recently, with sales of foreign light trucks having fallen by 7.1% in May and cars by 2.5%, while sales of domestically produced vehicles improving by 1.1%.

Source: Panjiva

The issue for the automakers currently may be tariffs and the impact on supply chains rather than underlying demand however. While a decision on section 232 tariffs has been delayed to November, as discussed in Panjiva’s research of May 30, the imminent application of 5% tariffs on all imports from Mexico could have an immediate impact.

Indeed, Toyota has already flagged that the proposed tariffs on Mexican exports could add $215 million and $1.07 billion to industry costs according to Reuters. Panjiva data shows that Mexican exports of cars and light trucks to the U.S. were worth $35.5 billion in the 12 months to Apr. 30, making the initial tariff rate of 5% equivalent to $1.78 billion annualized or $3.70 billion for calendar 2019 if the threatened escalation of rates to 25% by October occurs.

That would suggest Toyota’s assessments assume a netting off of value added in the U.S. side of supply chains as well as potential price increases for consumers and lower profitability for the automakers. It’s worth noting that the tariffs themselves will be paid by the U.S. importing entities.

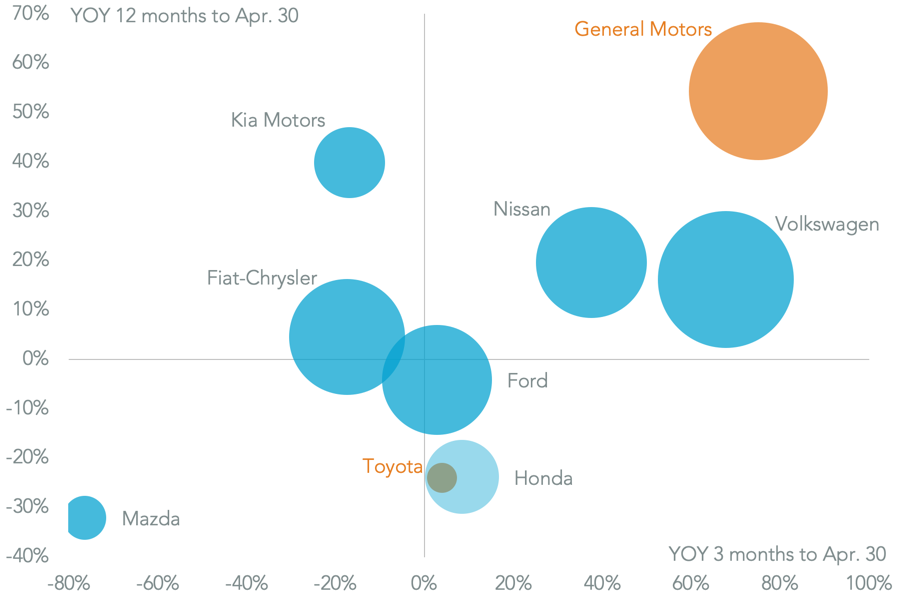

Toyota is the smallest of the big 10 exporters from Mexico to the U.S. with $346 million shipped, though that will increase with new model releases. The firm’s shipments have only increased by 4.0% year over year in the three months to Apr. 30, suggesting a relatively low level of concern about section 232 duties.

The largest exporter to the U.S. is General Motors with $7.20 billion shipped after a 67.7% surge in the past three months – suggesting some stockpiling ahead of tariffs – ahead of Volkswagen (including Audi) at $7.00 billion, Fiat Chrysler with $5.09 billion and Nissan with $4.62 billion.

Source: Panjiva