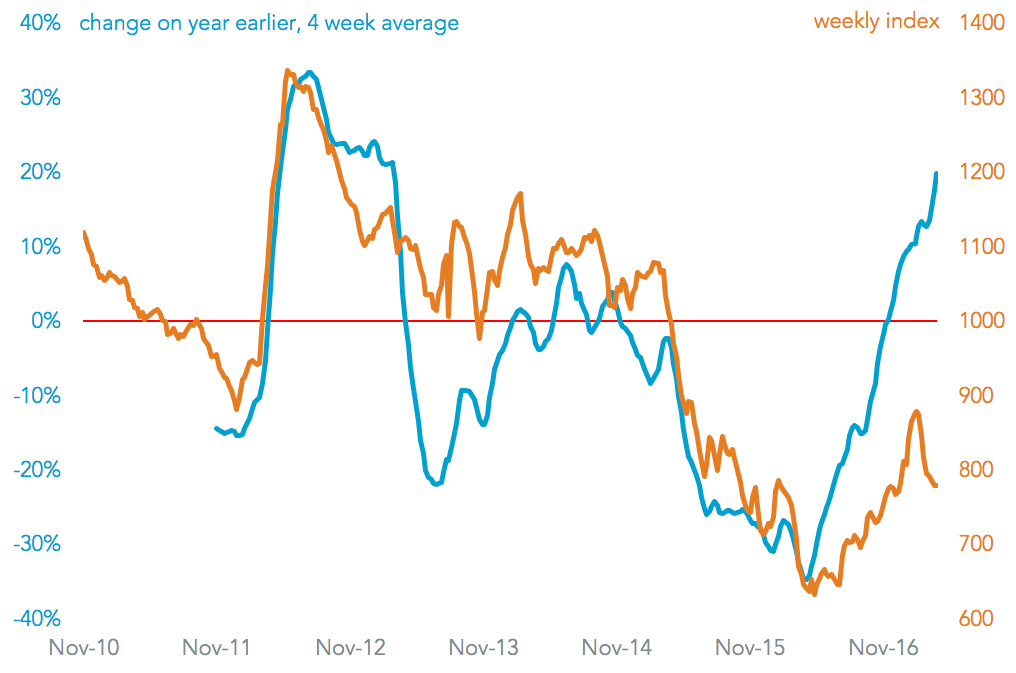

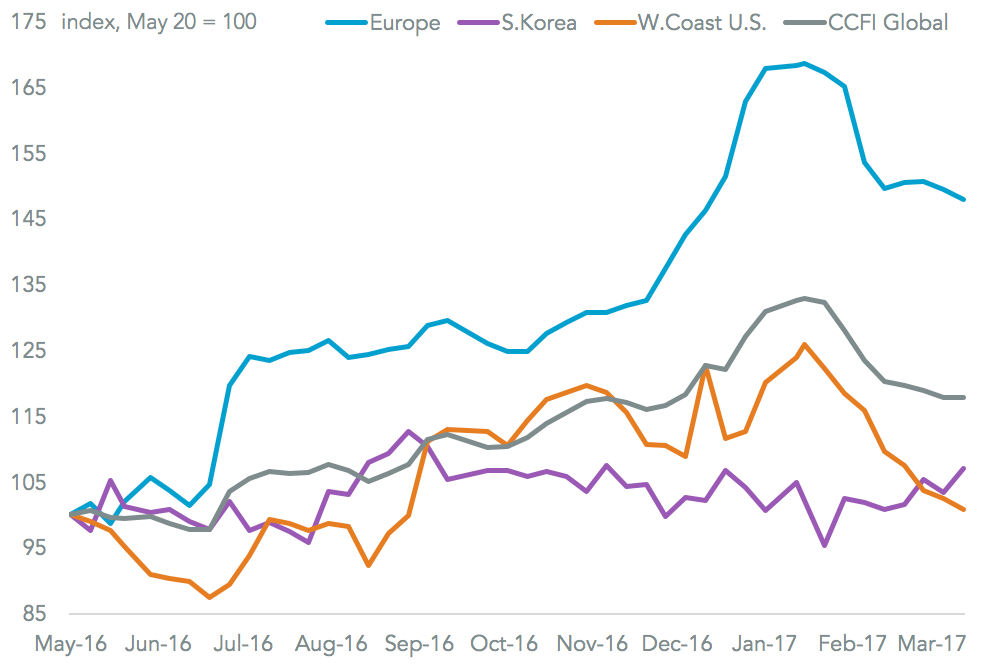

Container shipment rates, as measured by the Shanghai Shipping Exchange CCF Index, continued to decline in March. They fell 4.5% by the end of the month after eight straight weekly declines. They were still 19.8% higher than a year-earlier on a four week trailing average basis, but that is is comparison to the post-recession lows of last April. That comes despite upbeat commentary from most management teams as discussed in Panjiva research of April 1.

Source: Panjiva

Was the result of a 13.0% drop in the month on routes into the west coast of the U.S., now back to levels seen in September just after the Hanjin Shipping meltdown started. It isn’t clear whether this is simply a breather after extended gains, or a change in fundamental conditions. It was driven by a 13.0% fall in volumes handled on Asia-to-U.S. west coast routes.

That may be the result of expectations of renewed volume availability after the refinancing of the South Korean shipping industry and emergence of SM Line. It is important not to overstate that effect, however, as China-to-South Korea rates actually increased 5.2% during the month after a lackluster performance before that.

Rates to ship from China-to-Europe also fell by 3.6%, despite a restriction on Europe-to-China volumes by shippers including Maersk, The Loadstar reported. Rates near the month might not have reflected fundamentals, however, as vessels may have been moved to meet the new alliance commitments from April 1.

Source: Panjiva

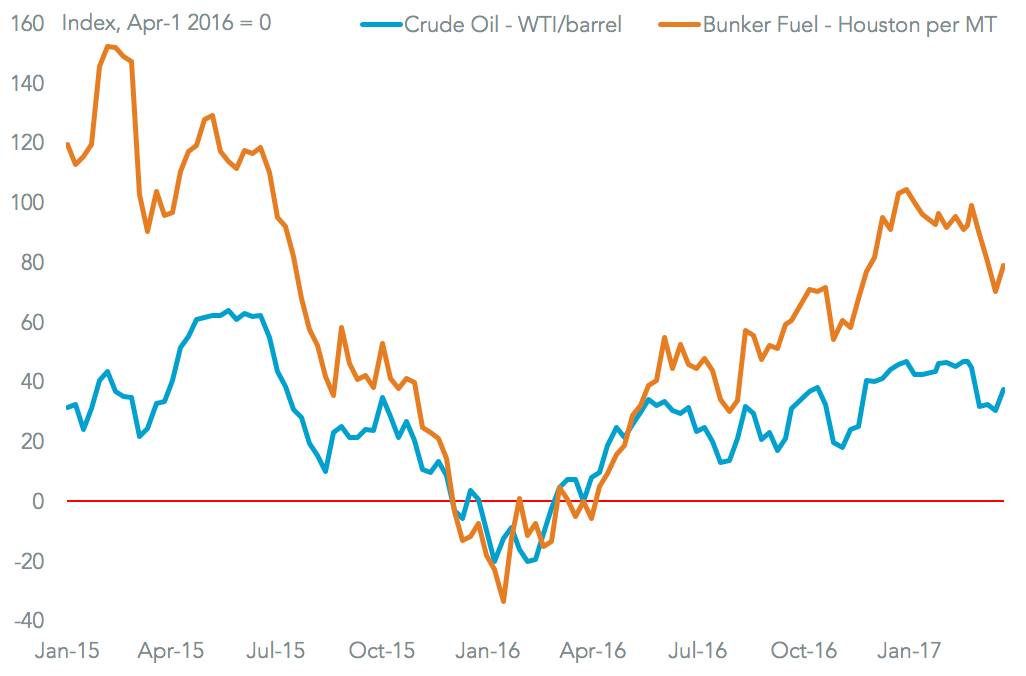

Fortunately for the shippers there was also a drop in bunker fuel costs of 6.9% in the month. That was led by a 6.3% fall in the crude oil price that resulted from expectations of a return of Libyan oil to the market, Bloomberg reports.

Source: Panjiva

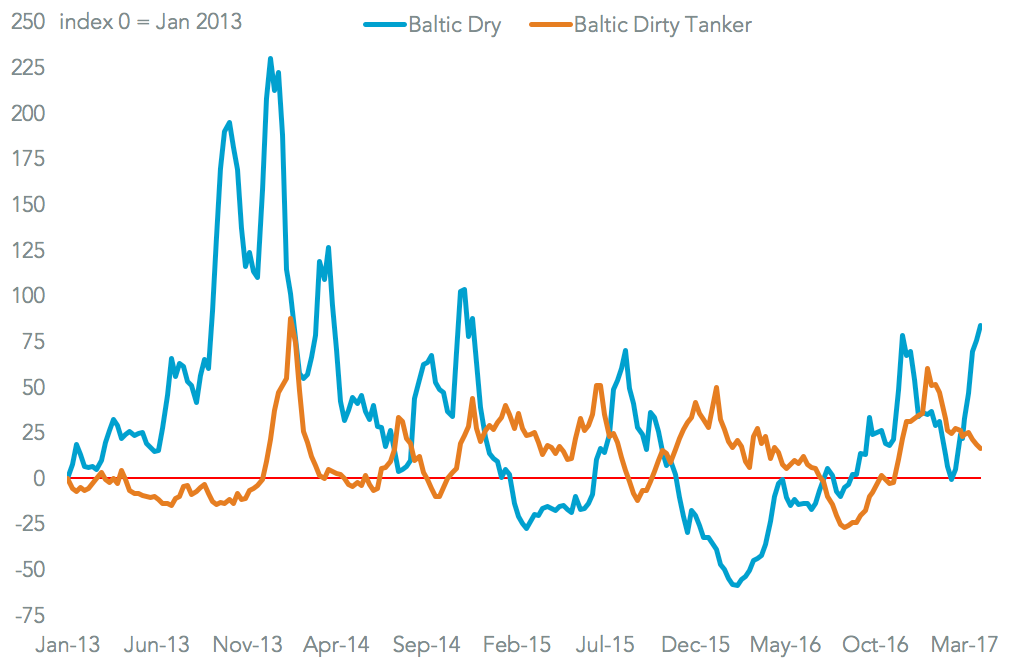

The lower oil price, reports of extended OPEC discipline that may suppress demand and potentially new vessel orders, resulted in tanker rates falling 5.4% during the month. That left them at their lowest since November. The anomaly was a 51.0% jump in the Baltic Dry Index, leading the index to its highest since November 2014. Prices for bulk commodities themselves actually fell, with Bloomberg’s broad index falling 2.7% during the month. Within that soft commodities fell 7.5%, grains by 5.7% and industrial metals by 2.3%.

In the short-term capacity factors may weigh on rates. Interruptions to coal mining output in Australia after Cyclone Debbie and increased vessel deliveries from South Korea suggests there may be extra vessel availability. From a longer-term perspective though it is worth noting that bulk rates actually fell 5.9% in the first quarter overall compared to the fourth quarter, which in turn had experienced the third straight double-digit expansion.

Source: Panjiva