The U.K. government is pressing on with two major trade deals this year. The most important, as discussed in Panjiva’s research of Feb. 5, is with the European Union. The first round of negotiations did not go well, with the European Commission‘s lead negotiator Michel Barnier stating that there are “very serious” differences between the two sides’ negotiating stances with regards to a trade deal after the first round of negotiations.

The four main areas of differences, according to Barner, include: approach to applying treatment of trade distortions, also known as the level playing field; the part played by the ECJ in a future agreement; application of sectoral or cross-sector governance; and access to fisheries. Negotiations are set to continue from March 18 in a series of alternating week discussions.

That comes against the backdrop of trade with the EU which dropped by 11.2% year over year in January, Panjiva’s analysis of official data shows. That included exports which dropped by 4.8% and imports which slumped 15.3% lower. By contrast trade with the rest of the world improved by 3.0% on a surge in exports of 40.1%.

Source: Panjiva

Trade negotiations with the U.S. meanwhile are complicated by the existence of a wide range of bilateral tariffs between the two sides.

The talks may be tripped up in the short-term by the U.K. imposition in the latest budget from HM Treasury of a digital services tax (DST). That will be applied at a 2% rate of revenue on companies running marketplaces or other digital services, and as such is likely to capture U.S.-domiciled firms. Early moves by the EU had already led to the threat of tariffs by the U.S. which could in turn derail their bilateral trade negotiations.

Improbably, given the DST implementation, the U.K. has reportedly asked for the removal of tariffs applied in relation to an Airbus subsidy case as an act of “goodwill” according to Inside Trade.

The tariffs are having a marked impact. Panjiva’s analysis shows that U.S. imports of products linked to that particular package of tariffs dropped by 15.1% year over year in January after falling by 23.1% in Q4.

The impact on food has been particularly keen with a 32.3% slump in January while the largest export line – whiskey – fell by 3.5% after collapsing by 24.0% in Q4. Aerospace exports have dropped to zero since May, though deliveries have historically been sporadic.

Source: Panjiva

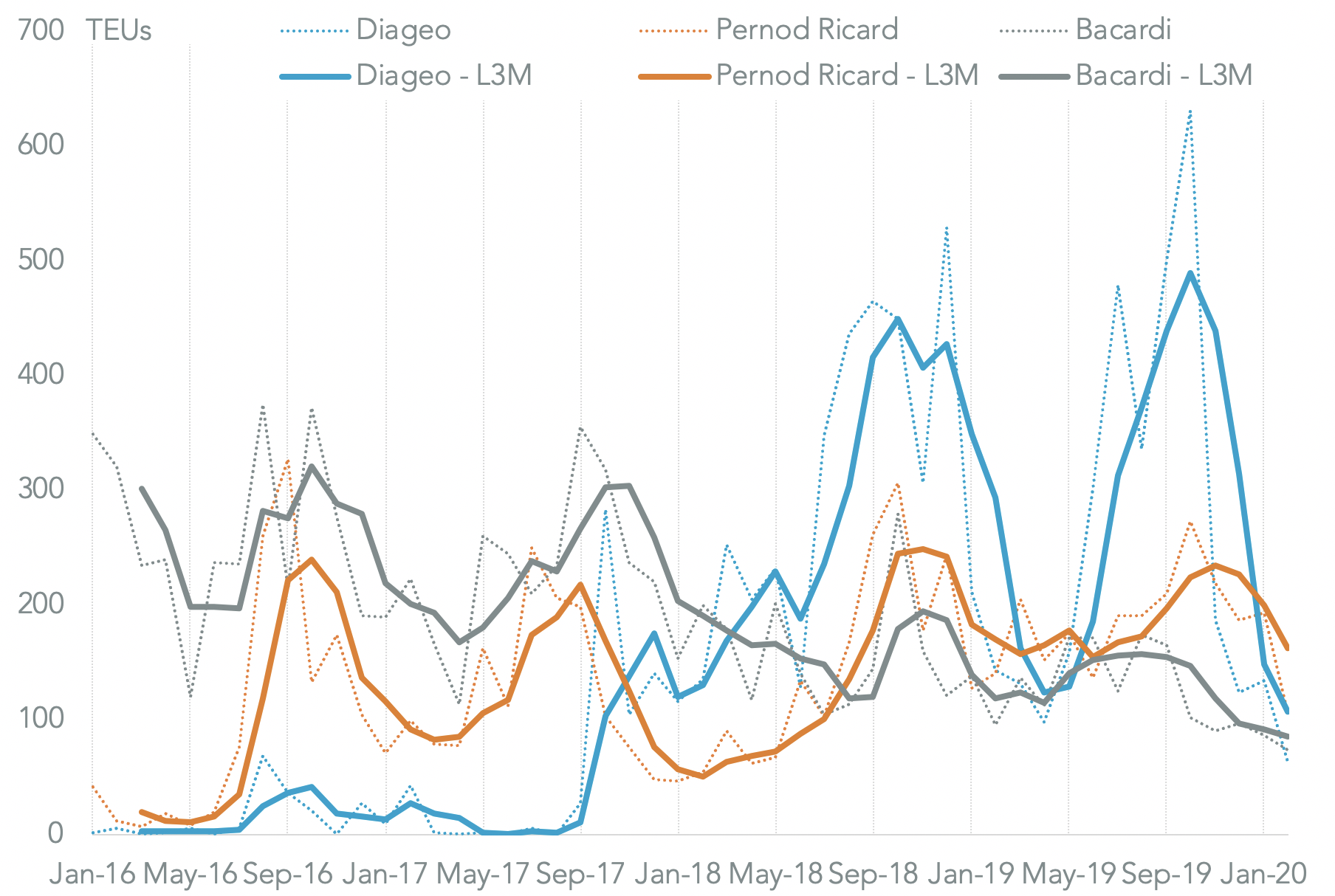

Among leading whiskey shippers to the U.S. the fastest decline has been in U.S. seaborne imports linked to Diageo which has fallen by 63.5% year over year in the three months to Feb. 28. Similarly there’s been a 27.6% slide in shipments linked to Bacardi while shipments linked to Pernod Ricard fell by a more modest 5.1% slip.

Source: Panjiva