A radical review of U.S. trade policy has been a signature part of the Trump administration’s economic policies since 2017, including a renegotiation of trade deals with Mexico, Canada and South Korea, a new trade deal with Japan and the ongoing trade war with China. There’s been a marked shift in the make-up of U.S. imports as well as a significant fiscal boost from tariffs.

Yet, so far trade does not appear to have been a significant part of the pre-election debate. Indeed, in the New Hampshire primary Democratic Party debate the only significant mention of trade policy was a commitment from Senators Klobuchar, Sanders and Warren as well as Tom Steyer to include environmental policy conditions in future trade policies. Mayor Buttigieg and Andrew Yang did not comment on the topic.

Both sides of the political divide more broadly have stated a hawkish stance with regards to trade deals and particularly towards China, as outlined in Panjiva’s Feb. 6 research.

The two states that have held primaries so far – Iowa and New Hampshire – both have a below-average exposure to exports at $4,178 per capita 2019 and $4,297 per capita compared to a national average of $4,800.

Later states that are more exposed to trade but where exports have been growing may be areas of strength for Republican electioneering on trade policy. One example is Indiana where exports were worth $5,900 per capita in 2019, Panjiva’s analysis shows, while exports grew by 4.2%, or $246 per capita since 2017. That was markedly better than neighbouring Michigan which had $5,534 per capita of exports after an 8.3% slide.

Source: Panjiva

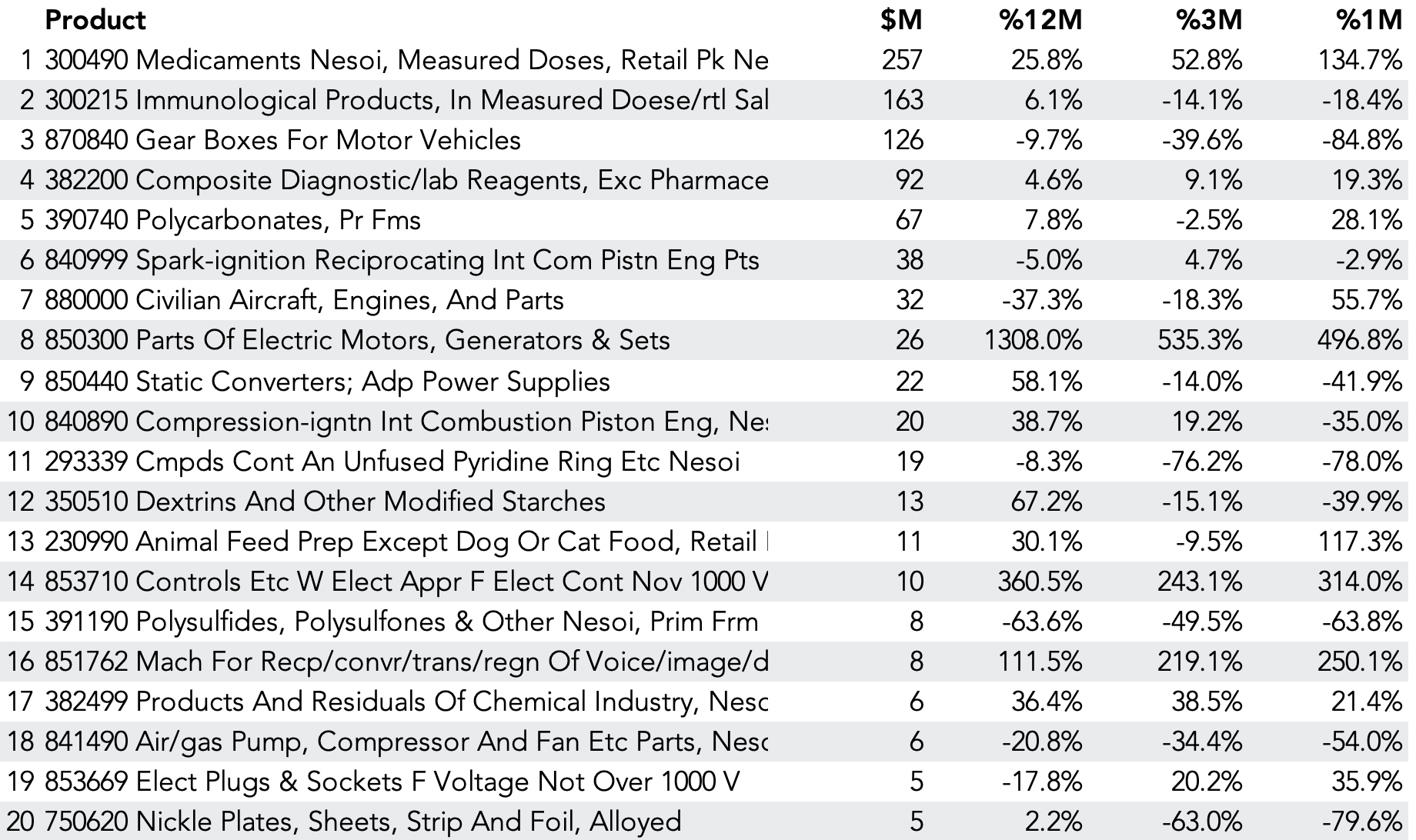

Indiana’s also notable in only having seen a $5 per capita, or 1.6%, decline in exports to China in 2019 versus 2017 – put another, the President’s trade war on China has largely bypassed the state. That’s largely been down to an acceleration in exports from the pharmaceutical sector that’s included a 25.8% year over year surge in shipments of packaged pharmaceuticals and a 6.1% improvement in immunological products – the two largest export lines from Indiana in 2019.

The main loser from the trade war in Indiana has been exports by the autos industry including a 9.7% slide in exports of gearboxes and a 5.0% slip in exports of gasoline engines. Major automotive firms in Indiana include automaker Toyota and driven train manufacturer NTN, Panjiva’s seaborne import data shows.

Source: Panjiva

Of much more relevance to Indiana however is the potential for a trade war with Europe – exports to the EU were worth $1,380 per capita compared to China’s $291. There’s also been negligible growth with exports having increased by just 0.7% year over year in 2019 while imports have surged 8.2% higher.

Source: Panjiva

A deterioration in relations between the U.S. and EU could take place in three principle areas: aerospace subsidies; the automotive sector; and carbon border taxes. In terms of aerospace a decision from the WTO on whether to allow the EU to apply tariffs against U.S. subsidies could impact upon $1.22 billion of exports in 2019 which had grown by 14.9%. Aerospace firms with operations in Indiana which may suffer from such tariffs include Alcoa and Rolls Royce.

President Trump’s dislike for European automotive exports, and associated tariff threats, could draw direct retaliation against exports of engines and gear boxes worth $132 million.

The EU’s new Green Deal could lead to carbon border taxes against imports in selected sectors. The direct impact on exports from Indiana may be minimal – the only semi-processed metals in the top 20 shipments were $19 million of nickel plates.

The state’s pharmaceutical lobby can be expected to be visible in any potential trade deal-making – there was a surge in imports of precursors and hormones in 2019 that drove a 37.7% surge in state imports from the EU in Q4. Major importers of pharmaceuticals to the state include Eli Lilly and Bristol Myers, Panjiva’s seaborne shipping data. Meanwhile healthcare products represent six of the 10 largest exports from the state to the EU.

Source: Panjiva