Maersk and Oetker Group have signed their formal purchase-and-sale agreement for Maersk’s acquisition of Hamburg Sud. This is a necessary step towards the merger, as discussed in Panjiva research of December 1. Unusually for a deal of this scale by a listed company the financial terms will not be announced until “the second quarter”. This presumably could be as soon as Maersk’s first quarter results of May 11.

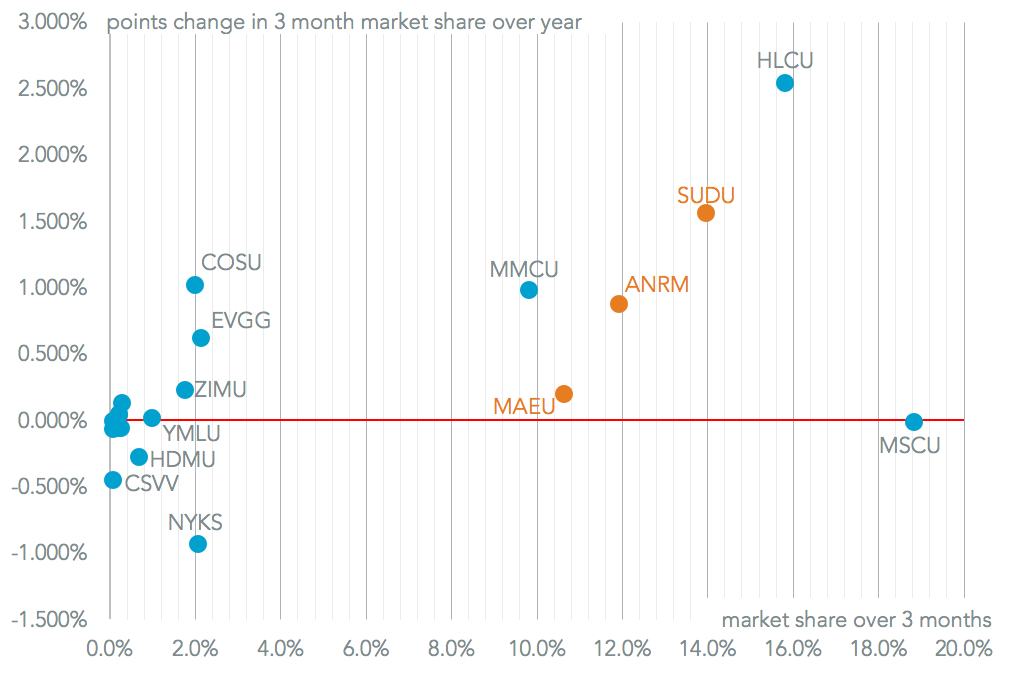

Assuming the financial terms are acceptable to Maersk’s investors, the biggest hurdle for the deal will likely be regulatory in nature. As application to the European Union for approval was made February 20 with a preliminary decision due March 27. Approval in the U.S. may not be a problem, as the combined entity would have a market share of 11.2% compared to 9.3% for Maersk alone according to Panjiva data. Individual route assessments may be made on routes coming in from South America.

Source: Panjiva

The issue will likely come from approval from authorities in South America (which the ‘Sud’ in Hamburg Sud’s name refers to). Panjiva data for the Brazilian market shows the two companies would have a joint market share of 36.6%, giving the revised 2M alliance a 55.4% share. That may lead the Brazilian authorities to question the deal. The deal’s completion still isn’t expected until the end of 2017, so there is plenty of time for more reviews to be completed.

Source: Panjiva