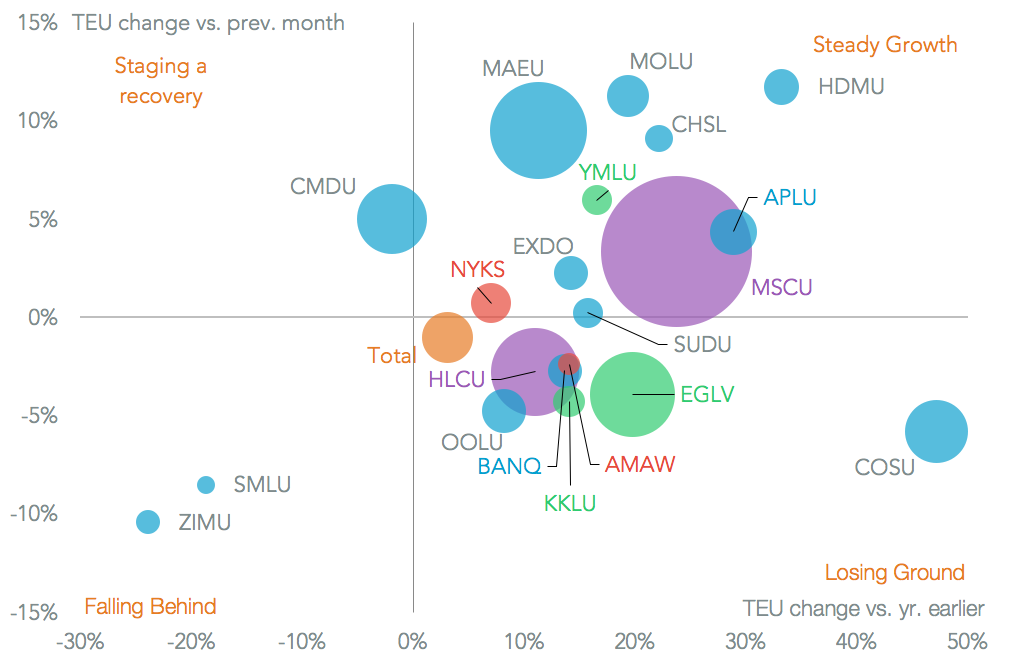

U.S. seaborne imports got off to a flying start in January, with ports handling 5.4% more containers than a year earlier, as highlighted in Panjiva research of February 9. Not all shippers shared in this bounty, however. COSCO was the worst performing of the large shippers, Panjiva data shows, with a 5.8% drop on a month earlier. Its 47.2% increase vs. January 2016 simply reflects the impact of its corporate restructuring. ZIM was the worst performing among the top 20 shippers, with a 23.9% drop on a year earlier. This may reflect its ongoing route restructuring announced in January.

The fastest growth was shown by Hyundai Merchant Marine, which expanded volumes 33.2% on a year earlier. This continues a trend likely shown in its fourth quarter earnings, where it has taken market share from the collapse of Hanjin Shipping. Among the companies going through a period of consolidation, Mitsui OSK outperformed its merger partners – NYK and K-Line – with a 19.4% growth rate. That follows a more upbeat outlook issued by management for 2017.

Source: Panjiva

Looking at market share for the past three months, Hyundai MM’s growth allowed it to jump to 11th from 17th at the end of 2016, while ZIM slumped to 18th from 12th. Despite its slowing volumes, COSCO still overtook Orient Overseas for sixth place.

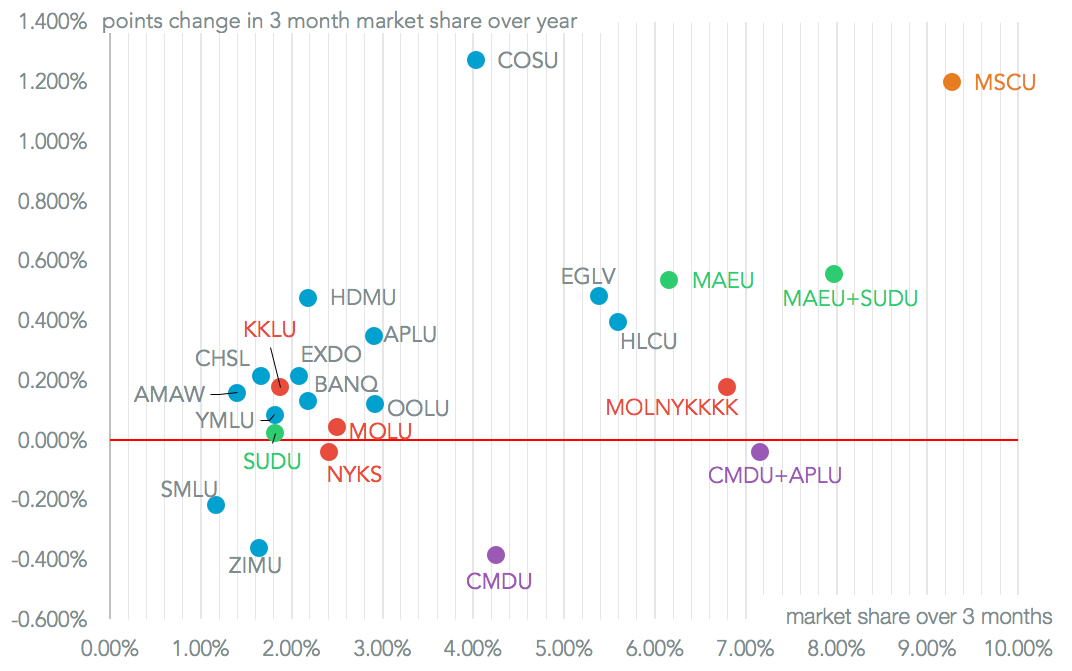

What has been remarkable is MSC’s growth given it was already the largest shipper. It added 1.20% points of market share to reach a 9.27% market share. This may represent an organic grab for market share as a response to deals from Maersk and the Japanese shippers. Indeed, among the major shippers only CMA-CGM has struggled to maintain market share, with a 39 basis point drop after its acquisition of NOL.

The process of consolidation is more broad-based though. The top 20 shippers increased their market share by 4.86% points to reach 63.3% in the three months to January 30 vs. a year earlier. The ‘top 5’, allowing for mergers as well as organic growth, would have had a 36.8% share vs. 28.5% a year earlier. This consolidation may begin to attract the attention of regulators, as the Federal Maritime Commission’s rumored industry report may suggest.

Source: Panjiva