U.S. crude oil imports increased 20.2% on a year earlier in March, Panjiva data shows, reaching their highest since August 2011. Exports also increased by 64%, though they were just 12% of imports by volume. Data from the EIA suggests this process may have continued in April, though at a slower rate of around 6%.

Source: Panjiva

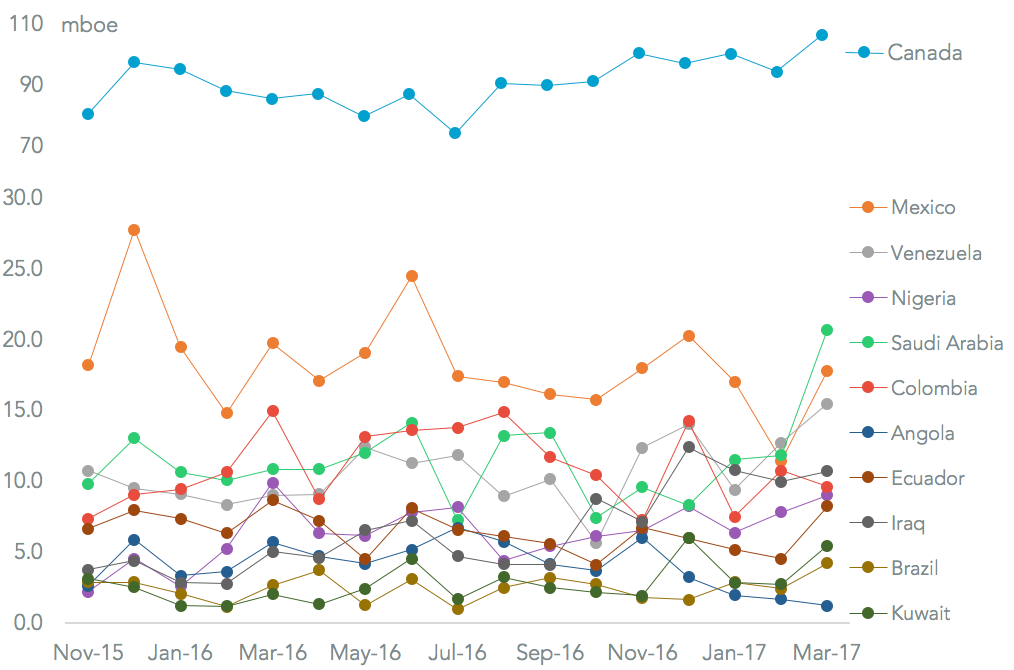

In absolute terms the growth was explained mostly by a 24.5% rise in shipments from Canada. That has been a critical part of Canada’s improving trade balance, as outlined in Panjiva research of May 4. Imports from Saudi Arabia also jumped 90.5%, making it the second largest supplier ahead of Mexico. That comes ahead of a visit by President Donald Trump to Saudi Arabia in May, which may come with commitments from the Saudi government to increase investments in the U.S. CNBC reports.

Source: Panjiva

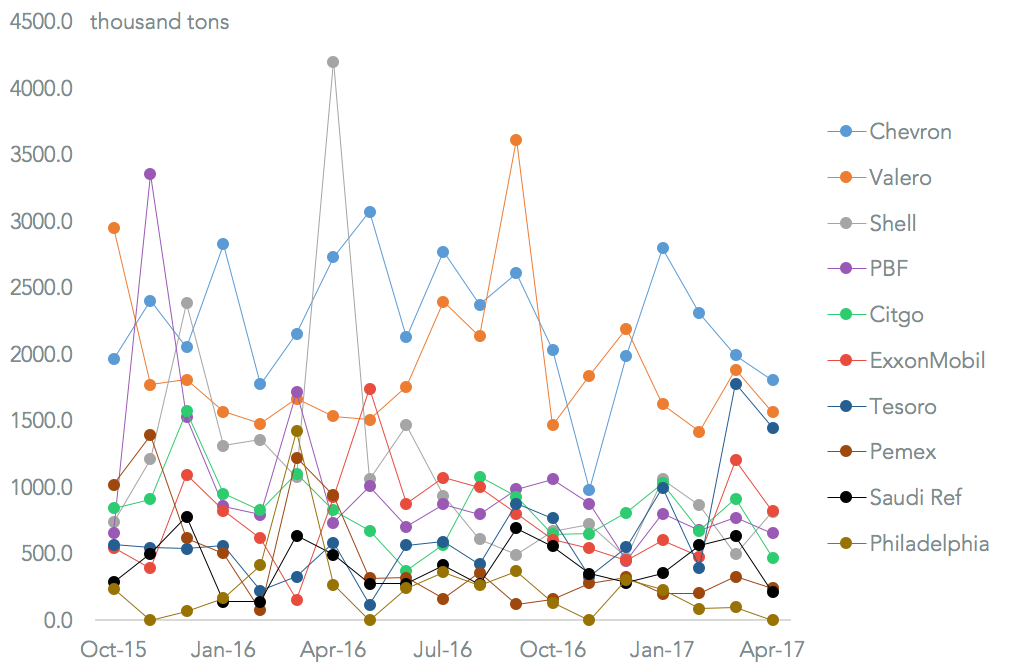

Import growth in April was more likely dominated by Canada and Mexico, however, with refiners importing by sea cutting shipments by 39.2%. Royal Dutch Shell made the largest cut in absolute terms, with an 80.6% cut compared to an abnormally high level of imports a year earlier. The increase in imports from Saudi Arabia in March was not repeated in April. That was likely ahead of the restructuring of Motiva, the refining joint venture between Shell and Saudi Aramco that has now been unwound. The only significant growth came from Tesoro on the back of its acquisition of Western Refining.

Source: Panjiva

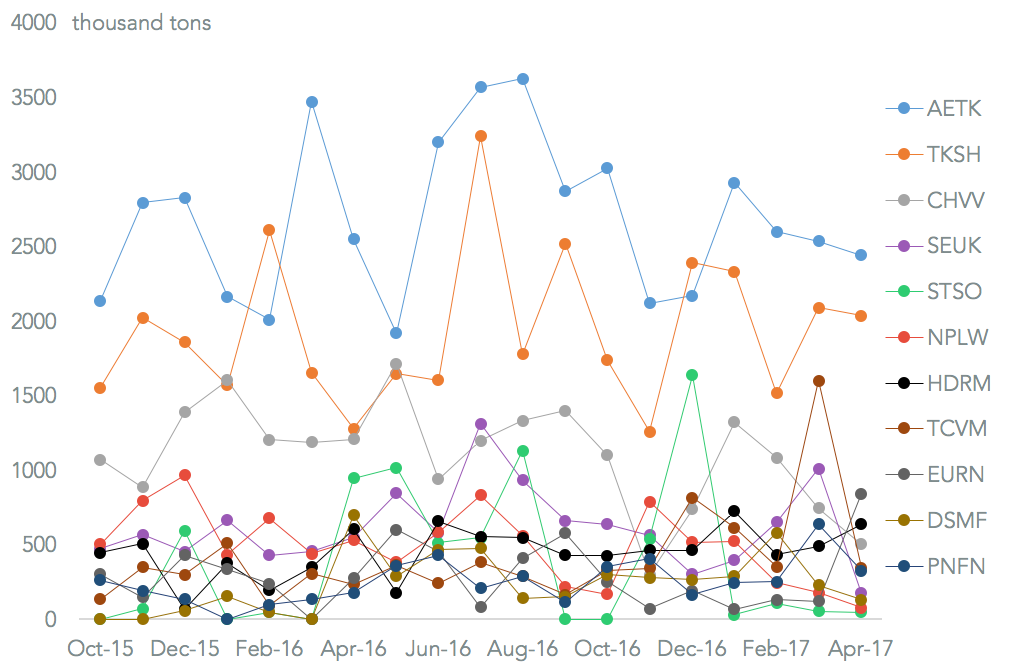

Perhaps unsurprisingly among the main carriers Shell’s in-house operation saw the fastest decline, with a 68% drop in shipments on a year earlier. Tsakos also saw a major downturn in handling following a jump in revenues in the first quarter when new vessels were delivered. By contrast Euronav saw a 206% rebound, which brought it to third largest carrier from 19th a month earlier. That may be a reaction to having had a disappointing third quarter.

Source: Panjiva