The Omnibus Report on the causes of the U.S. trade deficit will provide the evidence needed for future trade actions by the administration of President Donald Trump. The report is due by June 29, as outlined in Panjiva research of June 15, and is designed to identify the characteristics of the largest deficit partners along with causes.

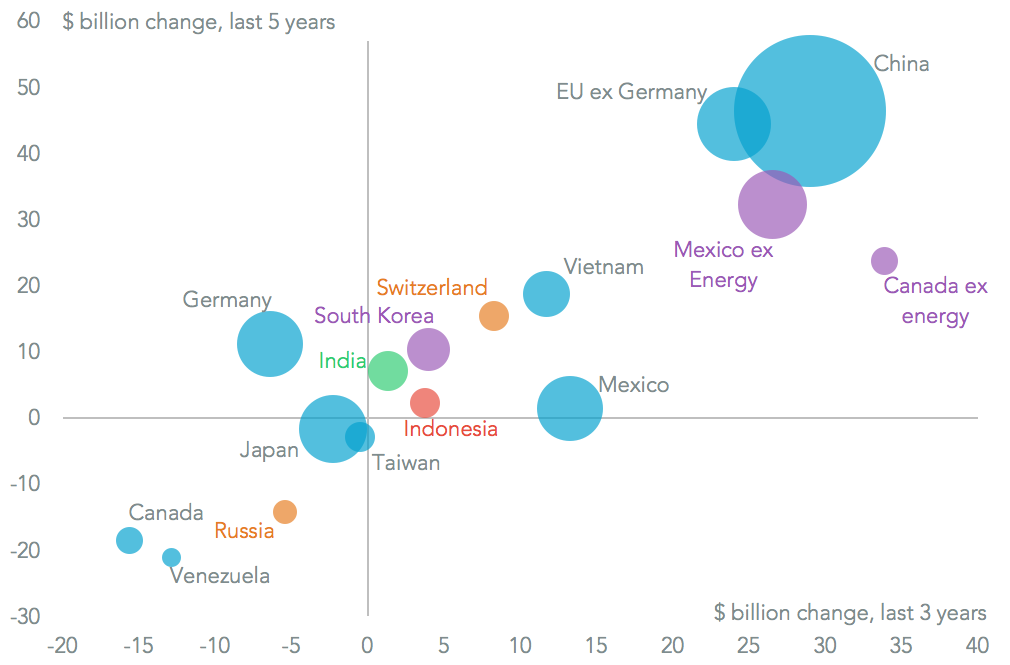

There is likely to be a particular focus on countries that have seen an increase in their trade surplus vs. the U.S. over time. Panjiva data for U.S. imports and exports shows countries that have not so far received attention from the administration, but are in the top 10 by surplus include Vietnam, Switzerland and India.

Vietnam was sixth in absolute deficit ($32.0 billion) in 2016 but was the third biggest contributor to the increase in the deficit. Similarly Switzerland was the ninth largest contributor to the deficit but the fourth biggest driver of the increase. The latter is partly the result of increasing pharmaceutical costs, and so is tied up with the ongoing healthcare reform in the U.S. Issues with India could be reconciled in meetings between Prime Minister Modi and President Trump.

It is also worth noting ahead of NAFTA negotiations that the contribution of Mexico and Canada to the change of the deficit is understated due to the shift in the value of energy trade over the past five years. Indeed, the “ex energy” position with Canada, while in a surplus, has contributed to a $23.7 billion increase in the overall deficit.

For the EU it should also be noted that while Germany has received much of the attention from the President, the non-German EU members have contributed four times as much to the expansion of the deficit ($44.5 billion over the past five years) as Germany has.

Source: Panjiva

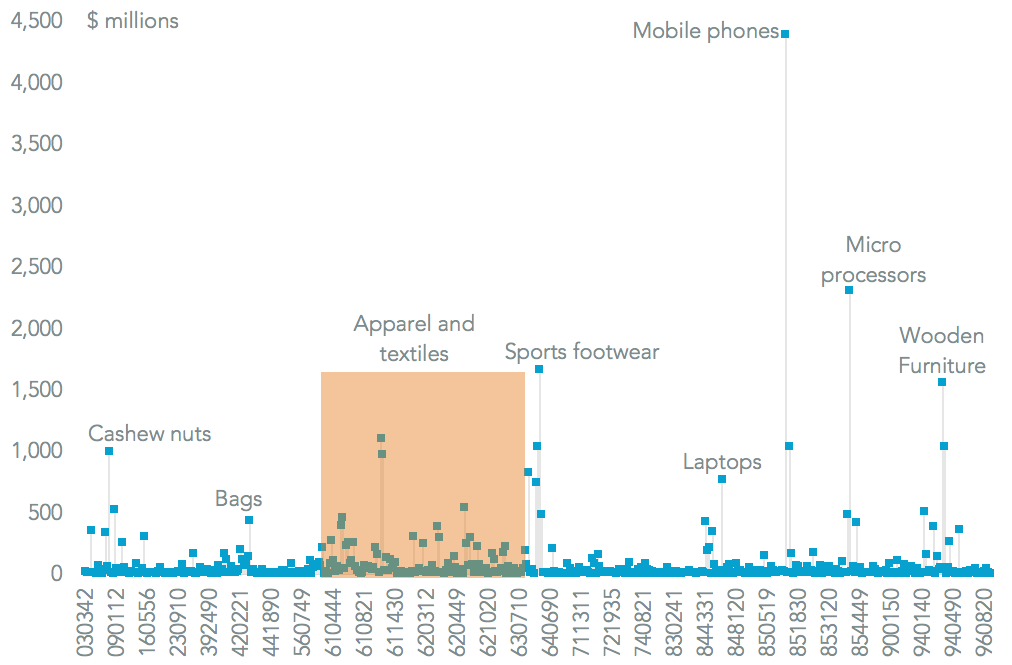

U.S. imports from Vietnam have increased in part because of increased manufacturing there by renewable energy companies (Trina Solar), smartphone manufacturers (Samsung Electronics) and home appliance makers (also Samsung Electronics and LG Electronics). Other significant exports, which might become subject to trade action include apparel (over $11 billion of exports), footwear (over $5 billion) and furniture ($4 billion).

Source: Panjiva