President Trump has accused Japan of currency manipulation, the Financial Times reports stating “they play the devaluation market and we sit there like a bunch of dummies,”. Unsurprisingly the Japanese government rejects the accusations, noting monetary policy is handled by the Bank of Japan.

The accusation echoes that made by Peter Navarro with regards to Germany, as discussed in Panjiva research of January 31 and follows the U.S. withdrawal from the Trans-Pacific Partnership which includes Japan. This may be the first salvo in the U.S. administration’s negotiation of a bilateral deal with Japan.

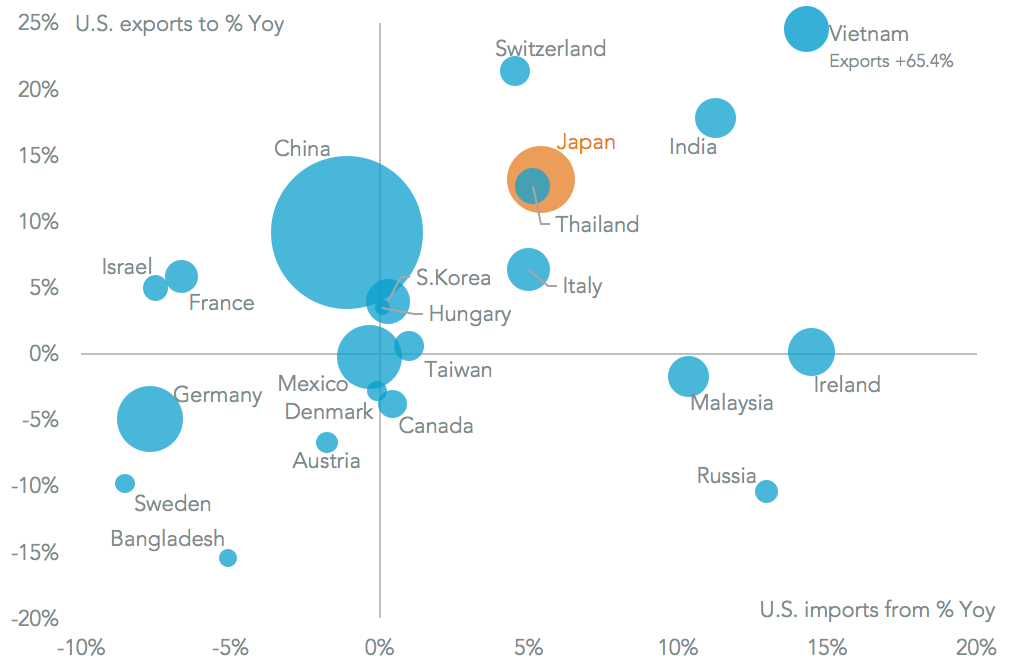

The move is unsurprising – Panjiva data for U.S. imports and exports show Japan ran a $68.96 billion surplus vs. the U.S. in the 12 months to November 30. That’s the second largest for an individual country after China. While the yen was 36.2% weaker compared to the dollar in 2016 compared to 2012, it actually strengthened 9.8% compared to 2015. Additionally, U.S. exports to Japan increased 13.2% in the three months to November 30 vs. a year earlier while its imports from Japan only increased 5.4%.

Source: Panjiva

Looking at the top six export industries from Japan to the U.S., healthcare, autos and electronics may be at the most risk of intervention. Exports of healthcare products (both medical devices and pharmaceuticals) increased 16.0% in the 12 months to November 30 on a year earlier, and have already been a target area for the administration’s healthcare policies.

The automotive industry has been under threat more broadly – and Toyota specifically – with Japanese exports to the U.S. of both cars and parts increasing 8.2% on a 12 month basis. These are nearly 10x the size of the next five biggest export lines.

One new area of focus would be electronics, where shipments of semiconductors and the manufacturing equipment for them increased 7.5%. These would be difficult to relocate given the labor education required and large scale investment needed for semiconductor fabs. Many other industries have already been in decline including aerospace exports (Japan is the biggest supplier of engines and parts) which fell 2.9% and printers which have dropped 7.4%.

Source: Panjiva