The global shipping industry is going through a period of intense upheaval with the failure of Hanjin Shipping (which may be nearing liquidation according to Chosun), the merger of the three major Japanese shippers, CMA-CGM’s integration of APL, Maersk’s takeover of Hamburg Sud and final polishing of the three major alliances all occurring in the past three months. During all this shippers still had to continue with business as usual.

In November U.S. import TEUs increased 7.7% on a year earlier, as outlined in Panjiva research of December 13. This had the result that only a handful of the top 25 shippers saw a slide in their shipments compared to a year earlier according to Panjiva data. With the exception of Seaboard Marine those that did see a reduction are involved in corporate restructuring in some way.

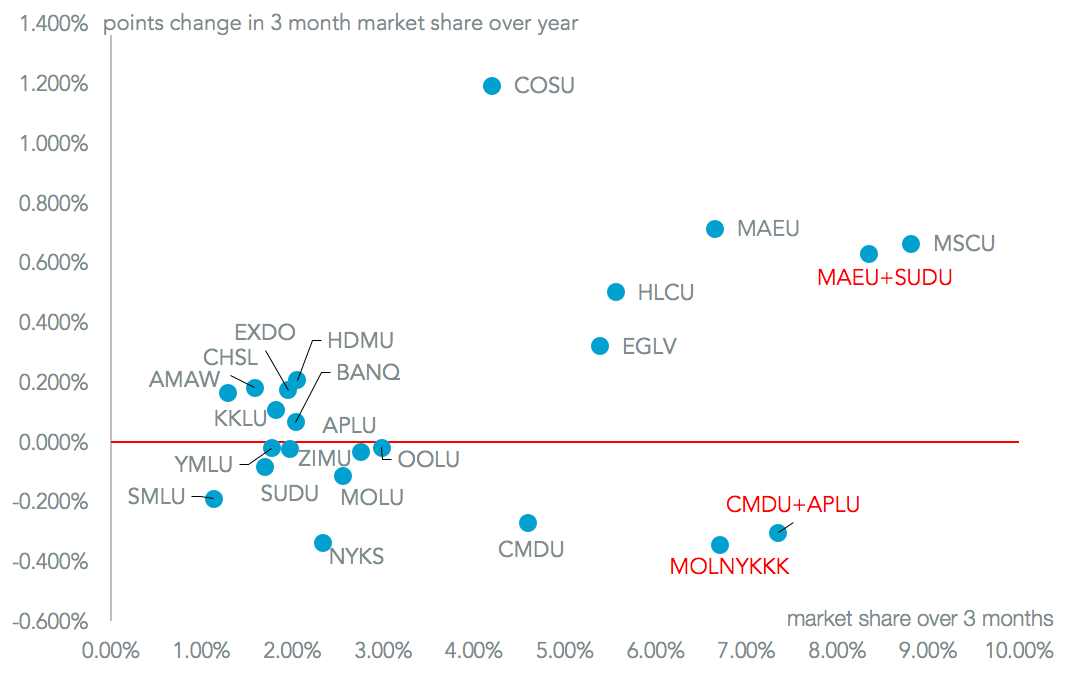

The biggest gainers, Hyundai Merchant Marine and Maersk, likely also gained share on a year earlier from Hanjin Shipping. COSCO’s expansion reflects the effect of absorbing CSCL, though a larger-than-average drop on a month earlier suggests it may be struggling to hold that market share.

Source: Panjiva

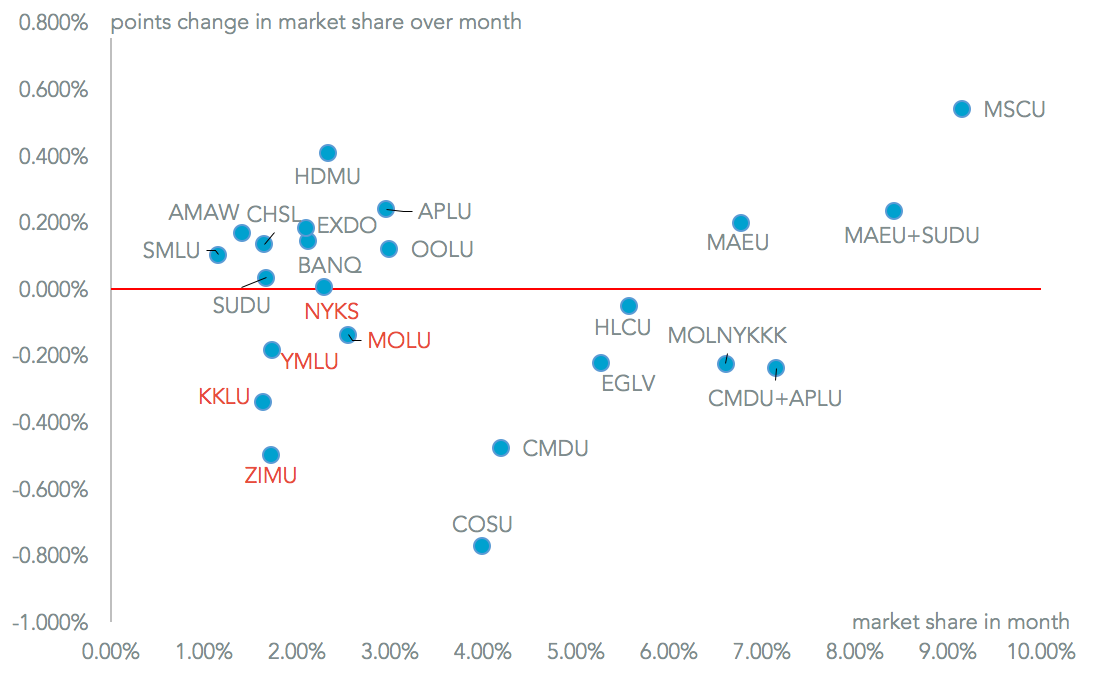

The performance over one month can be distorted by seasonality – November shipments are normally down on October due to the timing of holiday shopping imports. However, there does appear to have been a flight to safety, referred to in a November 2 conference call by Maersk management. Certainly both Maersk and MSC increased their market share by 0.54% points and 0.2% points respectively.

The Wall Street Journal reported that Zim was planning to sell most of its shipping operations, though it subsequently restructured some of its routes with THE Alliance. Meanwhile local legislators called the future of Yang Ming into doubt according to the Taipei Times. The decline in market share seen by all three Japanese shippers may be tied to the distraction from their merger announced on October 31.

Source: Panjiva

Looking at the past quarter vs. a year earlier, there has been a clear shift in market share from smaller players to larger ones. The current period of restructuring will lead to more of the same. The merger of Maersk and Hamburg Sud, discussed in Panjiva research of December 1, will still be the number two player on U.S.-bound routes. Yet it would be close with 8.35% market share in the three months to November vs. MSC’s 8.81%. More of the gap may be closed with further acquisitions at a later stage.

The recently completed combination of CMA-CGM and APL is in third place with 7.34%, though as mentioned already the decline of 30 basis points in its market share suggests market share is easy to buy, but hard to hold onto. This is also a potential lesson for the combined Japanese entity we refer to as MOLNYKKK ( Mitsui OSK, NYK and K-Line), which would be fourth with a 6.7% share.

Source: Panjiva