Apparel retailer Guess is starting to deal with U.S. tariffs on Chinese exports under the section 301 program that were applied in September and may be extended in December. The firm’s CEO, Carlos Alberini, has stated the firm is “reducing significantly our dependency on China to reduce tariff costs. And you can see the numbers there. We’re going from 47% to 23%”.

The firm’s strategy includes an aim to “leverage our European capabilities to source and procure products for our business in North America.” It’s not clear whether that is a reference to redirecting Chinese imports via Europe – which would represent tariff evasion – or a more sophisticated supply chain restructuring. In any event Guess’s strategy isn’t just a reaction to the trade war as the firm also plans to “reduce our base from 529 vendors last year that we had between the two, to about 200 next year“.

The latter is a sign that the firm is proceeding with a restructuring whether or not tariffs on Chinese exports continue. It’s more likely they will proceed – there are doubts as to whether a phase one deal will proceed, though if China gets its way then the tariffs afflicting Guess may be rolled back as outlined in Panjiva’s Dec. 6 research.

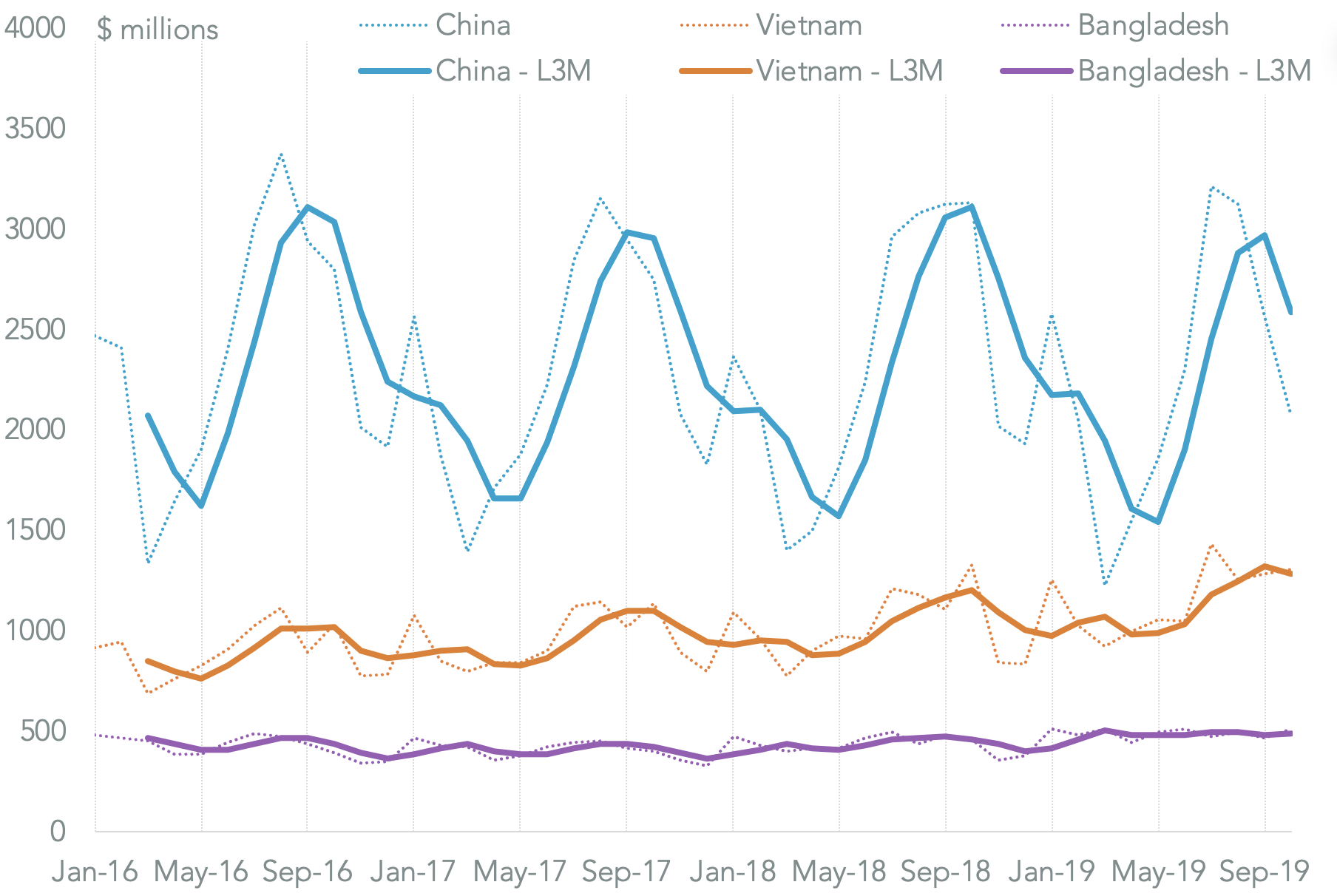

Panjiva data shows total U.S. imports of apparel from China dropped by 16.9% year over year in the three months to Oct. 31. That’s been partly replaced by imports from Vietnam which increased by 6.4% while those from Bangladesh increased by 6.6%. Yet, there may be an overall weakening of demand – total imports fell by 4.4% – while China still represents 32.6% of all imports of apparel.

Source: Panjiva

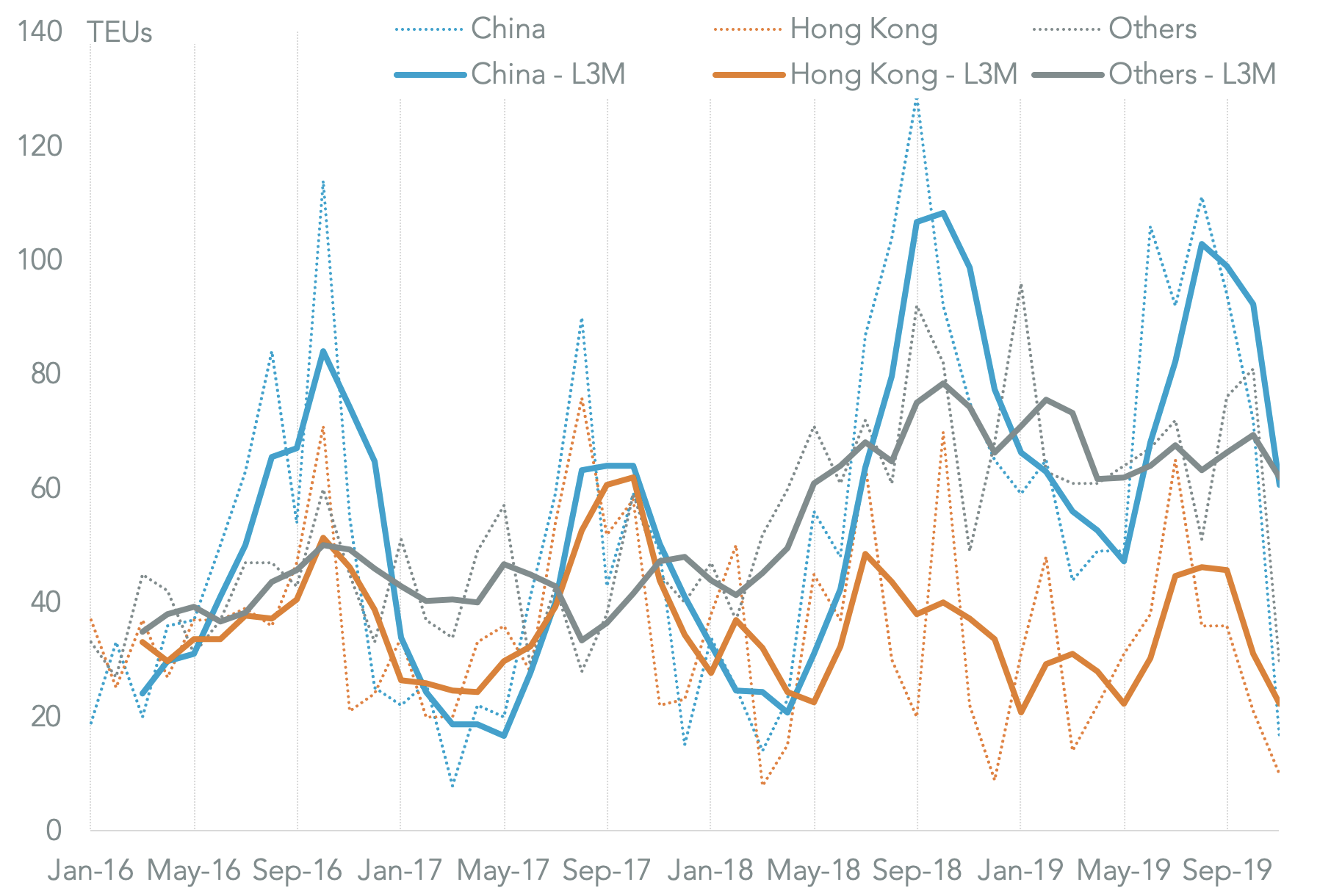

U.S. seaborne imports linked to Guess? from mainland China already declined to 41.8% of the total in the three months to Nov. 30 from 46.9% a year earlier. That represents a 38.5% slide in absolute terms, though there is evidence of stockpiling in August ahead of the list 4A tariff introduction in September. The inventories associated with that stockpiling were likely worked down in the past three months.

The firm isn’t out of the woods from a regulatory perspective though. Imports sourced from Hong Kong represented 15.4% of the total and may be exposed by new U.S. rules that could remove the city’s special tariff status.

Guess’s shipments from the rest of the world meanwhile increased to 42.7% of the total from 35.3% a year earlier due to an increased reliance shipments from Vietnam and India among others.

Source: Panjiva